Overseas independent contractors are a crucial aspect of global business expansion. However, managing their payroll includes complex compliance requirements. In this article, our EOR & AOR experts reveal how to pay international contractors seamlessly, as well as tax withholding and compliance.

Who Can Be Considered As International Contractors?

An international contractor is an individual who works on a project-by-project basis for a foreign-based company. Understanding that the definition hinges on where the services are performed rather than the contractor’s citizenship is crucial.

For example, in US-based companies, an international contractor is someone who neither lives nor works in the US and is not a US citizen. Some common independent contracting jobs are:

- Data entry clerk

- Health coach

- Graphic designer

- Social media manager

- Market researcher

- Content writer

In the last McKinsey American Opportunity Survey on 25,062 Americans, 36% of employed respondents, equivalent to 58 million Americans when extrapolated from the representative sample, are titled independent workers. Compared to 27% in 2016, this number showcases the growth of this workforce over the previous few years.

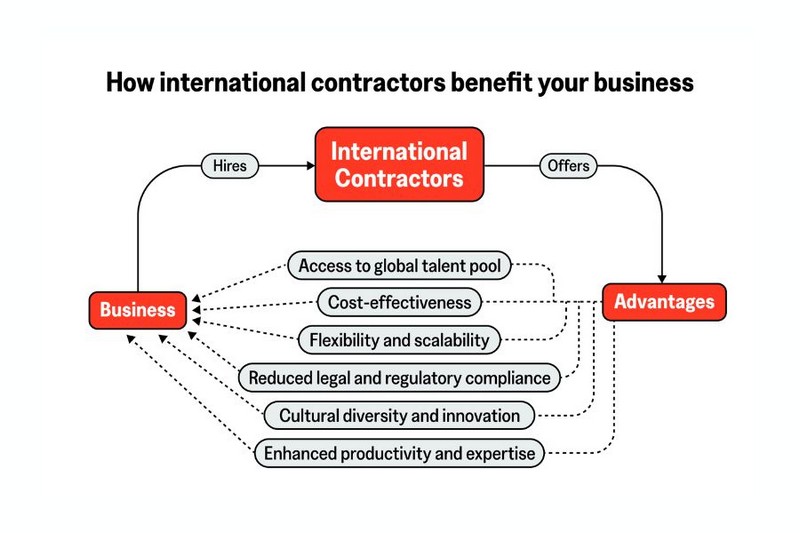

The reason for this growth is working with international contractors offers numerous advantages, let’s look at these pictures:

Along with these benefits, there are drawbacks, particularly regarding compliance with local regulations. Also, in some countries, the classification of contractors may change based on the duration of the working relationship.

To be clear, U.S. companies often use “1099” to refer to all contractors, regardless of location. However, the Internal Revenue Service (IRS) doesn’t mandate tax withholding or income reporting when paying international contractors 1099 who are not U.S. citizens and work outside the U.S.

Notices Before Paying Internationally

Before conducting payments to foreign contractors for services, consider what can impact transaction efficiency and contractor satisfaction.

Worker Classification

Accurately classifying remote workers is vital to avoid legal and financial risks. Are they international employees or independent contractors? The answer then affects tax withholding, labor rights, and benefits management.

The Wage and Hour Division announced a final rule on January 10, 2024, to tackle misclassification issues. This rule updates the guidance on determining whether a worker is an independent contractor or an employee.

Here is a general overview of the legal description of a contractor:

| Criterion | |

| Lack of Supervision | Contractors work without the company’s direct supervision, direction, or control (although they may receive instructions on project deliverables). |

| Independence | Contractors can provide services to other companies without requiring permission from the hiring company. |

| Non-Full-Time Engagement | Contractors do not work full-time for the hiring company on an indefinite basis. Instead, they work for specific tasks or projects. |

| Fixed Payment | Contractors usually get a fixed price after finishing assigned tasks or projects. They do not join in employee benefits programs. |

Misclassifying employees as independent contractors severely affects workers’ rights and the company’s legal and financial liabilities.

As a prime example, in January 2019, Swift Transportation signed a $100 million class action settlement with several truck drivers to end a nearly 10-year legal battle. The drivers claimed Swift Transportation misclassified them as independent contractors instead of company drivers.

Therefore, you must follow local labor laws to avoid penalties and maintain good standing.

Pro tip: If you prefer to hire remote employees instead of contractors, contact us for Employer of Record (EOR)services to simplify payroll and ensure compliance with local labor laws. We will act as the legal employer of your offshore workers, streamlining payment processes and legal obligations.

Currency Considerations

When managing international payments, you must consider currency exchange rates. This difference can significantly influence the amount contractors receive.

