Many people face a difficult choice when starting their own business: becoming an independent contractor or forming a Limited Liability Company (LLC). Which one is better? Let’s compare 1099 vs. LLC with ERA to understand the difference between these two business forms.

What Is A 1099 Employee?

A 1099 worker is a freelancer, independent contractor, gig worker or other self-employed worker who works for companies on a contract basis. They are not considered an official company employee and do not receive a salary. Instead, 1099 employees get paid according to their agreement with clients.

Some typical 1099 jobs are rideshare drivers, freelance web designers, photographers, etc.

However, it’s worth noting that the classification of 1099 workers can vary depending on the jurisdiction.

For example, the IRS has set rules for classifying workers correctly. The main factor they consider is control. According to that, if the payer can only control the result of the work, not how it’s done, the worker is likely an independent contractor.

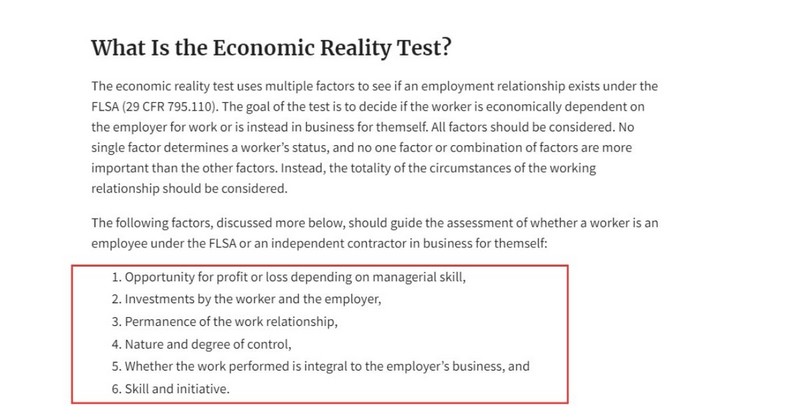

Meanwhile, the Department of Labor (DOL) uses the “Economic Realities Test” to distinguish whether someone is an employee or an independent contractor. Two main factors to consider are:

- How much control does the worker have over the job?

- How is their chance to make a profit or suffer a loss?

Economic Reality Test

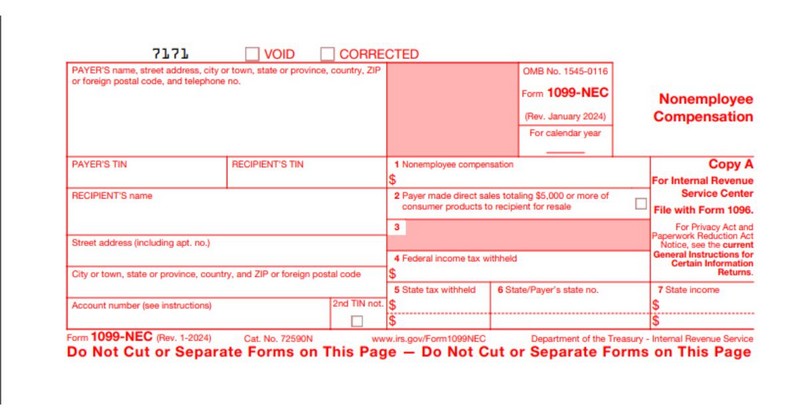

The phrase “1099 employee” comes from the fact that contractors receive a 1099 form when they earn more than $600 from a single client. In the past, this reporting would typically use Form 1099-MISC, but as of 2020, it must use Form 1099-NEC (non-employee compensation).

In many cases, 1099 employees may receive multiple 1099 forms if they worked for different employers during a tax year.

Form 1099- NEC

Most 1099 forms must be sent to recipients by January 31 of the tax year following the income earned. If January 31 falls on a weekend, the deadline will shift to the next business day. However, specific types of 1099s, like the 1099-S, must be issued by February 15.

If 1099 contractors do not form another business entity, they will automatically be classified as independent contractors.

