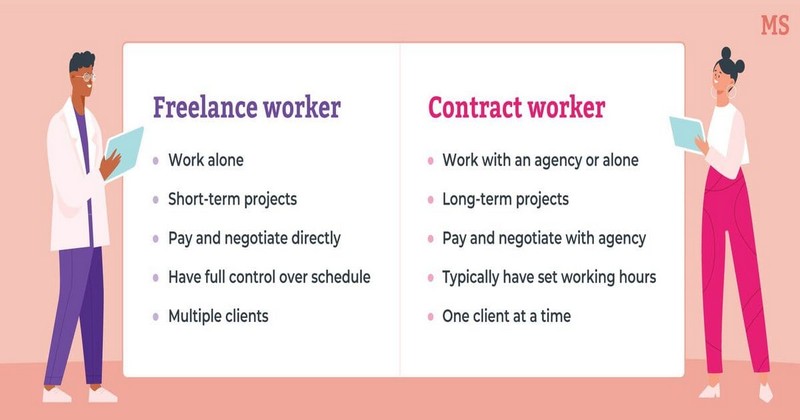

Many hiring managers face challenges when working with freelancers and contractors, such as control of meeting deadlines and planning projects. However, one aspect of freelancer engagements often goes undiscussed—making sure to hire a compliance contractor.

Therefore, this article will discuss contractor compliance, giving you a clear definition and how it can benefit your company.

What Is Contractor Compliance?

Contractor compliance is the legal and regulatory aspect of working with freelancers and self-employed contractors. It ensures that external workers (freelancers, contractors, etc.) provide services for the company workforce legally and compliantly, meet regulatory requirements in their work, and protect your company in case of any issues.

Every new Freelancer or Self-Employed Contractor will sign a formal contract outlining the agreement details, including the parties’ responsibilities, deadlines, payment terms, etc. This contract also holds both parties accountable for their legal and ethical responsibilities. HR and legal departments must be more involved in contract compliance.

Why Do You Need Contractor Compliance Management?

Now that we have defined “what is contractor compliance, here are the 5 key advantages your company benefit from:

Ensure Correct Employee Classification

It’s important to have a clear contractor compliance management protocol to understand the category of external workers you work with. If you hire an external worker through an outsourcing agency for a specific period, such as several months, the HR department will categorize it as a W-2 in the USA, PAYE in the United Kingdom, or employed contractor. Your company should avoid misclassifying employees as contractors.

Be aware that these classifications have distinct legal and tax implications for you and the workers. Misclassification can lead to workers falling under laws like IR35 in the United Kingdom or AB5 in California, USA, resulting in additional tax costs.

Outsourcing an agent of record (AOR) will be ideal if you are unsure about your classification. An AOR takes on the legal responsibility for classifying a company’s independent contractors, like ERA, which helps to reduce the company’s risk of misclassifying a contractor as an employee, leading to unwanted fines and penalties.

Formalize The Way You Work With Contractors

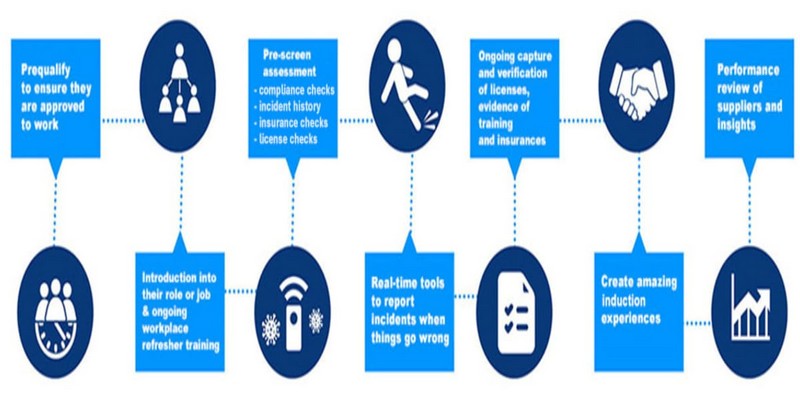

Contractor compliance management establishes a clear and consistent process for onboarding, evaluating, and managing contractors to ensure everyone involved understands the expectations.

