Are you a web developer, graphic designer, or professional contractor in general who has embraced the remote work lifestyle? The freedom to work from anywhere is fantastic, but tax season can bring new questions, especially when considering state lines and where exactly you owe taxes.

In this article, ERA’s experts answer your question: “If I work remotely where do I pay taxes?” We also explore the factors to consider and ensure you’re filing your taxes in the right place.

Understanding Remote Work Taxes Fundamentals

Understanding the fundamentals of remote work taxes is essential for navigating the complexities of modern employment arrangements. This guide explores key concepts and considerations to help you manage your tax obligations effectively while working remotely.

Federal vs. State/Local Taxes

- Federal Income Tax: Freelancers or contractors pay federal income tax based on their total income. The federal government doesn’t care where you work, only how much you earn.

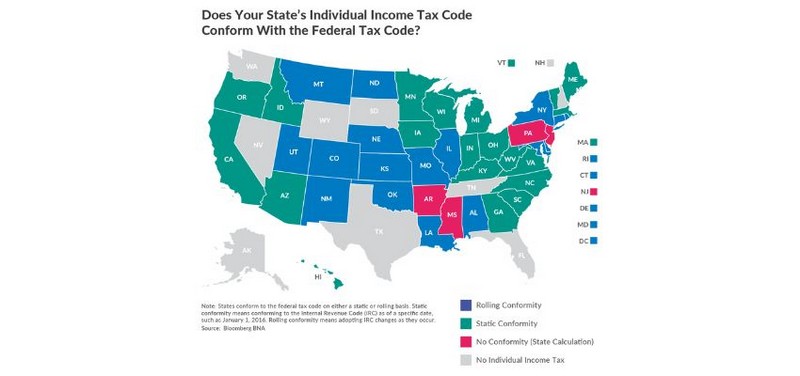

- State/Local Income Tax: Freelancers and contractors pay taxes based on where they live, not where their employer is. For instance, living in California while working for a Texas company may require paying California state income tax.

Residency vs. Work Location

Residency determines where you establish your domicile, typically your home state. Work location refers to the state where you physically perform your duties.

For remote workers, these can be two different places. The general rule is to pay state income taxes according to your resident state, even for income earned remotely.

Avoiding Double Taxation

There are ways to prevent you from paying taxes twice on the same income. Most states have reciprocity agreements to avoid double taxation for residents who work remotely in another state.

These agreements typically specify that wages earned in the non-resident state are not taxable in the resident state. It’s important to check your specific state’s regulations for details.

If I Work Remotely Where Do I Pay Taxes?

Contractors, while working remotely, offer a flexible work environment, which can introduce complexities regarding taxes. Understanding if you work remote where do you pay taxes is crucial to avoid filing errors and penalties. This is especially true if you live in a different state from your employer.

Working Remotely Within the Same Country

If you work remotely within the same country, your tax obligations typically align with the location where you physically perform the work.

For example, if you reside in California but work remotely for a company based in New York, you would likely owe state income taxes to California and not New York. Your clients may still withhold taxes based on location, but you may need to file working remote taxes in both states to reconcile differences.

You can find specific instructions at: How To File Taxes As An Independent Contractor?

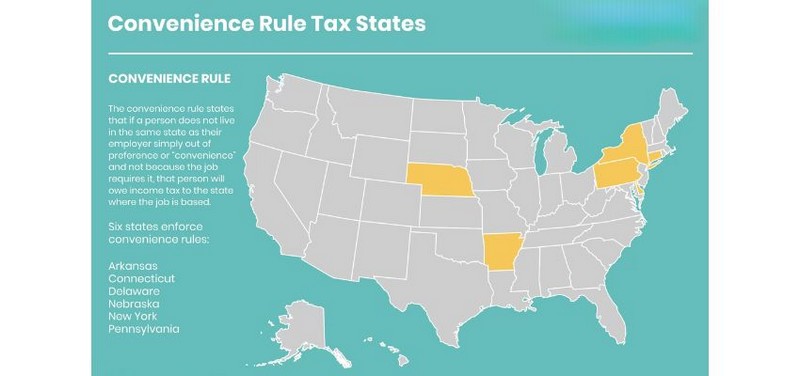

If your company operates in Arkansas, Delaware, Nebraska, New York, or Pennsylvania, they utilize a “convenience of employer” test to decide how taxes on remote workers’ income should be handled. If your employer mandates remote work, your income as a nonresident is tied to your physical location.