Working as a 1099 contractor offers several pros and cons:

| Pros | Cons |

| Complete control of business operations without the need for external oversight or paperwork beyond filing personal tax returns. | Unlimited personal liability for legal actions against the business. Significant risk in case of litigation. |

| Deducted home office expenses from income for tax purposes. Reduced overall costs because there are no employees. | Limited access to business capital leads to difficulties in securing loans or expanding businesses. |

| Simplified tax procedures, personal income tax declaration, and deduction of business expenses to reduce tax liability | Limited growth opportunities as sole proprietors cannot hire employees. |

See more: 1099 vs. 1040

What Is An LLC?

A limited liability company (LLC) is a business structure permitted by state law. Each state has its regulations, so verifying with your state if you plan to form an LLC is essential. It merges elements of a corporation and a partnership/sole proprietorship: While offering limited liability like corporations, LLCs provide flow-through taxation like partnerships.

A well-known example of an LLC is Google LLC, a subsidiary of Alphabet Inc., its parent company. Blockbuster LLC, also known as Blockbuster Video, is a video rental service provider based in the United States.

Individuals who own LLCs are called members. There is no maximum limit on the number of members an LLC can have. Furthermore, most states allow “single-member” LLCs to have only one owner.

Also, LLCs offer vast ownership possibilities: individuals, corporations, foreigners, and other entities can join. However, certain entities, such as banks and insurance companies, are not eligible to form an LLC.

The IRS classifies LLCs based on the elections made by the LLC and the number of members:

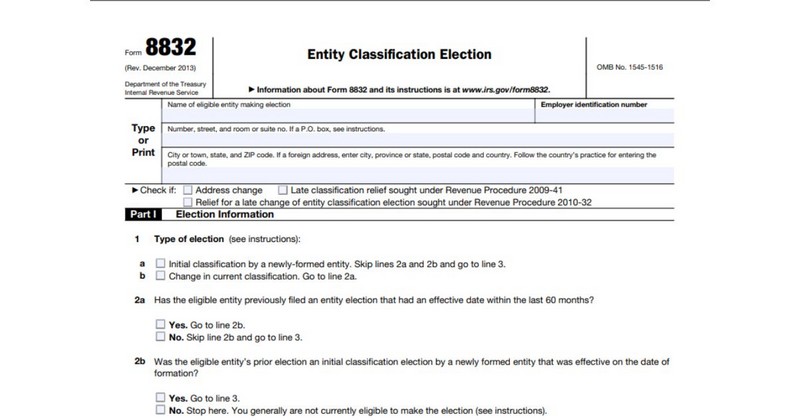

- If an LLC has two or more members, the IRS will treat it as a partnership for federal income tax purposes by filing Form 8832 (unless it elects to be treated as a corporation.

- If an LLC has only one member, it is a disregarded entity, meaning it is not separate from its owners for income tax purposes. However, it can be considered a corporation by filing Form 8832.

- If the LLC has only one member, it is still regarded as a separate entity for employment taxes and some excise taxes.

Form 8832

Forming an LLC varies slightly by state, but typically, the process involves these steps:

- Choose a name for your business.

- Appoint a registered agent to handle legal notices.

- File Articles of Organization with the Secretary of State.

- Draft an operating agreement and detail how the LLC will operate.

- Acquire an Employer Identification Number (EIN) from the IRS.

Note: LLCs can choose pass-through taxation, which means owners report profits and losses on their personal tax returns. However, if there is fraud or failure to meet legal obligations, creditors can pursue LLC members.

| Pros | Cons |

| Simplified tax services and solid legal protection, protecting personal assets from business risks | Dissolution after the death or bankruptcy of a member, depending on state regulations. |

| Streamlined profit streams, preventing the “double taxation” problem faced by both the company and its owners. | Risk of facing additional filing and tax preparation costs if you file LLC taxes separately. |

| Flexible management structure with minimal administrative requirements | Lack of ability to raise capital by offering shares like corporations and few options for business loans. |

Note: Don’t mistake LLC for an Unlimited Liability Corporation (ULC), which is a corporate structure permitted in specific countries and some provinces in Canada.