It also lays out the specific requirements for contractors, including necessary licenses, certifications, insurance, and safety protocols. This feature eliminates ambiguity and ensures contractors are qualified for the job. For example, a candidate must have a bachelor’s degree in Computing to be qualified for an IT position.

Moreover, all contractor information, from pre-qualification documents to performance reviews, is stored in a central location to track compliance status and access records easily l.

By formalizing the process, your company can mitigate risks associated with non-compliant contractors, including financial risks, legal liabilities, and workplace safety hazards.

Get Payments Right

Your contract with a self-employed worker outside the company has no required timelines requiring you to pay them. However, this payment process can be challenging for many client companies since some payment systems only focus on full-time employees, not freelancers or consultants, and it can take 15 – 60 days for the payment to be received.

Good contractor compliance software can help you avoid these issues by storing your workers’ bank details, tax information, and other data as soon as they are onboarded. This means managers will only have to search for this information occasionally to forward it to the accounts department when a new invoice needs to be paid.

Some contractor management systems can even automate payments, making it easier to process invoices as soon as the manager approves them.

Keep Your Organization Protected

When you hire someone outside your organization to do a job for you, you expect them to follow specific rules. For example, you expect them not to copy someone else’s work, use illegal software, or share secret information with people who should not know about it.

A contract ensures these rules are clear and everyone follows them.

Remember to track the parties involved in these documents. It is recommended that you use a system to manage these documents, which will spot the problem automatically and notify parties to fix it before causing any issues.

In some countries, all workers—even temporary ones—must attend a training session about treating people fairly and avoiding harassment.

Protect Your Contractor Data.

Freelancers and contractors must provide sensitive information like social security numbers and tax details. To comply, you must store this information securely, like on a contractor management system’s secure server.

However, when proper processes for onboarding freelancers are lacking, sensitive information is often stored disorganizedly, such as across various spreadsheets and inboxes. If a manager’s system is stolen, all this sensitive data can be left vulnerable, which could lead to fines or legal action against your company.

Contractor Compliance Checklist

A contractor compliance checklist ensures contractors meet all legal requirements and perform the job according to specific standards set by the corporation. Let’s look at the checklist below.

Hire Contractors Compliantly

When hiring freelancers or contractors, it’s important to follow contractors compliance guidelines. This means creating a project description that is clear, accurate, and inclusive of work responsibilities and payment details.

It also means conducting interviews in a fair and unbiased way. Make sure to treat all candidates equally and avoid any form of discrimination.

Project Compliance

When hiring a compliance contractor for a project, ensure they have the required skills and training to meet the role’s criteria.

To do this, ask for proof of work in the form of a resume, portfolio, work samples, or client references.

HR Compliance

After the initial round of checks, the next step is to request them to furnish the necessary information and documents for a compliant HR onboarding procedure.

This typically involves providing personal details such as name, address, and contact information and submitting KYC documents such as identity proof, address proof, and any other relevant identification documents.

Additionally, the contractor must provide their tax registration number and any other supporting documentation necessary for tax compliance purposes. This process ensures that the contractor is onboarded in instruction compliance with all HR policies and regulations.

Legal Compliance

Once you have identified potential contractors for a project, ensure you have all the necessary legal paperwork before starting work. This involves drafting and formalizing a contract outlining the terms and conditions and non-disclosure agreements (NDAs). You also need confidentiality clauses.

Additionally, ask recruiters for your specific scope of work, including the project briefings and the responsibilities of each party involved. It is important to consult with your legal team or Agent of Record (AOR) to determine what other forms or documents are required for everyone to be on the same page and for the project to proceed smoothly.

