Key Takeaways:

- Independent contractor or freelancer payment is a freelancer’s compensation for their work, often through various methods like hourly rates, project fees, or retainers.

- The best freelancer payment methods are bank transfers, peer-to-peer platforms, freelance marketplaces, and payment processors.

- To get paid as a freelancer, establish clear payment terms, use contracts or agreements, invoice promptly and accurately, and build strong relationships with clients based on trust and professionalism.

What Is A Freelancer?

A freelancer is a self-employed individual who offers their services to clients on a project or task basis rather than working for a single employer. Independent contractors are generally understood to include freelancers.

How Do Freelancers Get Paid?

Freelancers can choose from various payment structures depending on their preferences and the nature of their work. Here’s a breakdown of common independent contractor and freelancer payment methods:

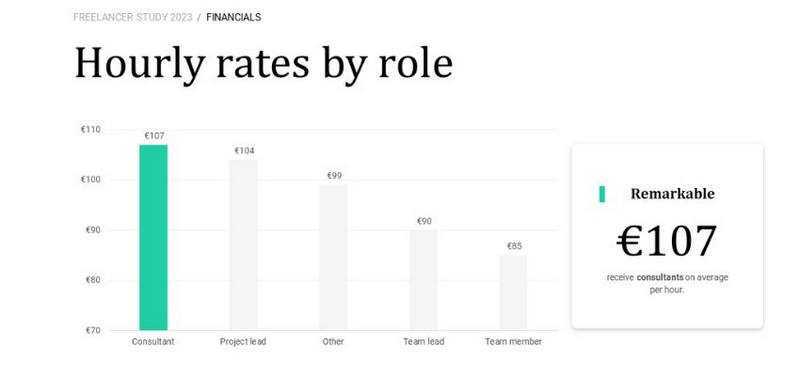

1. Hourly Rate

For every hour of work performed, the freelancer bills the customer. This approach is often used in ongoing or extended projects when the scope of work is not explicitly established.

For example, a finance freelancer, like a freelance consultant, charges €107 per hour on average, but this varies depending on their level.

2. Project-Based Fee

Instead of charging by the hour, freelancers agree on a fixed fee for completing an entire project. This approach clarifies both parties’ scope of work and the total cost.

3. Retainer Fee

A retainer fee is an upfront payment securing ongoing services, ensuring priority access and availability for future work. Some freelancers work with clients on a long-term basis, providing ongoing services. In these cases, clients may pay a monthly or quarterly retainer fee to secure the freelancer’s availability and services.

EOR services can be a valuable solution for companies seeking guidance on how to pay freelancers, especially for long-term engagements. Companies like ERA offer EOR solutions that simplify payments, manage payroll taxes, and ensure compliance.

4. Per-Unit Rate (E.G., Per Word, Per Image)

In fields like writing, editing, graphic design, and other creative endeavors, independent contractor and freelancer payments frequently operate on a per-unit basis. For instance, writers may bill by the word, and photographers may bill by the image delivered.

5. Commission

In certain industries like sales, marketing, and real estate, freelancers may earn a commission based on the sales or deals they facilitate. This method ties payment directly to the results achieved.

6. Value-Based Pricing

Adopting a value-based pricing approach is key when getting paid as a freelancer. This payment is determined by the value the job delivers to the client rather than just the time it takes to complete.

For example, a freelance software engineer specializing in complex machine-learning algorithms could command higher rates. This is due to their ability to handle large-scale data processing projects. These skills are often more niche and in-demand than front-end development or mobile app creation.

How To Get Paid As A Freelancer: Payment Methods

Navigating freelance work requires knowing the payment options for freelancers, ranging from traditional bank transfers to digital solutions like PayPal and cryptocurrencies. Each choice has its pros and cons, so freelancers must choose wisely based on their needs.

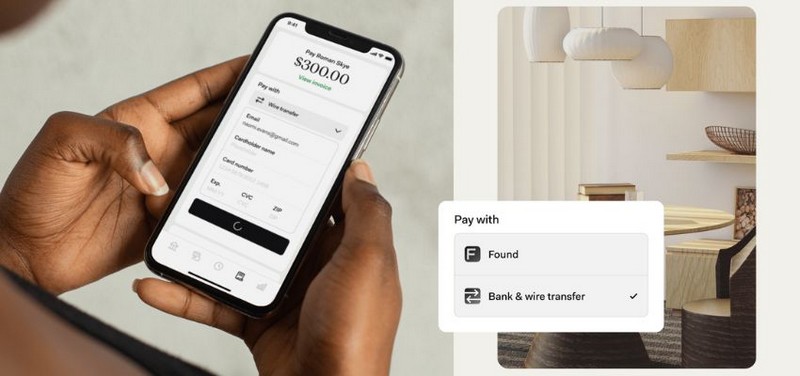

1. Bank Transfers (Wire Transfers, Direct Deposit)

Bank transfers, including wire transfers and direct deposits, are the best way to pay freelancers worldwide due to their reliability and convenience. With wire transfers, clients transfer funds directly from their bank account to the freelancer’s account.

