When staffing your business, you have many options for bringing on talent. The two most common types of work arrangements are W-2 and 1099 Independent contractor workers. Wages and other payments to employees are reported on IRS Form W-2, while payments to independent contractors are reported on IRS Form 1099.

In this article, you’ll learn more about the difference between 1099 and W2. With this information, you can decide which type of worker will work best for your business.

What Is A 1099 Worker?

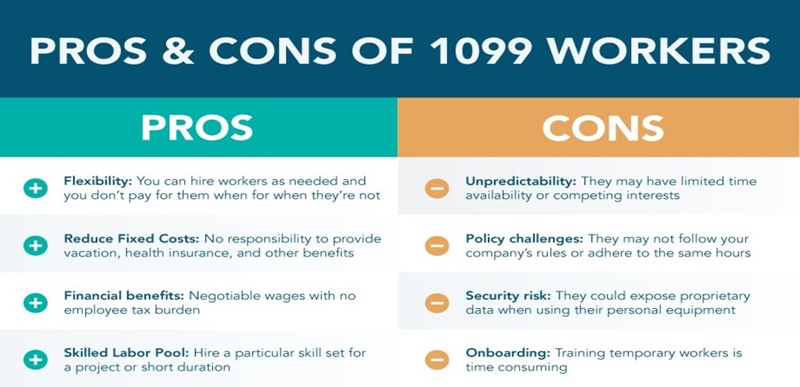

A 1099 worker is a freelancer / independent or unbiased contractor who is responsible for specific projects assigned by the company As they are not full-time employees, they won’t be charged for income taxes, Social Security and Medicare, or unemployment taxes.

Some common examples of 1099 vs W2 are:

- Freelance writers work on an assignment basis.

- Consultants support companies for a project with a clear start and end date.

- Gig workers get paid through an app for performing services.

- Freelance designers and developers work on an assignment or project basis.

Also, you don’t need to provide a W-2 to these 1099 workers during the tax period. However, you’ll need to issue a 1099-NEC to the independent contractors if you paid more than $600 during the year. And they will pay their self-employment taxes. For further understanding of 1099 workers, see the pros and cons below.

As a 1099 worker, there are some tax responsibilities you need to do:

- 1099 workers file their taxes, while employers pay payroll taxes for their employees.

- Independent contractors pay a self-employment tax covering their contribution to Social Security and Medicare taxes.

- Contractors must pay income tax after deductions.

- Independent contractors have the right to tax deductibles, including business-related expenses.

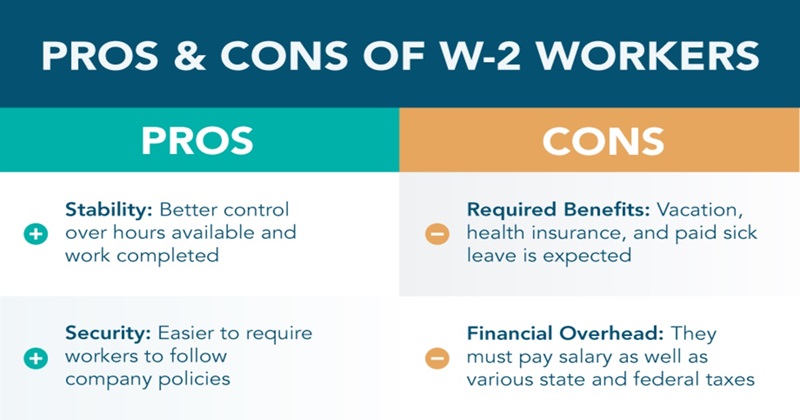

What is a W-2 employee?

A W-2 employee is an individual who is recruited by a company as a full-time employee “FTE” or employed contract worker who receives a W-2 tax form annually to report their income and taxes withheld.

W-2 employees are not considered independent contractors. This means employers have more control over their work, including their schedule, workload, and tools. If you classify a worker as a W-2 employee, you must withhold:

- Social Security tax

- Income tax

- Medicare tax and any state income taxes for the employee’s benefit.

For further understanding of W2 workers, see the pros and cons below:

Still confused about this term? Let’s look at 3 examples below to help you distinguish 1099 employee vs w2 more clearly:

- Staff writers, project managers, and designers/developers have scheduled hours and ongoing work, either remote or in-office.

- Delivery drivers have scheduled hours and routes and use a company vehicle or signage.

- Project managers have standing team meetings.