1099 Vs. LLC: Key Differences

Working as a 1099 or through an LLC offers similar advantages. You’ll set your schedule and self-report on your tax return. However, there are some crucial differences, such as registration processes and liability protection. Below is a comparison of LLC vs. 1099 and how each factor can impact you.

| 1099 Employee | Limited Liability Company (LLC) | |

| Definition | Self-employed workers contracted by firms for services | Business structure offering liability protection |

| Number of Members | Usually one person | No restrictions on the count of members |

| Taxation | Subject to self-employment tax | Taxable by classification (e.g., as a corporation) |

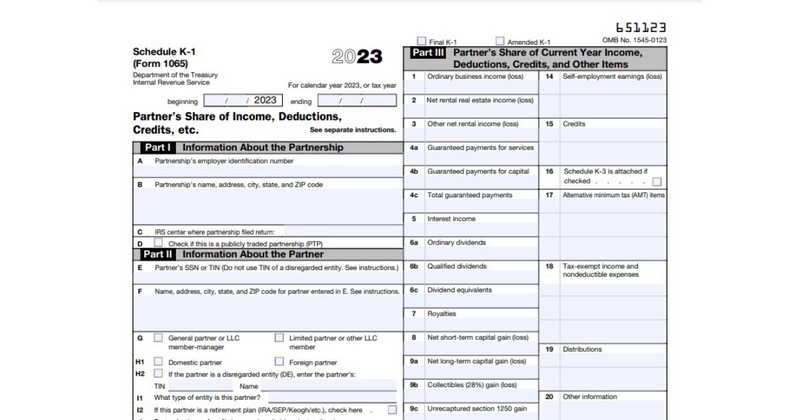

| Reporting | Form 1099-NEC (formerly 1099-MISC) | More complex reporting, often involves Form 1065 or 1120 or K-1 |

| Personal Liability | Personally liable for company debts and legal actions | Separation of personal assets from business liabilities |

| Business Flexibility | Less formal business structure | More formal business structure |

| Formation Complexity | Simpler setup, often no formal registration required | More formal setup and registration in most jurisdictions |

| Continuity | Business closure by individual decision or contractual completion | Business continuity, even with changes in ownership or members |

| Insurance Needs | Priority for insurance: liability protection, property damage, and professional errors | Varied needs based on the number of members, employees, and the nature of the business |

| State-Level Compliance | Usually, no state-level requirements | Responsibility for fulfilling extra paperwork and paying fees regularly, depending on state regulations |

1099 contractor vs. LLC comparison table

Now, let’s examine each factor further to answer the question: Is it better to be a 1099 or LLC?

LLC Vs. Independent Contractor Registration

Forming an LLC requires registration with the state’s governing body, usually the secretary of state. Sometimes, it also involves registration with the local chamber of commerce. This process ensures your business is legally recognized and under specific regulations.

Conversely, as an independent contractor, you don’t need to officially sign up before starting work. For example, plumbers, artists, and writers can simply begin offering their services without formal registration. Yet, certain professions, like doctors or lawyers, may need to register with the state or local government.

Liability Of Independent Contractor Vs. LLC

As a sole proprietor, you manage your business as an individual without creating a separate legal entity. It means you and your business are essentially the same in the eyes of the law.

This flexible setup gives you complete control over your business decisions and operations. You have direct access to any profits your business creates because there are no shareholders or partners.

However, a significant concern is you have unlimited personal liability for any debts or liabilities your business incurs. If your company is sued or cannot pay its debts, your assets, such as your home or savings, could be at risk.

On the other hand, an LLC is a legal entity separate from its owners. In most cases, the LLC will be responsible for its debts and liabilities, protecting the owner’s assets from business liability.

Tax Benefits Of LLC Vs. Independent Contractors

LLCs sit in the middle ground between sole proprietorships and corporations:

- Single-member LLCs are taxed similarly to sole proprietorships.

- Multi-member LLCs are taxed more like partnerships or corporations.

An LLC can choose different tax setups, like S corporation or C corporation status, which can give them tax advantages, especially for bigger businesses.

In the case of an LLC with multiple owners, each member must fulfill certain obligations, including processing forms such as K-1 and 1061. If the LLC has employees, it must also handle employer taxes. Furthermore, some states require LLCs to complete extra paperwork and pay fees regularly, like yearly or every two years.

Meanwhile, independent contractors must only pay self-employment taxes and usually don’t have to meet these state-level requirements. They handle their taxation by focusing on their business income and reporting earnings and losses on their personal tax returns.