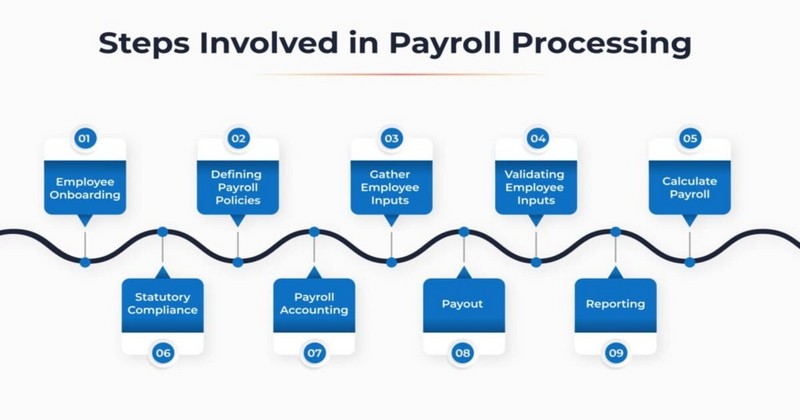

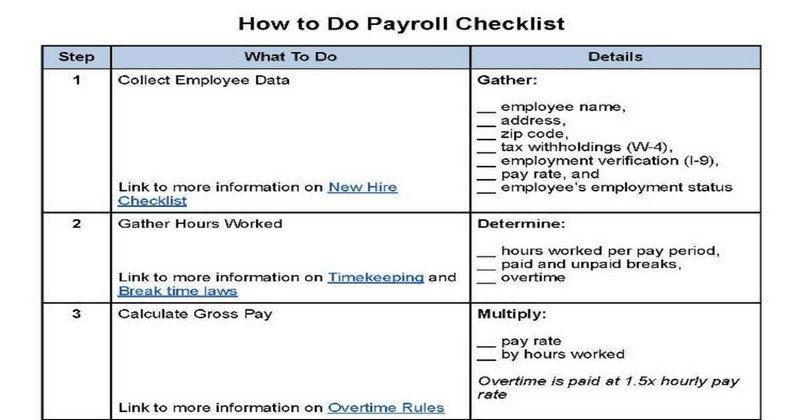

Payroll compliance

When paying your contractors, it’s important to accurately collect their bank account information and payment details. For international contractors, you may need to obtain additional transfer codes and currency details.

It’s also crucial to check with your payroll team whether their portal can support compliant payments to the relevant country. This will help you prevent any potential legal or financial complications from happening.

Tech Compliance

When hiring an external contractor for a project, the contractor must have the necessary software licenses and training certificates, depending on the role.

This ensures that the contractor has the expertise and knowledge to complete the project effectively.

Therefore, it is essential to verify the contractor’s credentials before hiring them to prevent future legal or financial problems.

Frequently Asked Questions

How Do You Ensure Contractor Compliance?

The critical elements of contractors compliance management are:

- Contract development and review.

- Training and development of team working with contractors

- Contractor selection process.

- Risk management and mitigation.

- Performance monitoring and auditing.

- Communication and reporting.

What Is Contract Compliance In Construction?

Construction compliance with a contract means following its rules and procedures. It is important to review the contract periodically to ensure these rules and procedures are followed. This includes checking for any deviations from the compliance mandates and protocols.

What Is A Contract Compliance Job Description?

The Contract Compliance Manager ensures that contract language complies with local, state, and federal laws, bidding procedures, and University policies. They do this by utilizing their expertise and knowledge of these requirements.

Final Thoughts

More and more companies are hiring external workforce to facilitate scaling and business continuity. Contractor compliance management should keep up with the changing times. It should not be an afterthought but also not be too complex and time-consuming. Hopefully, after reading this article, you will gain comprehensive knowledge relating to contractor compliance. For further information, feel free to contact ERA!

See more related articles

Understanding Contractor Workers’ Compensation

Contractor vs Subcontractor: How To Differentiate?

Consultant vs Contractor: 4 Fundamental Differences

Difference Between Vendor vs Contractor: What Should Employers Know?

Freelancer vs Contractor: Understanding The Key Differences

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.