This method is often preferred for larger transactions or international independent contractor and freelancer payments because it’s secure and ensures prompt payment. On the other hand, direct deposit is a domestic transfer where clients electronically deposit funds directly into the freelancer’s bank account. It’s convenient for both parties as it eliminates the need for paper checks and reduces processing time.

To receive payments via bank transfer, freelancers provide clients with bank account details, like the account and routing numbers. Freelancers need to ensure the accuracy of this information to avoid payment delays or errors.

Additionally, freelancers should be aware of any associated fees, such as international wire transfer fees, which may vary depending on the banks involved. Keeping detailed records of transactions and confirming receipt of payment ensures smooth financial transactions and maintains a healthy client relationship.

| Pros | Cons |

| Secure and reliable method for transferring fundsConvenient for both freelancers and clientsPrompt access to earnings with direct deposits | Costly fees for international wire transfersPotential processing delays |

2. Peer-To-Peer Platforms (Paypal, Venmo, Zelle)

Peer-to-peer (P2P) platforms like PayPal, Venmo, and Zelle are digital payment systems that enable individuals to send and receive money directly.

Things to consider when choosing a P2P platform:

- Transaction fees: Compare the fees associated with each platform and factor them into your pricing.

- International payments: If you work with international clients, ensure the platform supports transfers in their currency.

- Security: Choose a reputable platform with strong security measures to protect your financial information.

PayPal, Venmo, and Zelle are best payment methods for freelancers. They allow you to send and receive money with lower fees compared to traditional international wire transfers or other payment methods. You often just need an email address or phone number to receive or send money. Here’s a breakdown of each:

- PayPal: Charges a transaction fee (2.9% + $0.30 USD) for both domestic and international clients. Offers a “Friends and Family” option with no fees.

- Venmo and Zelle: These free P2P services are ideal for smaller payments or working with local clients. It charges a 1% fee (minimum $0.25) for receiving payments for goods or services.

- Zelle: Focuses on bank transfers between individuals in the US. Free to receive payments.

| Pros | Cons |

| Allow quick and easy transfers between accounts, often without waiting days for checks to clear.Often free for personal transactions (be aware of terms of service)Be a good option for splitting bills, paying for occasional freelance gigs,… | May not offer the same level of security features as traditional business accounts. |

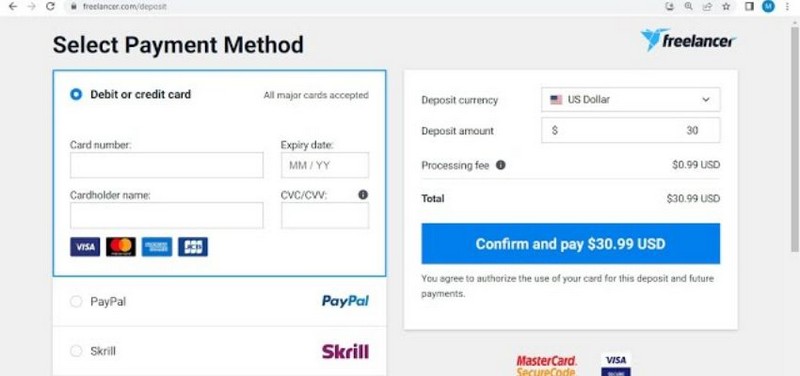

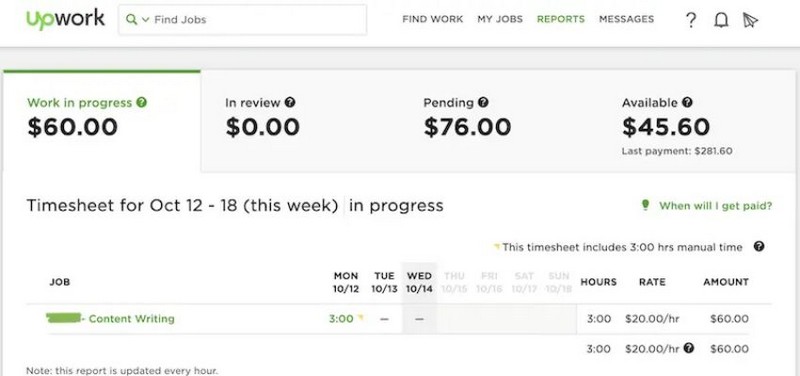

3. Freelance Marketplaces (Built-In Payment Systems)

Freelance platforms, like Upwork, Freelancer, Toptal, or SolidGigs, are intermediaries between clients and freelancers, facilitating job postings and proposal submissions. These platforms are where newbie freelancers can gain job opportunities. However, they may charge a percentage of freelancers’ earnings depending on the plan subscription.

For freelancers working remotely or internationally, freelance platforms offer the best way to get paid as a freelancer and receive payments from anywhere.