How to pay an international contractor when there are exchange rate differences between currencies? These questions will help you solve this issue:

- In what currency do your contractors want to be paid?

Affirm whether contractors prefer to be paid in their local currency or a base currency like USD. Due to fluctuating exchange rates, this choice will impact tax obligations and income stability.

- How much is the currency conversion cost?

Opt for payment services with competitive exchange rates and lower fees. Consider the timing of payments, as exchange rates fluctuate daily. Also, consistent payment dates allow both parties to plan for rate variations.

- Should you use multi-currency accounts or a support platform?

Many companies prefer to provide multi-currency accounts or use a platform that allows contractors to manage multiple currencies. They help avoid risks associated with currency fluctuations.

Complying With The Law

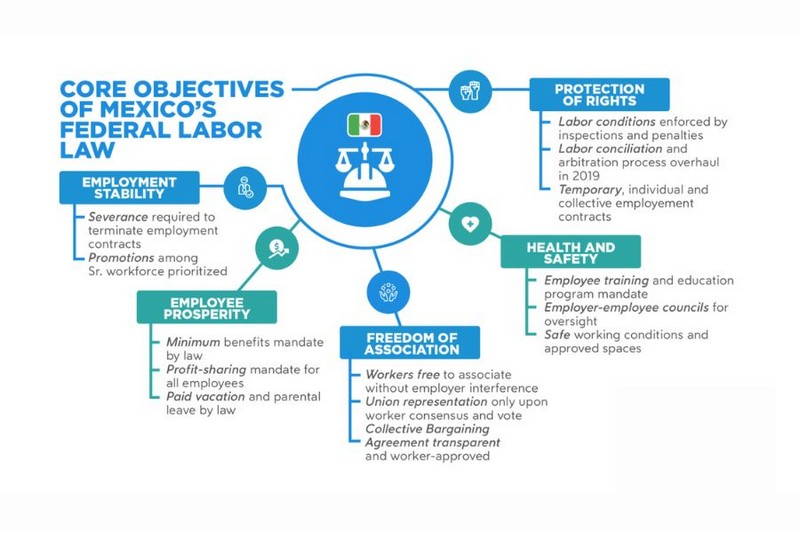

Ensuring compliance with employment laws in each foreign country where contractors live allows your company to avoid penalties and legal conflicts.

For instance, Mexico has strict regulations governing outsourcing and employment practices. They require businesses to follow formalized labor and tax laws when working with contractors.

Agencies specializing in international employment and contractor relations play a vital role in mitigating risks related to non-compliance. Follow their websites to stay updated with legal changes and get guidance on hiring practices and payment procedures.

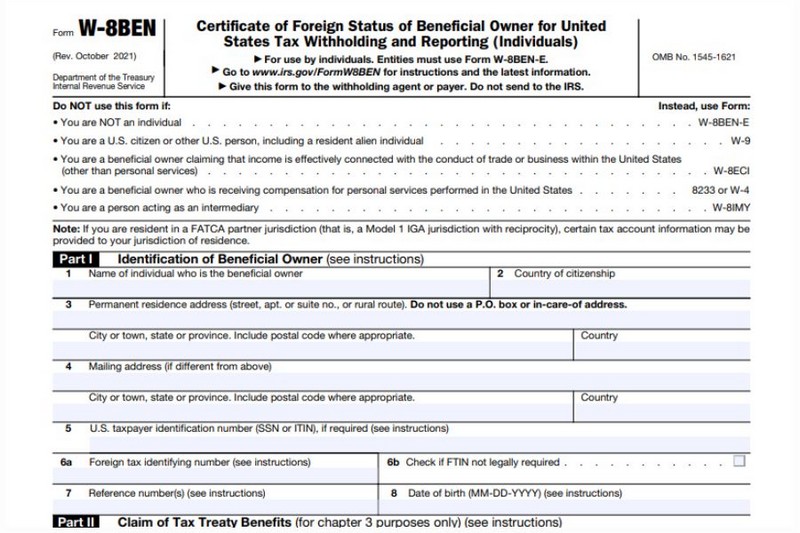

Tax Documentation

Before paying international contractors outside the U.S., initially require them to fill out a W-8 form, such as the W-8BEN. Foreign workers use this form to confirm their non-US status and claim any applicable treaty benefits.

Each country has different tax regulations, which may require extra documentation or tax withholding. So, familiarize yourself with local tax laws to pay international contractors. This approach ensures proper payroll tax handling for your business and the contractor.

