When it comes to taxes, there are many forms to keep track of, including the 1098 and 1099. These forms serve different purposes and work for different income types. Let’s compare 1098 vs. 1099 with ERA to better understand your tax responsibilities.

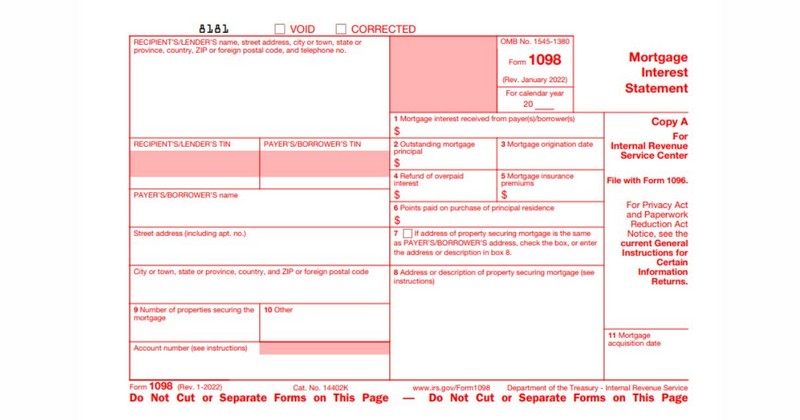

What is Form 1098?

Form 1098, the Mortgage Interest Statement, reports the interest and mortgage-related expenses payable to the lender during a tax year. This form is critical for taxpayers because they must use these numbers to calculate their taxes.

What is a 1098 tax form used for? You must file Form 1098 if you receive $600 or more in mortgage interest from an individual. However, you do not need to use this form for interest received from entities such as corporations, partnerships, trusts, estates, associations, or companies.

Each mortgage requires a separate Form 1098. It’s worth noting that there are seven variations for different situations:

| Form | Purpose | What It’s For |

| 1098 | Mortgage Interest Statement | At least $600 in mortgage interest |

| 1098-C | Contributions of Motor Vehicles, Boats, and Airplanes | Donations worth more than $500 to a charity |

| 1098-E | Student Loan Interest Statement | At least $600 in qualified loan interest |

| 1098-F | Fines, Penalties, and Other Amounts | Court-ordered fines, penalties, restitution, or remediation |

| 1098-MA | Mortgage Assistance Payments | Homeowner assistance payments received or paid through a state Housing Finance Agency |

| 1098-Q | Qualifying Longevity Annuity Contract Information | Payouts from certain retirement accounts |

| 1098-T | Tuition Statement | Tuition paid to eligible higher education institutions |

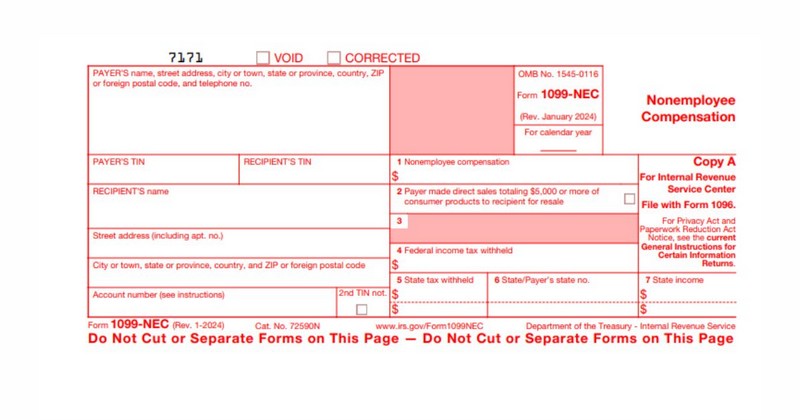

What is Form 1099?

Forms 1099 report various types of non-employment income to the Internal Revenue Service (IRS), such as dividends or payments to independent contractors. Businesses must issue 1099 forms to any payee (except corporations) who receives at least $600 in non-employment income during a tax year.

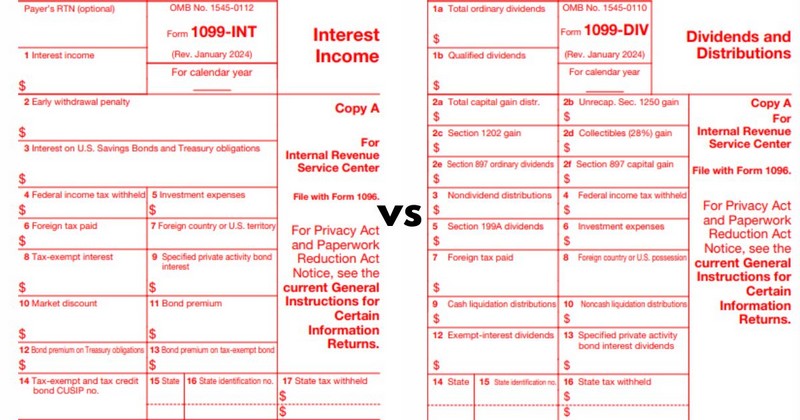

Different types of 1099 forms correspond to different types of income during the tax year. Some of the most popular ones include:

