Tax forms can be confusing, especially for small employers. One such form is IRS Form 1096.

So, what is a 1096 tax form? Our ERA expert will make Form 1096 easier to understand in this guide. We’ll explain its purpose, who needs to deal with it, and give you a step-by-step guide on how to get, fill out, and submit Tax Form 1096.

What Is Form 1096?

If you are wondering what is a 1096, here is a simple explanation:

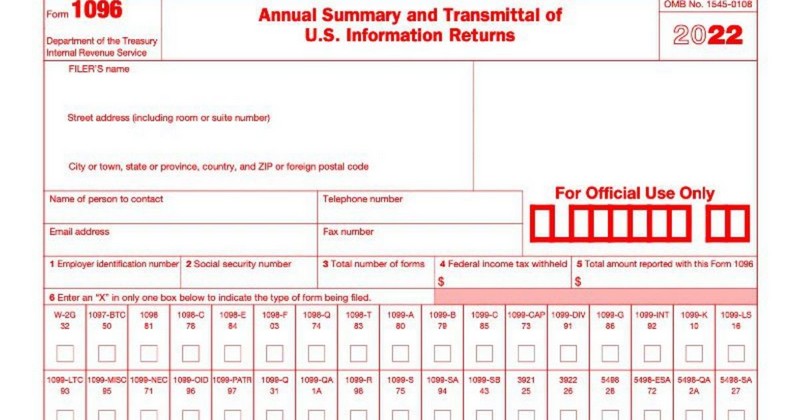

Form 1096, Annual Summary and Transmittal of US Information Returns, is a tax form businesses submit to the IRS. It reports non-employees’ income.

1096 form summarizes information in various forms, such as 1097, 1098, 1099, 3921, 3922, 5498, and Form W-2G, and helps the IRS organize and verify what employers have reported. If they forget to include it, they might face penalties. It’s also useful for keeping their records straight and for the IRS to keep track of their submissions.

Form 1096 is for mailing when filing an informational return. It is not used for electronic filing or tax software.

Who Can File IRS Form 1096?

Simply put, businesses and entities that file physical copies of certain types of information returns with the Internal Revenue Service (IRS) are those who need to fill out the 1096 form.

It is like a cover sheet summarizing the submitted forms, such as 1099s, which report various types of non-employee compensation, dividends, and other income. Essentially, Form 1096 compiles the information from the attached forms, providing the IRS with an overview of the submissions for accurate processing and record-keeping.

Also, small employers often use the 1099 and 1096 forms, which report payments to independent contractors.

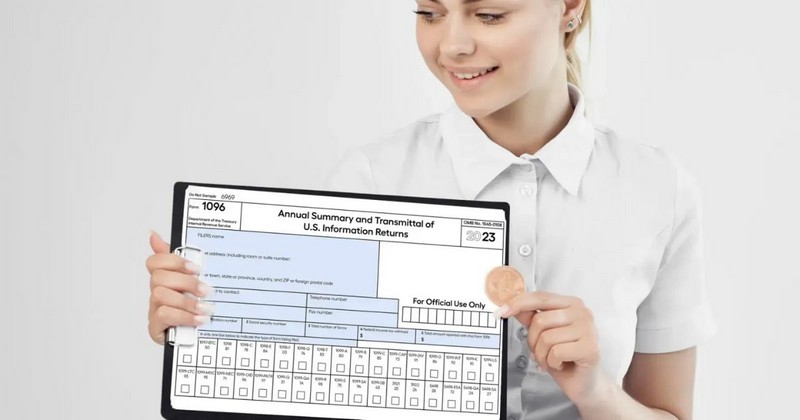

How To Fill Form 1096: Step By Step Guide

Following our ERA step-by-step guide, filling out IRS Form 1096 is simple. Let’s check 4 following steps to help you fill out Form 1096 correctly.

Step1: Complete Form 1096

Before you fill out form 1096, you need to complete it by following the guidance below:

- Business Info: Fill in your business details at the top, including the name, address, and the total number of forms you’re sending to the IRS.