One key advantage of freelance platforms is the protection they offer. Funds for a project are typically held in escrow until the client completes and approves the work. In case of any disputes, platforms often provide arbitration services to resolve issues between clients and freelancers.

| Pros | Cons |

| Allow quick and easy transfers between accounts, often without waiting days for checks to clear.Often free for personal transactions (be aware of terms of service)Be a good option for splitting bills, paying freelancers for occasional freelance gigs,… | May not offer the same level of security features as traditional business accounts. |

4. Payment Processors

Payment processors are companies that securely handle payment information and facilitate transactions between buyers and sellers.

One such processor is Stripe. It integrates with your existing website or creates a custom payment page, allowing you to accept client payments online via credit cards, debit cards, and ACH transfers. Stripe also provides invoicing tools, automatic payouts, and real-time transaction tracking, giving you a clear view of your income and expenses.

To explore alternative payment methods or how to get paid for freelance work efficiently, freelancers can seek advice from financial experts or online resources tailored to their specific needs and circumstances.

| Pros | Cons |

| Offers seamless integration with websites and applicationsProvides robust security measures against fraud and unauthorized transactionsTransparent pricing structure with competitive fees. | May experience occasional downtime or technical issues, affecting payment processing |

How To Select The Ideal Independent Contractor And Freelancer Payment Methods?

Exploring numerous payment options for your freelance endeavors raises the question: How do you determine the most suitable one? Here are the key factors to weigh when making your decision:

- Client Preferences: Some clients may have specific payment methods they prefer. Be flexible to their needs to maintain a positive working relationship.

- Security: Look for options that offer robust security measures to protect your personal and financial information from unauthorized access or fraud.

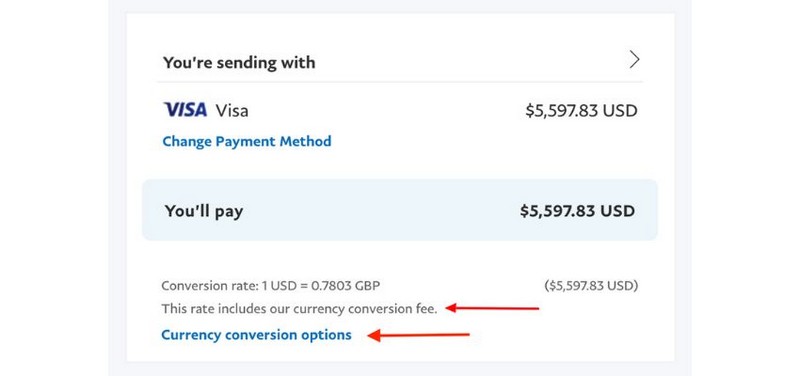

- Fees: Understand the fee structure associated with each option, including transaction fees, currency conversion fees, and any other charges.

- Speed of Transactions: Some payment methods offer instant or next-day transfers, while others may take several days to process payments.

- Accessibility: Consider factors such as geographic location, currency support, and ease of use to minimize any potential barriers to payment.

- Integration with Accounting Software: If you use accounting software, choose a payment method that seamlessly integrates with your platform.

- Reputation and Reliability: Research online reviews and testimonials to gauge the experiences of other freelancers and businesses using the same payment method.

- Flexibility for International Transactions: If you work with clients internationally, consider payment methods supporting international transactions.

- Customer Support: It’s essential to have access to responsive customer support to resolve issues promptly and efficiently.

Frequently Asked Questions

1. What Do You Need To Pay A Freelancer?

The payment for a freelancer typically depends on several factors such as the scope of the project, the freelancer’s expertise, the time required, and the market rate for similar services. Businesses need to discuss and agree upon the payment terms and rates before starting the project to avoid any misunderstandings later on.

2. What Is The Payment Method For Freelancers?

Payment methods for freelancers can vary depending on the agreement between the freelancer and the client. Payment methods include bank transfers, PayPal, Venmo, Payoneer, and direct deposit. Some freelancers also accept payments through platforms like Upwork, Freelancer, or Fiverr, if they are associated with these platforms which offer their own payment processing systems.

3. What Is Needed In A Freelance Invoice?

A freelance invoice should include essential details such as:

- Your name or the name of your freelance business.

- Contact information (address, phone number, email).

- Client’s name and contact information.

- Invoice number and date.

- Description of services provided, including quantity, rate, and total amount.

- Payment terms and due date.

- Any additional terms or notes relevant to the project or payment.

4. How Do I Ensure I Get Paid As A Freelancer?

To ensure you get paid as a freelancer, consider these steps:

- Establish clear payment terms and agreements before starting any work.

- Use contracts or agreements outlining project scope, deliverables, timelines, and payment terms.

- Invoice promptly and accurately after completing the work.

- Follow up politely and consistently on unpaid invoices, sending reminders as necessary.

- Consider requesting a deposit upfront for larger projects.

- Use secure payment methods and platforms to minimize the risk of payment issues.

- Build strong relationships with clients based on trust and professionalism, which can lead to repeat business and timely payments.

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.