Payment Process

A transparent payment process ensures smooth transactions and maintains a positive working relationship with contractors. Here are some crucial things you should have:

- Regular Payment Schedule: Set up a regular payment schedule, such as bi-weekly or monthly. It helps contractors know when they will receive money and manage their finances effectively.

- Streamlined Invoicing: Clearly outline the details you need for the invoicing process, such as hours worked or project milestones, and any other necessary information for prompt payment.

- International Factors: Consider the time required to process payments internationally. Also, list any potential delays or early payments related to national holidays to manage payment effectively.

- Timely Payments: Adhere to the agreed-upon payment schedule to satisfy contractors and maintain your reputation. You can automate invoicing and use payment reminders.

How To Pay International Contractors: 5 Payment Methods

As mentioned above, paying overseas contractors has several obstacles. To minimize these, you need a payment service or method that aligns with your business needs. Here are our recommendations on effective ways to pay international contractors.

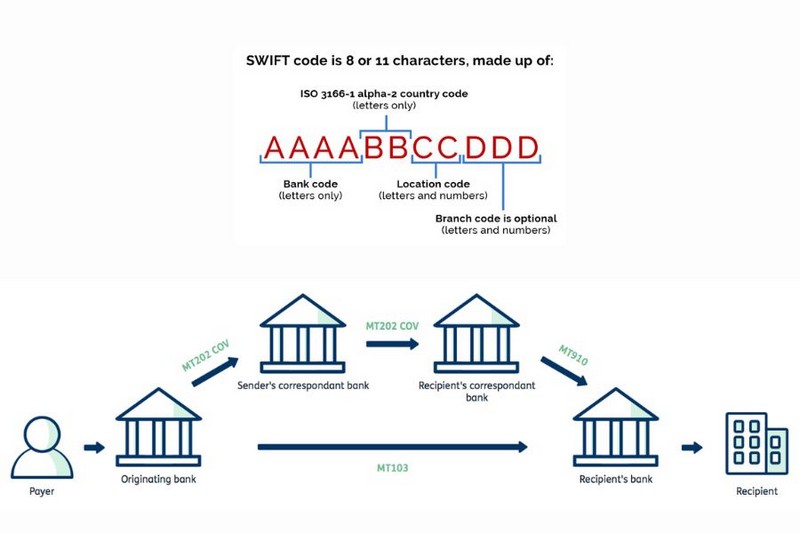

International Wire Transfers (SWIFT)

An international wire transfer is a banking service that electronically transfers funds from one bank account to another in a different country. The transfer process takes 1 to 4 business days to complete.

International transfers from your company’s bank account directly to the international contractor’s bank account are typically made using a global standard known as the SWIFT network. The SWIFT network is an instant messaging system tailored for secure transaction messages using specific SWIFT codes.

To transfer, visit your nearest bank and input the recipient’s SWIFT code. Once the process is underway, the funds go directly into the recipient’s account, ensuring swift and hassle-free transactions.

| Pros | Cons |

| Money goes directly into your recipient’s bank account. No need to create a new account.Many banks charge a fixed, upfront fee regardless of the amount sent. Banks operate under stringent security measures, so the risks are relatively low. | These extra charges can make sending even a small amount overseas quite costly.Banks set their exchange rates when transferring your money with an average of 4-6%.Some banks do not allow wire money internationally through online banking. Errors such as the wrong SWIFT code can result in money being lost or delayed for long periods. |

International Payment Gateways

Consider international payment gateways when making cross-border transactions to pay international contractors. These platforms enable businesses to accept various payment methods, such as credit cards, debit cards, and digital wallets. The top choices in the market are CorpayAmazon Pay, WorldPay, PayPal, Stripe, and Adyen.

Among these five, PayPal is one of the most widely recognized platforms for international transactions.

How do I pay foreign contractors via PayPal? All you have to do is enter the contractor’s PayPal email address, input the payment amount, and then select the correct currency. Confirm payment and send.

| Pros | Cons |

| PayPal supports payments in multiple currencies, enabling you to send money to contractors in their local currency.It offers helpful invoicing tools that aid in tracking payments and managing billing efficiently.PayPal’s payment system includes dispute resolution services and payment protection policies.PayPal provides a mass payment option for businesses with multiple contractors. | PayPal’s fee structure is complex and may lead to unexpected charges.PayPal’s exchange rates are with significant markups when converting currencies.Recipients must have a PayPal account to receive payments via PayPal. |

Wise Business

If you are wondering how to pay overseas contractors using a modest standard fee for all transactions, choose Wise (formerly known as TransferWise). It is one of the top fintech platforms for international payments.