6 Differences Between 1099 and W2: Know These Before Hiring

If the IRS knows you intentionally misclassified employees, it can impose additional fines and penalties, such as paying 100% of the employer’s and employee’s share of FICA taxes. By evaluating 6 criteria, we will give you a comprehensive view of these terms.

| Criteria | W-2 Employees | 1099 Workers |

| Amount of Control | Direct the work performed, including instructions, tools, training, and scheduling. | Use their methods, work on their schedule, and provide services to others. |

| Job Duties | Employers control what W-2 employees work on and can assign various tasks. | Contractors are hired for specific tasks, set their hours, and their duties are limited to the agreement’s scope. |

| Associated Costs | Payroll, taxes, benefits, equipment, and office space. | Contractors save employers money on taxes, benefits, and office space. |

| Payroll Taxes | Taxes are deducted from employees’ paychecks. Employers pay a portion of Social Security, Medicare, and unemployment taxes. | Contractors handle their taxes, using Form 1099-NEC for earnings over $600, and deduct work-related expenses. |

| Employee Benefits | Be entitled to minimum wage, overtime, and medical leave, and may receive health and dental insurance. | Not receive employer-sponsored benefits, saving employers on these expenses. |

| Cultural Impact | Contribute to company culture and team environment, improving retention and recruitment. | Contractors are less invested in company culture due to the transient nature of their work. |

Failing to distinguish the difference between W2 and 1099 can harm your HR operation. For instance, if you classify and make payment to an individual as an independent contractor when they should be classified as a W2 l employee, you could be responsible for back employment taxes and substantial penalties plus interest.

That’s why Employer of Record service from ERA can help you get over this nightmare. By legitimately employing workers on your behalf, our service saves your business from liability and compliance risks. Contact us now!

How Do You Know If 1099 or W2 Is Good For You?

Deciding which one to choose between 1099 and W2 is a confusing question. Let’s see the criteria below and make your decision:

A W-2 employee is a good fit if you:

- Seeking committed workers for long-term loyalty and productivity.

- Preferring to keep worker knowledge and skills in-house.

- Fostering and maintaining a distinct corporate culture.

A 1099 worker could be suitable for your business if you:

- Avoid paying payroll taxes and benefits to keep costs low

- Prefer specialized expertise over investing in training

- Want the flexibility to terminate a relationship when the project is done, or budget allows.

Frequently Asked Questions

Is It Better To Be Paid 1099 Or W-2?

Yes. Freelancers, also known as 1099 workers, have more flexibility in their work arrangements than their W2 colleagues. A 2017 tax bill grants them an additional 20% pass-through deduction, which leads to significant tax savings. However, they usually receive fewer benefits and are less secure in their employment status with their organization.

Do 1099 Pay More Taxes?

Yes. Currently, the tax rate for these employment taxes is 15.3% of a worker’s gross wages, so employers have to pay 7.65 of that and withhold the other half from W-2 employee paychecks. 1099 workers pay the complete 15.3% of the money they earn.

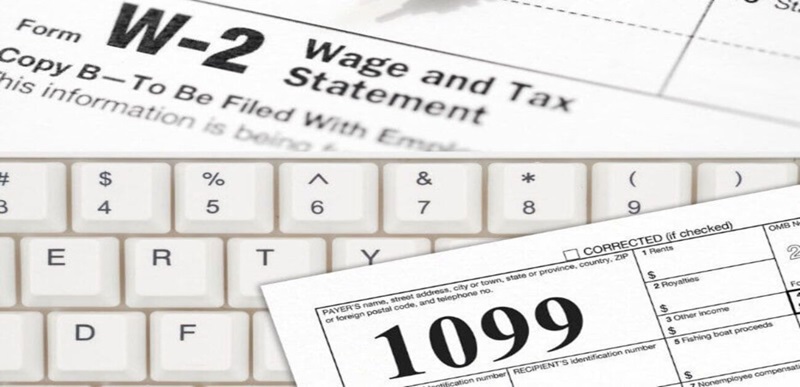

What Is A 1099 Form Used For?

A 1099 form is an information return you may receive from an entity that paid you certain types of income during the tax year. Even if you receive a 1099, it doesn’t necessarily mean you owe taxes on that income. However, you must report it to the IRS when you file your tax return.

Who Should Receive A 1099?

Businesses must use a 1099 form to report non-employment income to the IRS. If individuals who are not corporations receive at least $600 or more in non-employment income during the tax year, the business must issue a 1099 form to them.

As you can see, understanding the difference between 1099 and W2 workers can be a bit confusing. Again, a 1099 is self-employed and provides services to you. In contrast, a W2 works for your business and follows your rules.

Still confused about these terms? Feel free to contact ERA for further information. We offer many comprehensive staffing solutions while still focusing on leveraging your business.

See more related articles:

Navigating Tax Forms: 1099-NEC vs 1099-MISC Explained

1099 vs. 1040: Key Differences Every Taxpayer Should Know

1098 vs 1099: Which Form Should You Receive and Why?

5 Key Differences Between 1099 and LLC

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.