Given that each state has its own set of rules, it’s advisable to consult your employer’s state’s Department of Revenue website or an EOR service to understand how the convenience test affects you.

Working Remotely from a Different Country (as a U.S. Citizen)

As a U.S. citizen working remotely from a different country, your tax situation can become more complex. Generally, you must still file U.S. taxes on your worldwide income, regardless of where you live or work.

However, you may qualify for the Foreign Earned Income Exclusion (FEIE) or the Foreign Tax Credit (FTC) to reduce or eliminate U.S. tax liability on income earned abroad. Researching and understanding the tax treaties and agreements between the U.S. and the country where you reside is crucial to ensure compliance with both tax laws.

Working Remotely from a Different Country (as a Non-US Citizen)

Non-U.S. citizens working remotely from a different country must consider their tax obligations carefully. The tax implications can vary depending on the length of stay, visa status, and tax treaties between countries. Some countries tax individuals based on residency, while others tax based on income sourced within their borders.

For example, a French citizen working remotely from Spain may still owe taxes to France if they maintain residency there, but they may also have tax obligations to Spain. Understanding the tax laws of both countries is essential to avoid unexpected tax liabilities.

4 Tips for Avoiding Double Taxation as a Remote Worker

1. Track Your Work Location Carefully

Keep detailed records of where you perform your work duties. This includes logging the days you work in each location, whether it’s your home office, a client’s site, or a co-working space.

For example, if you’re a remote worker based in New York but occasionally travel to California for business meetings, accurately documenting those workdays can help prevent double taxation.

2. Understand Tax Residency Requirements In Different Countries

Research and comprehend the tax residency rules of the countries where you live and work. Some countries may consider you a tax resident if you spend a certain number of days there within a tax year.

For instance, if you’re a remote worker residing in Spain for more than 183 days in a calendar year, you could be deemed a tax resident and subject to Spanish taxes on your worldwide income.

3. Claim Any Available Tax Deductions And Credits

Take advantage of any tax deductions or credits available to freelancers or contractors to reduce your remote work state taxes. This may include deductions for home office expenses, internet and phone bills, or even travel expenses related to your remote work.

For example, if you use a portion of your home exclusively for work, you may be eligible to deduct a portion of your rent or mortgage interest as a home office expense on your taxes.

4. Consult A Tax Professional For Personalized Advice

Seek guidance from a qualified tax professional specializing in international tax matters for EOR service. They can provide personalized advice tailored to your specific situation and help you navigate the complexities of cross-border taxation.

For instance, a tax advisor can assist you in determining your tax residency status, optimizing your tax deductions, and ensuring compliance with relevant tax laws in different jurisdictions.

Conclusion

Working remotely offers flexibility, but tax implications can get complicated, especially when considering, “If I work remotely where do I pay taxes?” To ensure you’re filing correctly and avoiding penalties, stay informed about the latest rules for freelancers and contractors. The constantly evolving tax landscape requires keeping your knowledge up-to-date. Visit the ERA website for the most recent information and resources.

Frequently Asked Questions

1. Where Do You Pay Income Tax If You Work Remotely?

Income tax for remote work is typically paid to the jurisdiction where the work is performed. If you’re working remotely from a state or country different from your employer’s location, you may owe taxes in both places. However, many jurisdictions have reciprocal agreements or tax treaties to prevent double taxation.

2. Do Remote Workers Get Taxed Twice?

No, remote workers usually don’t get taxed twice on the same income. However, depending on tax treaties and laws, they may need to pay taxes in both their resident state/country and the state/country where the work is performed.

3. Are Remote Work Expenses Taxable?

No, for employees, remote work expenses are not generally tax deductible. This is because employers are typically expected to provide the equipment and workspace needed to perform the job.

4. Is Working Remotely A Tax Deduction?

No, working remotely itself is not a tax deduction. However, if you are self-employed and run your business out of your home, you may be able to deduct certain home office expenses.

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.