Do you know “How much do independent contractors pay in taxes?” As an independent contractor in Vietnam, you must understand your tax obligations, including the self-employment tax rate of 20%. Additionally, they may also be subject to other taxes, such as value-added tax (VAT) and corporate income tax, depending on the nature of their business and their taxable income.

Therefore, this comprehensive article will provide all the information to help you accurately estimate your self-employment tax rate. Keep reading in order not to miss any exciting things in this article.

Who Can Be An Independent Contractor In Vietnam?

Freelancing in Vietnam is open to both residents and non-residents. Yet, there are different requirements for each group. Non-residents who want to work in Vietnam legally must get a work visa. This is impossible on a tourist visa, as tourist visas can only be used for a maximum of three months. Due to the COVID-19 pandemic, Vietnam has temporarily suspended the allocation of new tourist visas. Therefore, you must apply for a work visa to be a freelancer in Vietnam with local companies or Vietnamese people.

However, there is a workaround. Independent contractors who work online can continue their careers without a work visa. For instance, a person from Ireland visiting Vietnam for a few months and working remotely for an Irish company can work without worrying about paying the self-employment tax rate in Vietnam or receiving a work visa.

See more: How to hire independent contractors?

What Are Independent Contractor Taxes?

Independent contractor taxes differ from traditional employee taxes, including federal and state taxes. It’s essential to understand what taxes you’re responsible for and how they differ from employee taxes.

You’ll be responsible for the self-employment tax rate as an independent contractor, which includes Social Security and Medicare taxes. This tax is calculated based on your net income, and the self-employment tax rate is 15.3%.

In addition to the self-employment tax rate, you may also be required to pay federal and state income tax and state unemployment insurance tax. These taxes are calculated based on your taxable income and are filed through estimated tax payments throughout the year.

As an independent contractor, keeping accurate records of your self-employment income and expenses is essential to estimating your self-employment tax rate. You may also consider working with a tax professional to ensure you meet all your tax obligations.

How Much Do Independent Contractors Pay In Taxes In Vietnam?

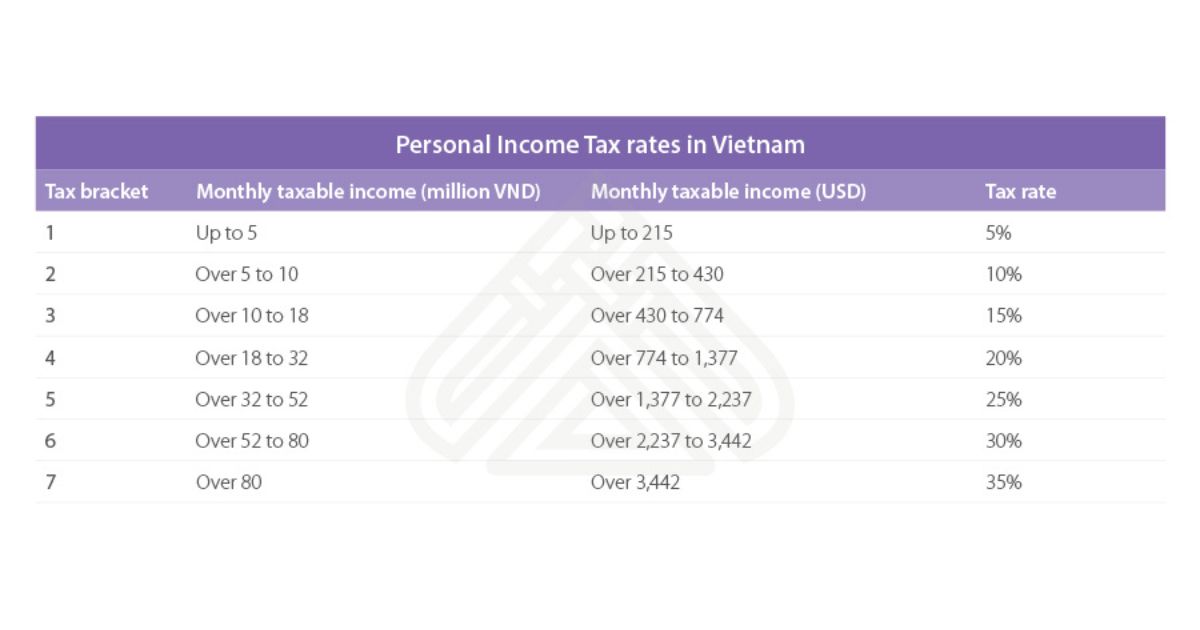

An independent contractor in Vietnam must understand self-employment tax rate obligations. Independent contractors are responsible for paying taxes, including personal income tax and social insurance contributions. The personal income tax rate for independent contractors in Vietnam ranges from 5% to 35% and is based on your taxable income.

Social insurance contributions are also a requirement for independent contractors in Vietnam. The current contribution rate for social insurance is approximately 10.5 % for employees and 22.5% for self-employed individuals. It’s essential to keep accurate records of your income and expenses and stay informed on any changes to tax laws to ensure that you meet all your self-employment tax obligations as an independent contractor in Vietnam.

How To Pay Taxes In Vietnam?

If you are a tax resident freelancing in Vietnam, your employer or hiring company will handle your Personal Income Tax (PIT) and deduct it from your income directly. On the other hand, if you are paying taxes in your home country, you will need to show proof in the form of a certificate from your hometown.

If you are a Vietnamese working as an independent contractor, tax filing before the due date or paying monthly taxes is essential to avoid penalties. You can pay your taxes in two ways: through cash payment or bank transfer.

Frequently Asked Questions

How Much Money Should I Keep For Taxes As An Independent Contractor?

As an independent contractor in Vietnam, keeping enough money aside for taxes is essential. This is because a self-employed individual is responsible for paying both the employer and employee portions of the Social Insurance and Health Insurance contributions and personal income tax on their earnings. The amount you should keep aside for taxes will depend on some factors, such as your estimated taxable income, the tax rates applicable to your income, and any tax deduction you may be eligible for.

What Is The Tax Form For An Independent Contractor In Vietnam?

In Vietnam, independent contractors must file a tax declaration form, the Personal Income Tax Declaration Form (PIT-ND), to report their taxable income. The PIT-ND must be submitted annually, usually in the first quarter of the year, and must be accompanied by a tax payment based on the contractor’s taxable income.

Can An Independent Contractor Be Paid A Salary?

In Vietnam, an independent contractor can be paid a salary as long as it is consistent with the terms of their contract and complies with the country’s labor and tax laws. The salary should be agreed upon between the contractor and the hiring company. It should consider the contractor’s level of expertise, experience, and the scope of work they will be performing.

Conclusion

An independent contractor needs to understand the tax obligations of your work status. In this ultimate guide, ERA aim to answer the question “How Much Do Independent Contractors Pay In Taxes?” and provide a comprehensive overview of the tax requirements for independent contractors in various countries. Whether you are a resident or non-resident, operating as a sole proprietor or an S-corporation, this guide will help you understand your tax obligations and plan accordingly.

See more related articles:

Best Independent Contractor Jobs For A Flexible Work Lifestyle

Independent Contractor Agreement: Definition & Must-have Clauses

Understand the Differences: Independent Contractor vs Sole Proprietor

ndependent Contractor vs. Employee: What’s The Difference

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.