California PTO Laws

Key Takeaways

- The California PTO Laws 2024 raises the minimum paid sick time to five days or 40 hours. Discover the latest PTO laws in California in this article.

- Employers cannot limit the accrual of vacation time. Find out why and explore ERA’s highlights on the new law, accrual, payment, and other aspects of vacation days.

How Does PTO Work In California?

Under California law, employers are not mandated to provide paid time off (PTO), vacation days, holiday pay, or personal days. However, if a company’s policy offers paid time off California, employees are entitled to the specified amount of leave outlined in that policy.

PTO encompasses vacation days, holiday pay, sick leave, and other types of paid time off

California law also mandates employers to compensate employees for unused vacation time upon termination. Vacation/PTO payouts at termination must be prorated daily and paid at the final rate, effective at the date separation.

For example, according to the California Labor Commissioner, here’s how to calculate daily proration:

An employee entitled to 120 hours of annual vacation who quits on August 7 (the 219th day of the year) with no vacation taken and no carryover is entitled to 60% of their vacation or 72 hours. A final pay rate of $15 per hour results in a payout of $1,080 (72 hours x $15/hour).

Moreover, if an employer fails to pay accrued vacation time, the employee can seek compensation by filing a claim for unpaid wages or pursuing legal action.

California PTO Laws 2024

The new California PTO Law 2024 introduces significant changes to paid sick leave (PSL) policies.

Increase in the Minimum Employer-Mandated Paid Sick Leave

Starting January 1, 2024, California Senate Bill (SB) 616 mandates that employers provide workers with a minimum of 40 hours or five days of paid sick leave annually. This amount is an increase from the previous limit under the 2023 laws, where employers could restrict sick leave usage to 24 hours or 3 days per year.

For example, employees who work 10 hours a day would be entitled to five days or 50 hours of PSL. Similarly, if employees work 6 hours per day and take five days of paid sick leave, totaling 30 hours, they would still have 10 remaining.

Application of the New Paid Sick Leave Law

This new law applies to employees in California who work at least 30 days for the same business within a year and includes:

- Part-time employees

- Per diem workers

- In-home supportive services providers (IHSS)

- Temporary employees

Staffing agency employees are also covered under the paid sick leave law. Consequently, whether as the primary or joint employer, the employer is responsible for providing paid sick leave to eligible employees.

PTO Laws California 2024 grant workers additional paid sick leave.

Exceptions of the New Paid Sick Leave Law

The following employees are exempt from the new law:

- Flight deck or cabin crew members hired by air carriers provided they receive compensation for time off that meets or exceeds the law’s requirements.

- Retired annuitants who were employed by government entities.

- Railroad employees.

- Construction industry employees are covered by a Collective Bargaining Agreement (CBA) with specific provisions.

Additionally, employees outside the construction industry who a CBA covers with specific provisions are partially exempt from the PSL requirements.

Accrual of Paid Sick Leave

Employers have several options for how employees can earn paid sick leave:

- Workers accrue an hour of paid sick leave for every 30 hours they’ve worked.

- Employers may grant employees an up-front allocation of 40 hours (or five days) of PSL at the beginning of employment and every 12 months after that.

- Employers can choose a different accrual method if it ensures employees accrue at least 24 hours (or three days) of paid sick leave by the 120th day of employment and 40 hours (or five days) by the 200th day.

- Employers may require employees to complete 90 days of employment before using PSL, or they may advance PSL before entirely accruing.

Employees may be required to complete 90 days before becoming eligible for paid sick leave.

Capping Paid Sick Leave

Employers can set a maximum accrual cap of 80 hours (or ten days) if they accrue sick leave rather than front-loading it. Additionally, employers can limit employees to using up to 40 hours (or five days) of accrued PSL per year.

Carry-Over

Employers must allow at least 40 hours (or five days) of accrued paid sick leave (PSL) to carry over into the next 12-month period. So, employees who have 40 hours or more of unused PSL can carry over the total 40 hours without restriction.

For example, if an employee has 50 hours of unused PSL at the end of the year, the employer must allow at least 40 hours to carry over into the next 12-month period. The remaining 10 hours could be forfeited, depending on the employer’s policy.

Written Notice

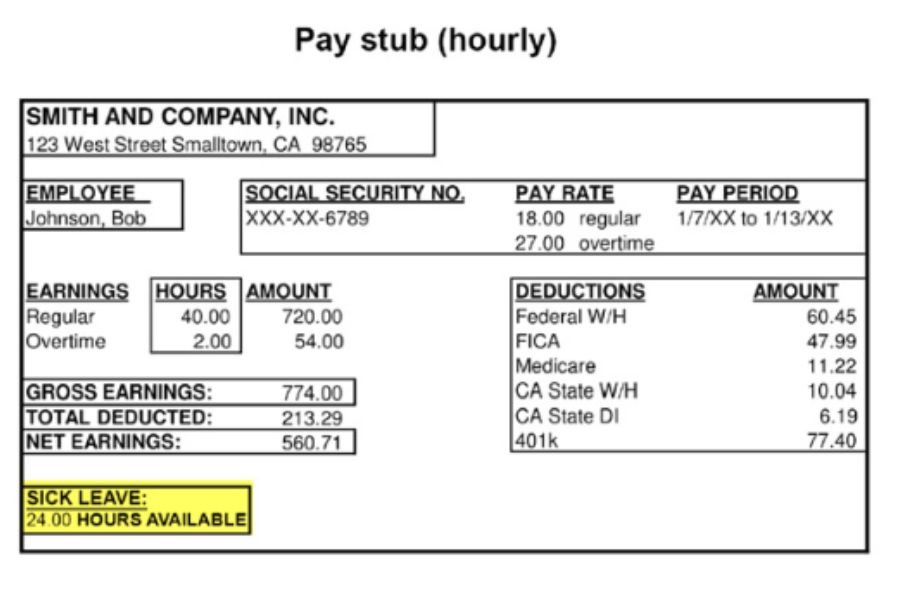

Employers are responsible for giving employees written notice of their available paid sick leave by including the current balance on pay stubs or a similar document.