Many independent contractors prefer pass-through taxation over the double taxation faced by corporations.

For tax filings, involved forms are the following:

- Independent contractors use Form 1040-ES to estimate and pay taxes quarterly.

- The Schedule C form details business income and deductible expenses. It calculates the business’s profit or loss, which is then reported on the tax return (Form 1040).

- Self-Employment Tax contains Social Security and Medicare taxes for self-employed individuals.

- If a business pays an independent contractor more than $600 in a tax year for services provided, it must issue a Form 1099-NEC to the contractor and the IRS.

Unlike W-2 forms for regular employees, 1099s don’t detail tax deductions, so contractors must track their earnings and taxes independently.

Business Operations Of 1099 Individual Vs. LLC

Another difference between a 1099 employee and an LLC is the business operations:

- As an independent contractor, you operate as self-employed, providing your services directly to customers or through intermediaries such as agencies or platforms. You have complete control over your work schedule, client selection, and pricing.

- A single-member LLC functions similarly to an independent contractor in managing businesses. The main administrative difference is an LLC must follow certain formalities, such as maintaining separate business bank accounts and filing annual reports with the state. All LLC’s must receive payments into their LLC bank account not a personal account.

However, where LLCs can offer distinct advantages lies in the ability to scale and expand more effectively. As an LLC, you can hire employees to support business operations, increasing your ability to take on more work or expand into new markets.

Further, lenders and investors may view the LLC structure as more stable and trustworthy. As a result, forming an LLC makes securing business loans or attracting investment capital easier.

Insurance Difference Between 1099 Vs. LLC

Regarding insurance, the decision-making process between 1099 workers and LLCs differs in a few aspects:

For independent contractors, choosing an insurance plan is critical because their personal finances will be at risk in case of any mishap or lawsuit. As a result, they often prioritize insurance to protect against risks such as liability lawsuits, property damage, or professional errors or omissions. Common insurance types for independent contractors include:

- General liability insurance

- Professional liability (or errors and omissions) insurance

- Business property insurance.

Meanwhile, LLCs only need some insurance to minimize the risks associated with their business. Their insurance requirements vary based on the number of members and employees, the nature of the company, and applicable state regulations.

Common types of LLC insurance include:

- General liability insurance

- Workers’ compensation insurance (if the LLC has employees)

- Commercial property insurance

- Professional liability insurance (if applicable for the LLC industry).

Furthermore, an LLC’s insurance needs may change as the business grows. For example, when an LLC expands its operations or hires more employees, it should reassess its insurance coverage to deal with new risks and liabilities.

Overall, being an independent contractor or LLC has different pros and cons. While forming an LLC as an independent contractor can be financially beneficial, you should weigh challenges and benefits carefully to ensure success.

The Bottom Line

Understanding the differences between 1099 vs. LLC is critical for entrepreneurs in navigating their business paths. Moreover, it helps employers classify and select service providers suitably.

Whether you hire independent contractors or work with an LLC, let’s partner with ERA – a reputable Employer Of Record service provider. Contact us today, and we will help you manage contractors effectively!

Frequently Asked Questions

Is it better to be self-employed or LLC?

Whether you should remain self-employed or form an LLC depends on your goals, efforts, income, and risk tolerance. For instance, if you want limited liability protection and plan to work with many clients or earn significant income, you should form an LLC.

Should I create an LLC for my 1099 income?

Yes. Forming an LLC as a 1099 employee is quick and inexpensive yet offers significant benefits. These include legal protections, the right to hire employees to grow the business, and access to business loans. It is a wise business decision for many contractors.

Is it better to be an independent contractor or sole proprietor?

Choosing between being an independent contractor or sole proprietor is not necessary. You can be both, depending on the type of work you do.

For example, you are a freelance writer and sell your writing course. You are a sole proprietor if you have not established a formal business entity. However, you can also write regularly for a publication or company website, where you are an independent contractor.

See more related articles:

1099 vs. 1040: Key Differences Every Taxpayer Should Know

1098 vs 1099: Which Form Should You Receive and Why?

Navigating Tax Forms: 1099-NEC vs 1099-MISC Explained

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.