Instead of steep fees, Wise charges a nominal fee based on factors like currency and destination country. It’s crucial to note that Wise operates as a Money Services Business (MSB) provider, offering a savvy alternative to traditional banks.

| Pros | Cons |

| You can send up to $1,000,000 in a single transaction or even more in batches.Businesses can save up to 19 times compared to using PayPal or traditional transfers.With a multi-currency account, you can pay contractors in 80 countries.Contractors receive emails upon payment, ensuring transparency for both parties.Unlike some payment solutions, recipients don’t need a Wise account to receive money.Payments can be made in local or US dollars, providing flexibility based on recipient preferences.Financial authorities in each operating country regulate bank-level security for all transactions. | You need a one-time verification process to set up the account, which takes several days.To pay, you need the recipient’s local bank details instead of just their account number. Wise offers transfers from bank account to bank account only, so cash pickups are not an option.Wise does not intervene in disputes between senders and recipients. |

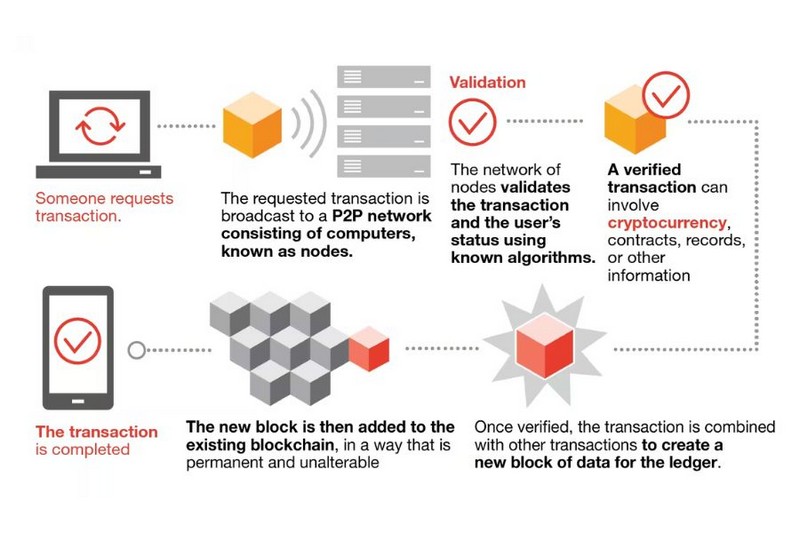

Cryptocurrency

Cryptocurrencies (Bitcoin, Ethereum, Tether, etc.) are digital assets that alternate to conventional fiat currencies such as the US dollar. They are not controlled or issued by a central authority like a bank or government.

| Pros | Cons |

| When you transfer cryptocurrency to contractors, no intermediaries are involved. Sending Bitcoin to another wallet only costs about $1.00 per transaction, while Ethereum is $0.50.Cryptocurrency transactions are almost instantaneous and can be conducted 24/7.Bitcoin transactions are secure and reliable, resilient against cyber attacks. | While blockchain technology offers anonymity, transactions are traceable. Exchanges and payment processors charge fees and require extra administration.Cryptocurrency price fluctuations make it difficult to price services and decide optimal transition times.Using cryptocurrencies requires knowledge and familiarity with digital wallets. |

Corpay

Corpay is a comprehensive corporate payments platform that assists businesses in managing their financial transactions more efficiently. It processes over $145 billion annually in over 140 currencies, demonstrating its significant global reach and financial impact.

| Pros | Cons |

| Corpay allows you to make payments in over 200 countries.The platform helps businesses manage the risks associated with currency fluctuations.It offers a trading platform and integrated payment solutions for global payments.Its user-friendly design makes it one of the easiest online payment methods. | Some customers are concerned about poor management and frequent turnover. Users must use extra solutions to manage business checking accounts and treasury functions.Customer service relies on email instead of phone support. |

Conclusion

How to pay international contractors is a complex question because it requires careful consideration and regulation adherence. By following our expert guidance, companies can ensure compliance and efficient payment management for their global workforce.

If you have any questions about international contractors, contact us, and we will be happy to help!

Frequently Asked Questions

1. Do I issue a 1099 to a foreign contractor?

No. You only issue Form 1099-NEC (and sometimes Form 1099-MISC) to independent contractors residing in the US who have received payments over $600 in a tax year.

2. How do I pay a contractor from another country?

There are various ways to pay a contractor from another country, including but not limited to:

- SWIFT

- International money order

- International payment gateways

- Wise

- Cryptocurrencies

3. Do international contractors need a w9?

No. International contractors only fill out IRS Form W-8 BEN. Form W-9 sent by US companies is for local contractors.

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.