- Personal Info: Add your details, such as your full name, contact information, home address, and accountant’s information.

- EIN or SSN: If your business has an Employer Identification Number (EIN), put it in Box 1. If you’re a sole proprietor without an EIN, use your Social Security Number (SSN) in Box 2.

- Number of Forms: In Box 3, write down how many forms you’re sending. For example, if you have five 1099-MISC forms, write “5.” It’s the number of forms, not the pages.

- Withheld Federal Income Tax: In Box 4, write the total amount of federal income tax withheld from all your forms. If none, write “0.”

- Information Return: Mark an “X” in Box 6 next to the type of return you’re sending so the IRS knows what you’re sending. If you’re sending different types, fill out a separate Form 1096 for each.

- Review and File: Double-check everything, sign, date, and add your title at the bottom. Make copies for yourself before sending them off to the IRS.

Step2: Sort by Form Type

After filling out the forms, group them by their form numbers. For example, if you have Form 1099-MISC, keep it separate from the others. Checking these steps to make sure you do it better:

- Sort Forms: Gather your different forms, such as 1099-MISC or 1099-INT, and put them in piles based on their type.

- Count and Add Up: Count the number of forms in each pile and add the total tax withheld for each type.

- Fill Out Form 1096: Complete a separate Form 1096 for each pile. Write down the total number of forms and tax withheld.

- Sign and Send: Sign and date each Form 1096. Then, send each one along with the forms to the IRS.

- Double-Check: Before sending anything, double-check everything to ensure it’s right. This way, you keep your reporting organized and correct for the IRS.

Step3: Find the Right Mailing Address

To send the IRS your completed information returns and Form 1096, you’ll need the correct mailing address based on your business’s location.

For example, if your business is in California, you should follow the address: Department of the Treasury Internal Revenue Service Center Ogden, UT 84201. Each regulation address will take responsibility and deal with the correct location.

It would be best if you double-checked the IRS Form 1096 PDF to ensure you’re sending your documents to the correct IRS address.

Step4: Follow IRS Instructions

The IRS offers clear instructions for filing paper returns in their official 1099 and 1096 instructions document. These instructions cover details like using staples, print type, and more. Checking these instructions before mailing ensures you follow IRS guidelines.

*Note: There are exceptions for low-volume returns. If you’re dealing with any of these IRS business forms, you can print the form and Form 1096 from the IRS website, complete them, and mail them based on your business’s location. It makes filing these forms easier, giving businesses more convenience.

This step-by-step guide offers employers clear direction on filling out Form 1096 and what is a 1096 tax form used for. By following these instructions, employers can confidently fulfill their tax reporting obligations, ensure compliance with IRS regulations, and boost the smooth operation of their businesses.

Frequently Asked Questions

When is the deadline for filing Form 1096?

The Form 1096 filing due date is between January 31 and March 31. The specific deadline within this range depends on the tax calendar, how you file and what information you include.

For example, the deadline for Form 1096 for the 2023 tax year is as follows:

- Give recipients the copies by January 31, 2024.

- If you’re filing on paper, the deadline is February 28, 2024.

- If you’re e-filing, do it by April 1, 2024.

How to Complete Form 1096?

Completing form 1096 is not complex if you follow these 7 steps:

- Fill in business info: Fill in your business details at the top, including name, address, and total number of forms.

- Fill in personal info: Add your full name, contact info, home address, and accountant’s details.

- EIN or SSN: Use your EIN in Box 1 or your SSN in Box 2, depending on your business type.

- Number of Forms: Write the total number of forms in Box 3.

- Withheld Federal Income Tax: Put the total amount withheld in Box 4.

- Information Return: Mark an “X” in Box 6 for the type of return you’re sending.

- Review and File: Double-check, sign, date, and make copies before mailing to the IRS.

What is Use Form 1096?

Form 1096 is like a summary sheet that sends specific information returns (like Form 1099) to the IRS. It includes the total number of returns and the total amounts reported. It’s like a cover page that helps the IRS organize and handle the data quickly and accurately.

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.