Understanding the different tax forms and knowing which ones to use to organize and report your financial information is crucial. This article compares two common forms, 1099 vs. 1040, which is critical for self-employed workers. Let’s ERA explore the basics of these forms and compare them to better understand each role and how they affect workers.

Understanding the 1099 Form

1099 forms are records of what an organization or individual that you are performing freelance or independent contractors would provide for the annual total payments made to you.. The payer fills out these forms and sends copies to you and the Internal Revenue Service (IRS). Most are required by January 31, with some exceptions extending until February 15.

These forms document payments from various sources, such as individuals, businesses, and government entities. If you receive a 1099 form, you must report the income earned on your tax return.

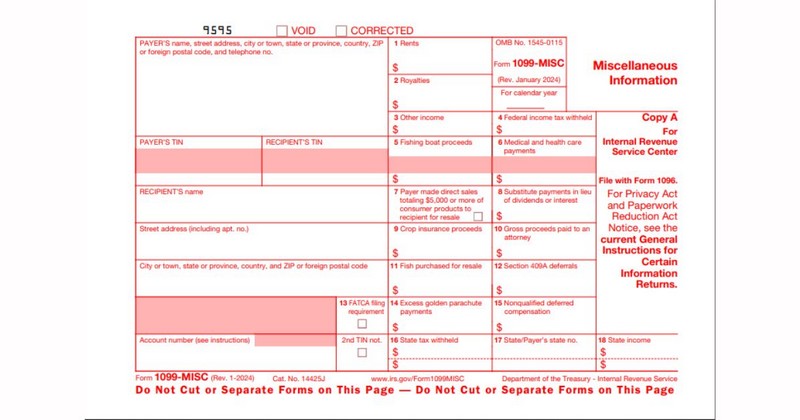

There are various types of Form 1099 used to report a specific type of income other than salary or wages:

| Form Name | What It’s For |

| 1099-NEC | Report non-employee compensation such as income earned as an independent contractor, freelancer, or self-employed worker. |

| 1099-MISC | Report different types of payments, including rent, royalties, awards, etc. Also, used for payments instead of dividends, medical and health care payments, and similar items. |

| 1099-A | Come from the mortgage lender if they cancel part or all of your mortgage as part of a foreclosure. Another situation is when you lose title to your property or your property is sold in a short sale. |

| 1099-B | Report sales of stocks, bonds, derivatives, or other securities made through one or several brokers during the tax year. |

| 1099-C | To reach an agreement with the lender to negotiate debt forgiveness. |

| 1099-DIV | Report receipt of dividends and certain distributions typically from investments. |

| 1099-G | Report unemployment compensation and state or local income tax refunds during the year. |

| 1099-INT | Report receipt of interest payments (you may not need to pay income tax on this interest). |

| 1099-K | Report credit card payments and third-party payment processing received over the Internet. |

| 1099-LTC | Report payments under long-term care insurance policies. Also shows the death benefit paid in advance by the life insurance policy or the settlement provider. |

| 1099-OID | Report an annual discount when you hold bonds or certificates of deposit (CDs) issued at less than face value. |

| 1099-Q | Report distributions from qualified tuition programs and Coverdell Education Savings Accounts (ESAs). |

| 1099-QA | Provide information related to distributions from Achieving a Better Life Experience (ABLE) accounts |

| 1099-R | Report distributions of retirement benefits of $10 or more. |

| 1099-S | Report the total proceeds from the sale or exchange of real estate. Also used for some royalty payments. |

| 1099-SA | Report distributions from a tax-advantaged health care savings plan. |

| SSA-1099 | Report the amount of Social Security benefits paid and refunded. Also, show Medicare premiums, federal income taxes, and other amounts withheld from your benefits. |

See more: 1099-NEC vs. 1099-MISC

Understanding the 1040 Form

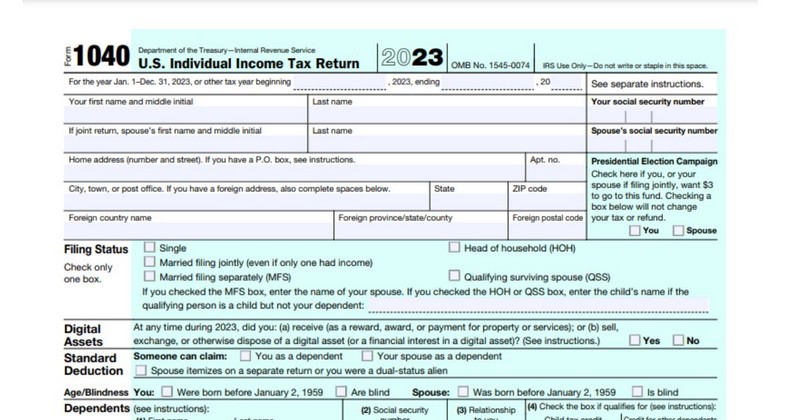

The 1040 form is the document most people use to report their income to the IRS in the USA. It summarizes all the income-related information you need to report. In most years, you must file Form 1040 with the IRS by April 15. By filing this form, you can determine whether you owe taxes or qualify for a refund.

For example, if you have different jobs simultaneously and earn income from various sources, you can include all of them on a 1040 form.

