How do you record wages when using a PEO? A PEO keeps track of your employee’s salaries and wages records within a given accounting period. Hiring a PEO equally means your business would not have to spend much effort in taking care of payroll responsibilities and focus more on developing your business operation. This is the ultimate guide in explaining the definition, of how to record wages and benefits in hiring a PEO.

What Is A PEO?

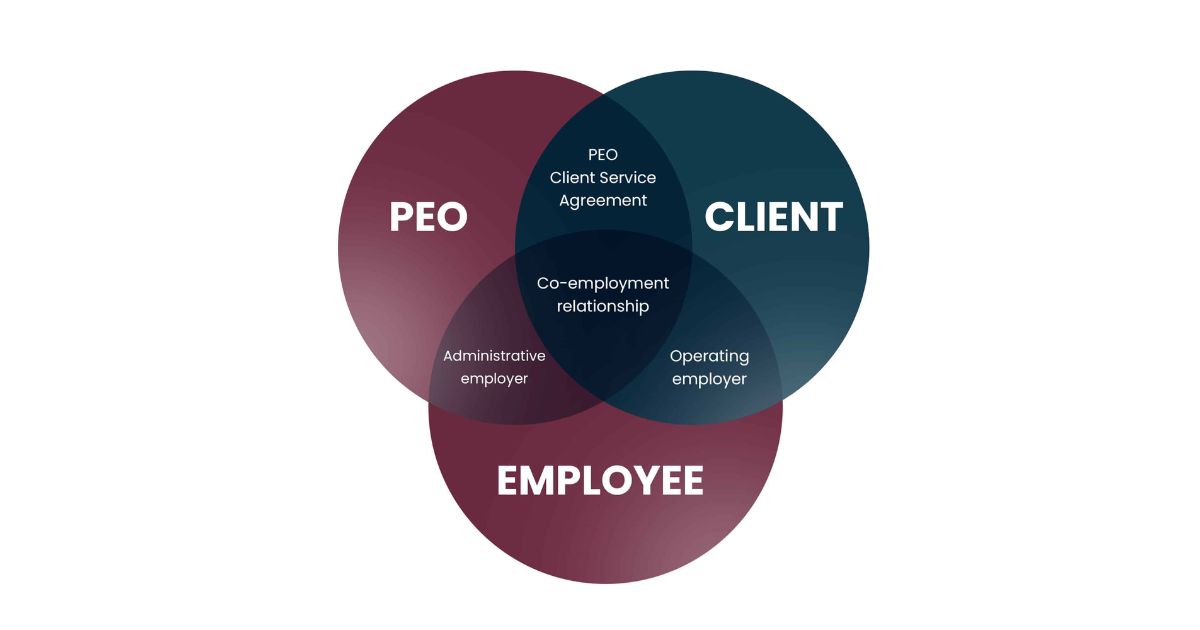

PEO is also known as Professional Employer Organization. A PEO in Vietnam is defined as an HR outsourcing. It provides employee administration services to businesses, which are responsible for taking care of payroll duty, employee classification, tax management, documents, and paperwork.

PEO in Vietnam, or in general, plays an important role in helping the business to:

- Recruit Quality Employees.

- Internal Training.

- Manage Employee’s Benefits.

PEO also specializes in taking a good hand on your employee’s wages, whether it is paid weekly, monthly, or even hourly. With that being said, how do you record wages when using a PEO?

See more: PEO vs. EOR

How Do You Record Wages When Using A PEO?

A practical problem that most businesses are facing is keeping track of wages, salaries, expenses, and taxes. These are commonly known as payroll tasks of each individual employee, within a specific accounting period. It is time-consuming, requires a lot of dedication, and some even costly.

However, with a PEO structure, the business has time to concentrate on its operation. A PEO will accommodate recording specifically how much money each employee makes during the accounting period. Moreover, this structure helps them to classify employees based on the personal wages that are paid weekly, or their salary. This allows PEO to calculate accurately employees’ payment reports and send them on the payment day.

This structure needs to qualify for federal and state laws related to minimum wages and overtime policies. Even with all the strict regulations on documents and paperwork, a PEO in Vietnam ensures to handle these tasks properly.

What Are The Benefits Of Hiring A PEO?

With all duties that have been mentioned above, business owners definitely receive benefits when hiring a PEO takes care of their employee management, as below which are:

Time and money savings

It requires a lot of dedication to manually track employee payroll. For example, are they being paid weekly, hourly, or monthly? Or through checks, deposits, or any form of payment?

Payroll duties require accurate records. Therefore, it is undeniable that they are time-consuming and costly. However, a PEO structure covers all the tracking and reporting of any payroll-related tasks, which allow business owners to focus more on developing operation.

Accurate tracking

PEO ensures a proper record of each individual employee’s wage, expense, and date is given within a designed accounting period. This system will input these payroll tasks in a report, where tax is added, and issue them on the contracted day.

Employee classifications

With an accurate record of employees’ wages, PEO will break down into paid weekly, hourly, monthly, or salaried employees. Employee classifications will enable PEO to comply with individual contracting policies. Moreover, keeping track of government law, especially for hourly-rate wage employees, to meet minimum wages and overtime requirements.

Payroll-related Paperwork

PEO is also responsible for payroll-related paperwork such as onboarding, new hire, W-2s and W-3s, 941 quarterly and unemployment, and others. This minimizes employees’ stress whenever it comes to organizing paperwork.

Frequently Asked Questions

1. What are the disadvantages of a PEO?

Though PEO advances businesses in many ways, it still has disadvantages:

- Lost control of HR operations, including employee benefits.

- Unguaranteed compliances.

- May occur opposite effects on company cultures.

- Limit access to HR

Check out the Pros & Cons of PEO: https://www.paycor.com/resource-center/articles/pros-and-cons-of-using-a-peo-company/

2. What is the difference between employee leasing and a PEO?

Employee leasing is mostly associated with staffing services, where they provide workers to temporarily work for their client’s project within a contracted period. Meanwhile, a PEO does not supply workers. They will use current employees that are available at their client’s business or ask their client to hire potential employees.

For payroll tax reasons, your employees are leased employees; nevertheless, your business has a right to hire and fire and also pays their salary and benefits through a PEO. The only additional cost here is the fee for PEO, they must give you a comprehensive ledger listing all costs incurred for each payroll run, broken down by employee.

3. What is the average cost of a PEO?

Starting from between $900 and $1,500 per employee annually is the foundation fee. PEOs often charge between 7 and 10% of the total payroll in case the business owner chooses to pay through the company percentage.

Check out the list of the top 7 PEO services in 2023: https://www.investopedia.com/best-peo-services-5088881

Conclusion

PEO, also known as Professional Employer Organization, supports payroll duties to be less time-consuming and provides accurate data. They handle most administrative work, specializing in precise tracking of wages, employee classification, tax management, and paperwork. Therefore, this system allows the business to focus on other operation missions, without caring too much about payroll-related tasks.

This article gives the ultimate answer to the question: How do you record wages when using a PEO? If you are a business owner and want to improve your HR system, then it’s your time to choose a comprehensive PEO structure and upscale your business.

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.