An example of a pay stub that lists the available sick leave hours.

Existing Employer Plans and PTO

Businesses with PTO plans comply with California law if those plans meet or exceed the state’s minimum of five days or forty hours of paid sick leave. PTO plans must also allow accrual of up to ten days or eighty hours of paid sick time.

If employees traditionally used PTO for vacation but exceeded the new paid sick leave requirements, employers are not required to provide additional days. The same applies to businesses offering unlimited paid sick leave—simply noting “unlimited” on pay stubs is sufficient to meet the standard.

Permitted Uses of Paid Sick Leave Under the New Law

Paid sick leave can be used for various purposes, including:

- Preventive care for the workers or a family member

- Treatment for an existing health condition

- Services related to sexual assault, domestic violence, or stalking

- Annual physicals and seasonal vaccinations

The term “family member” encompasses the worker’s parent, spouse, child, registered domestic partner, grandparent, grandchild, or sibling.

Expanded family sick leave for eligible employees takes effect in January 2024.

Notification Requirements for Using Paid Sick Leave

The new law requires employees to inform employers of their intention to use sick leave as soon as possible. Prompt notification is needed in emergencies or unexpected illnesses with little advance notice. Employees should also provide as much advance notice as possible for planned absences, such as surgeries.

Protections for Employees Under the New Paid Sick Leave Law

The new law prohibits employers from demanding evidence of medical visits or treatment to validate the use of sick time. Employees are entitled to use sick time with only a verbal or written request. However, employers may request documentation if evidence suggests that employees used the time off for an improper purpose.

The law applies only to using sick time properly accrued for legally protected reasons. It does not apply to unexcused absences or ill days taken without accumulated time. Employers are allowed to discipline employees for such non-covered absences. However, they cannot retaliate against employees or impose penalties for using their accrued sick time.

Determination of Paid Sick Time

Employees have the discretion to decide how much sick time they need. Employers cannot impose minimum standards, requiring employees to take sick time in whole or half-day increments. While employers may establish a minimum of two hours for sick leave usage, the duration of time taken is ultimately determined by the employee.

The new law gives workers complete control over the amount of sick leave time.

Payment for Earned Paid Sick Leave

Payment for earned PSL varies by employee classification. Eligible employees should receive payment for sick leave within the same pay period at their regular hourly rate, with details itemized on their pay stubs. Exempt employees’ sick leave is paid at the same rate as other types of leave, such as vacation.

While the state mandates the accrual of paid sick leave, employees are only entitled to cash out unused hours if their employer has a specific policy allowing it.

How Many Vacation Days In California?

California Vacation Law 2023 does not specify employers’ required number of vacation days. Employers can set their own vacation policies, which may vary based on an employee’s length of service, job position, and company-wide policies. This flexibility continues under the California Vacation Law 2024.

Can the Employer Limit the Accrual of Vacation Time?

No. In California, vacation time cannot expire, so employers cannot implement a “use-it-or-lose-it” policy. However, employers can manage the accrual of excessive vacation days by setting a reasonable cap or requiring employees to take their vacation days periodically.

Can the Employer Eliminate Accrued Vacation Time?

No. Accrued vacation time is classified as earned wages under the California Labor Code and cannot be taken away as a penalty or for any other reason. Employers must also pay out accrued vacation time to employees upon separation from employment, whether due to resignation, termination, or any other cause.

Is Vacation Pay the Same as PTO?

No. PTO is a broader term that includes vacation days, holiday pay, sick leave, and more. Vacation pay refers explicitly to compensation for time off for leisure or personal reasons.

Unlike PTO, vacation pay is not legally required, but other types of PTO, such as sick leave, must be provided according to California law. For simplicity, employers may combine various forms of PTO, including vacation days and sick leave, into a single bank of hours.

Vacation pay is an optional requirement under California PTO laws.

Are Employers Required to Pay Employees for Unused Vacation Time Upon Termination?

Yes, employers are required to pay employees for unused vacation time upon termination. According to California Labor Code Section 227.3, if a contract or policy provides for paid vacations, employees must be paid for any vested vacation time at their final rate when terminated.

Employment contracts or policies cannot allow the forfeiture of vested vacation time upon termination.

What Happens to PTO When an Employee is Laid Off?

Under California law, any “earned” PTO, including vacation days, personal days, or holiday pay, must be paid out to employees upon layoff or involuntary separation from employment. However, mandated sick leave is not required to be paid out upon layoff.

Can Employees Sue Employers for Unpaid Vacation Time?

Yes. Employees can sue employers if they fail to comply with California PTO laws or employment agreements regarding vacation time. California considers accrued vacation time as earned wages, which employers must pay out upon termination. It is illegal for employers to deny or withhold vacation pay upon separation.

How Can Global Businesses Ensure Compliance with California PTO Laws?

Partnering with ERA’s Employer of Record (EOR) services effectively ensures compliance with California PTO laws. ERA serves as the legal employer for employees in 100+ countries, managing HR tasks such as payroll, tax compliance, and employee benefits. This partnership helps businesses adhere to federal and state labor laws and mitigate legal risks while reducing future costs related to labor obligations and the establishment and maintenance of international offices. Contact us for a free consultation!

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.