| Form | What It’s For |

| 1099-INT | Taxpayers who earned more than $10 worth of interest in the tax year |

| 1099-K | Payment companies, online marketplaces, or payment apps for goods or services provided |

| 1099-DIV | Taxpayers who receive dividend income throughout the tax year |

| 1099-G | Those who received money from federal, state, and local governments |

| 1099-R | Taxpayers received a distribution or payout from a pension, retirement plan, or IRA |

| 1099-B | Taxpayers listing various transactions from a broker |

| 1099-S | Real estate transactions if a sale or exchange occurred during the tax year |

| 1099-SA | Taxpayers who receive distributions from health savings, medical savings, and Medicare Advantage accounts |

| 1099-MISC | Income outside other 1099 forms, such as money from prizes or awards |

| 1099-PATR | Cooperative patronage dividends and dividend payments associated with farms. |

| 1099-NEC | Some types of non-employee compensation. |

See more: 1099-NEC vs 1099-MISC

Now that you understand the 1099 and 1098 tax forms, let’s compare them and explore their differences.

Key Differences Between 1098 vs. 1099

Here is a comprehensive comparison between Form 1098 and Form 1099:

| Form 1098 | Form 1099 | |

| Reporting Entities | Financial institutions such as banks, mortgage lenders, or credit unions | Various organizations, including banks, brokerage firms, payment companies, etc. |

| Recipients | Individuals who have paid mortgage interest to the financial institution | Vary depending on the specific type of income being reported |

| Tax Implications | Potential reduction of taxable income and overall tax liability | Potential increase in taxable income and tax liability (with a few exceptions) |

| Information Reported | Total interest paid during the tax year and lender information. | Varies depending on the specific type of income |

1099 vs 1098

Reporting Entities

A significant difference between 1098 and 1099 is the reporting entities:

- Form 1098 is for financial institutions like banks, mortgage lenders, or credit unions. It reports a taxpayer’s mortgage interest payments.

- Form 1099 is for various organizations, including banks, brokerage firms, payment companies, online marketplaces, and government agencies. It reports multiple types of non-employment income received by taxpayers.

Recipients and Tax Implications

The recipient of Form 1098 is usually the individual who has paid mortgage interest to the financial institution. Meanwhile, Form 1099 recipients vary widely, depending on the specific type of income being reported. For example, the recipient may be an individual receiving the dividend or an independent contractor.

One more difference between 1099 and 1098 is their tax implications:

- Form 1098 shows that the recipient can deduct mortgage interest paid can be deducted from the recipient’s tax return. It potentially reduces their taxable income and overall tax liability.

- Income reported on Form 1099 is generally taxable and must appear on the recipient’s tax return. It is likely to increase their taxable income and tax liability.

However, certain types of income reported on Form 1099 may qualify for specific deductions or tax treatment. Therefore, recipients must understand the tax implications of the income reported on their Form 1099 to ensure their tax liability.

Information Reported On Each Form

Comparing the details of the 1099 Form vs. 1098 Form is complicated because the information to fill out on 1099s varies depending on the income type you report.

For instance:

- Form 1099-INT reports interest income earned from savings accounts, CDs, or other investments.

- Form 1099-DIV reports dividend income received from stocks or mutual funds.

- Form 1099-MISC reports miscellaneous income, such as payments for services rendered, rent, or royalties.

Meanwhile, Form 1098 typically reports the taxpayer’s mortgage interest to the lender, including the total interest paid during the tax year and lender information.

Conclusion

To summarize, Form 1098 relates to mortgage interest paid by the taxpayer, while Form 1099 reports various types of non-employment income earned. Understanding the differences between 1098 vs. 1099 will help you optimize your tax situation and ensure compliance with IRS regulations.

Don’t forget to follow ERA today to learn more about tax forms!

Frequently Asked Questions

Do you get a 1099 for mortgage interest?

No. If you want to report mortgage interest ( at least $600), use Form 1098.

Do I have to report 1098 on my taxes?

No, you do not need to file Form 1098 or include it with your tax return. Instead, you will report the amount of interest expressed in the form, usually when listing deductions on your tax return.

Is it worth filing a 1098?

Sure! If you disregard filing requirements and knowingly fail to file an accurate information return, the penalty is at least $250 per Form 1098. There is no maximum.

See more related articles:

Difference Between 1099 and W2: What Should Employers Know?

1099 vs. 1040: Key Differences Every Taxpayer Should Know

Navigating Tax Forms: 1099-NEC vs 1099-MISC Explained

5 Key Differences Between 1099 and LLC

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.