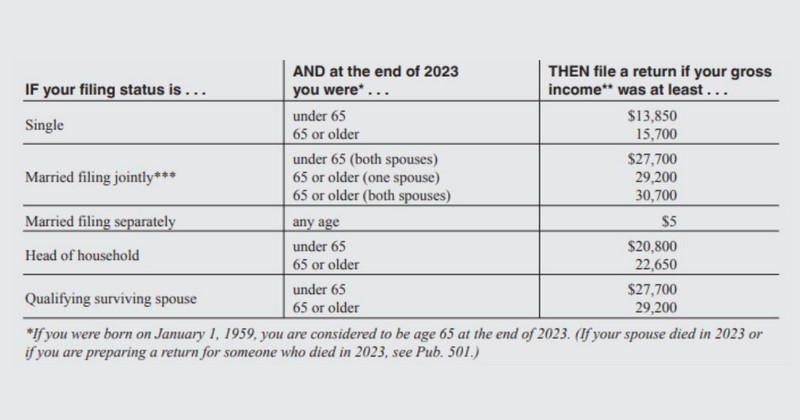

When U.S. citizens file a Federal income tax return, they need to use Form 1040 or a variation of Form 1040. The conditions determining whether an individual needs to file are the following:

- Gross Income Thresholds: Individuals with certain gross income levels must file taxes, which vary by filing status and age.

- Dependents: Children and dependents claimed as dependents might not need to file.

- Specific Situations: Some situations mandate filing Form 1040, such as owing special taxes.

Here are some critical components of Form 1040:

- Lines 1 through 9 list your income from all sources, including wages, salaries, investments, etc. You will list each income type in a separate line.

- Lines 10a and 10b calculate your adjusted gross income. In this section, you can subtract certain deductions, like student loan interest or charitable contributions.

- Lines 12 and 13 are the starting point for calculating your taxable income. You can deduct your standard or itemized deductions and any qualified business income here.

- Lines 16 through 24 help you calculate your total tax liability and determine how much you owe.

- Lines 25 to 33 are where you report the taxes you paid (deductions from your paycheck or estimated payments you made).

Form 1040 itself is only two pages long. However, it comes with additional schedules that provide comprehensive details about taxable income, credits, and deductions. These schedules help the IRS gain detailed insight into various aspects of a taxpayer’s financial situation.

Understanding these sections of Form 1040 allows you to report your income accurately. Besides that, it helps you take advantage of any deductions or credits for which you are eligible.

Key Differences Between 1099 Vs. 1040 Forms

Now, let’s dive further to answer the question: “What is the difference between a 1099 and a 1040?”

| 1099 | 1040 | |

| Source of Income | Focuses on specific types of income earned | Reports all income and possible deductions |

| Reporting Process | Filled out by the payer | Filled out by taxpayers |

| Tax Implications | Calculates specific tax rates for reported income types | Calculates tax liability comprehensively |

| Deadline | January 31 (some exceptions extending until February 15) | April 15 |

Are 1040 and 1099 the same?

Source of Income

- The 1099 forms focus on only one specific income type you’ve earned, such as interest or freelance work.

- Form 1040 reports all aspects of their financial lives, including income, deductions, and payments they’ve already made toward their taxes.

When filling out your Form 1040, you use the information from all your 1099 forms and other income and deductions to see the complete picture of your taxes. It helps you understand whether you need to pay more taxes or are due for a refund based on your financial situation.

Reporting Process

Another difference between 1040 and 1099 is who uses them and what the reporting process is:

- The payer fills out 1099 forms and sends copies to you and the IRS.

- Taxpayer uses Form 1040 to report income and deductions on their own.

So, 1099 forms notify you and the IRS about the income you’ve received, while Form 1040 reports your financial life when filing your tax return.

Tax Implications

Regarding tax implications, there are several differences in how income reported on 1040 vs. 1099 is treated:

- Form 1099 helps you calculate the specific tax rate for the type of income reported.

- Form 1040 allows for a comprehensive calculation of your tax liability based on your overall financial situation.

That means the income reported on Form 1099 is part of your total taxable income. Your tax liability may vary depending on the nature and amount of income reported on Form 1099.

Not only that, while Form 1099 only reports income, Form 1040 offers the opportunity to claim deductions and credits that can decrease your tax liability.

Tax Planning Considerations

Now that you have a basic understanding of the differences between forms 1040 vs 1099, consider these things when planning your taxes:

- Withholding and Estimated Taxes: Income reported on Form 1099 is generally not subject to tax withholding. Therefore, those receiving Form 1099 should estimate tax payments during a tax year to avoid underpayment penalties and ensure tax liability.

- Record-Keeping: Maintaining records of income and expenses is beneficial for those whose income is reported on Form 1099. They can use accounting software or organize paper receipts. This practice will minimize errors when reporting income and claiming deductions on Form 1040.

- Seeking Professional Guidance: Reporting income from Form 1099 and Form 1040 is complicated, so don’t hesitate to seek help from ERA. We will provide detailed guidance and help you ensure tax compliance.

Conclusion

In summary, the difference between 1099 vs. 1040 lies in many aspects, such as income source, reporting process, and tax implications. Understanding these differences helps you effectively manage your tax obligations and avoids errors related to tax reporting. Finally, contact ERA today to get all your tax-related questions answered!

Frequently Asked Questions

Do I need to send a 1099 with a 1040?

No. When filing Form 1040, you only have to send it along with additional schedules, such as Schedule 1, 2, and 3 (if required).

Is a 1099 the same as a tax return?

No, they have different purposes. A 1099 form reports income, while a tax return is a form filed with the government to calculate and pay taxes or claim refunds.

Can I use a 1040EZ with a 1099?

As of the 2018 tax year, the IRS discontinued using Form 1040EZ.

See more related articles:

Difference Between 1099 and W2: What Should Employers Know?

Navigating Tax Forms: 1099-NEC vs 1099-MISC Explained

1098 vs 1099: Which Form Should You Receive and Why?

5 Key Differences Between 1099 and LLC

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.