Are you considering hiring an independent contractor or freelancer for specific projects or tasks, such as photography or designing posters for an upcoming company event? Regardless of your employment status, a firm Independent Contractor Agreement protects businesses and freelancers by outlining key work responsibilities and expectations for each other.

In this article, we’ll break down what an Independent Contractor Agreement is, when you might need one, and the essential components it should include.

What is An Independent Contractor Agreement?

An Independent Contractor Agreement (ICA), often known as a Contractor Work Agreement or a 1099 Agreement, is a legally binding document between contractors and clients (individuals or entities).

It outlines the terms and conditions of their working relationship, including details about the project, payment terms, responsibilities, and more.

In Which Case You Need A Contractor Work Agreement

A contractor work agreement protects the client and the contractor by laying out the job expectations. Here are some specific scenarios where a contractor work agreement is written:

- Contracting for IT or web design services: A well-defined contract becomes essential when engaging a freelance worker for tasks like website development or managing IT aspects of your business.

- Any professional service: If you hire a consultant, freelancer, or independent professional for a specific service, having a contractor agreement is advisable. This could include services like writing, marketing, or bookkeeping.

For personalized consulting on 1099 agreements and other business-related matters, contact ERA for expert guidance and support.

8 Must-have Parts In A 1099 Agreement

“What is a 1099?” If you’re a freelancer or an independent contractor, you’re likely familiar with this crucial tax form.

A 1099 independent contractor agreement outlines the terms and conditions of your work arrangement, and understanding its components is essential for protecting both parties involved. Here are eight essential parts when drafting or reviewing such an agreement:

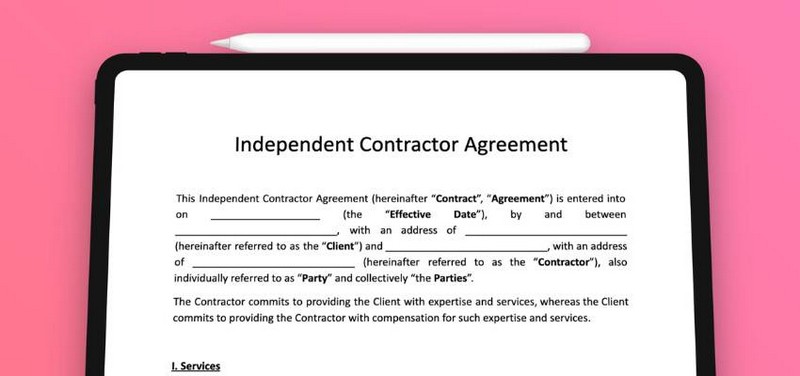

Introduction and Identification

Begin your 1099 agreement with a clear introduction. Identify both parties involved: the contractor (the person providing services) and the client (the person or company hiring the contractor). This section should also outline the agreement’s purpose and the scope of work to be performed.

Template:

“This Independent Contractor Agreement (the ‘Agreement’) is entered into by and between [Contractor’s Name], from now on referred to as ‘Contractor,’ and [Client’s Name], from now on referred to as ‘Client.’ The agreement’s purpose is to specify the terms and conditions for the provision of [specific services] by the Contractor to the Client.”

Scope of Work

Define the tasks and responsibilities expected from the contractor. Be specific about what services they will provide and any deadlines they must meet.

For example, if hiring a freelance graphic designer, specify that they will create five social media graphics per week, like this:

“The Contractor agrees to provide [specific services] according to the specifications outlined in Exhibit A attached hereto. The services shall be performed at [location or remotely], and the estimated completion date for each task is as follows: [insert timeline].”

Payment Terms

Clearly outline it, when and how the contractor submits invoices and when the contractor will be paid. This includes the rate of pay, whether hourly, project-based, or commission-based, as well as the payment schedule.

For instance, you might agree to pay the contractor $50 per hour, with payments made at agreed milestones or project completion, like this:

“In consideration for the services provided by Contractor, Client agrees to pay Contractor a rate of [insert rate] per milestone [hour/day/week/month]. Payment shall be made on a [weekly/monthly] basis within [number] days of receipt of an invoice submitted by Contractor.”

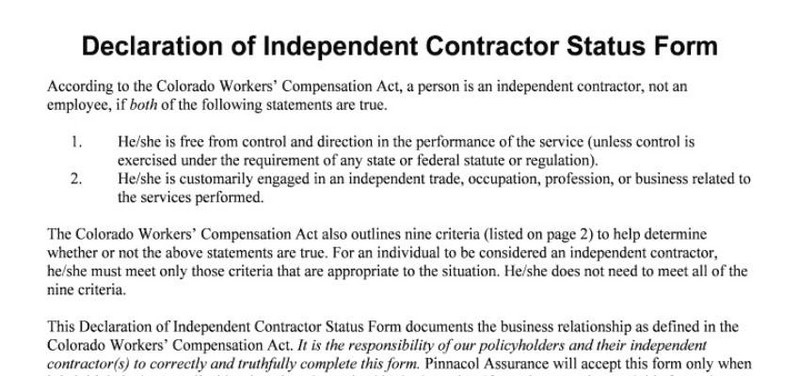

Independent Contractor Status

State that the contractor is an independent contractor, not an employee. This section should clarify that contractors are responsible for their taxes, insurance, and benefits.

You could write things like, “Both parties recognize and affirm that the Contractor operates independently and is not considered an employee of the Company.“

Or:

“Both parties recognize and affirm that the Contractor operates independently and is not considered an employee of the Client. The Contractor retains complete autonomy in the services and is responsible for all tax, insurance, and other duties typically associated with independent contractors.“

Confidentiality Clause

Include a confidentiality clause to protect your business’s sensitive information. This clause should specify that the contractor cannot disclose any proprietary or confidential information they may encounter during work.

For example, “The Contractor agrees to keep all information received from the Company confidential and not to disclose it to any third parties.“

Or:

“The contractor commits to keeping all proprietary and confidential details shared by the client confidential throughout the agreement’s duration and beyond. They are prohibited from sharing or utilizing such information beyond the services specified in the agreement.”

Termination Clause

Outline the conditions under which either party can terminate the independent contract agreement. This might include breaches of contract, failure to perform, or other specified circumstances.

For instance, “Either party has the right to end this agreement by giving written notice if the other party violates any significant part of this agreement and doesn’t fix the violation within 30 days of getting written notice about it.“

Or:

“Either party may terminate this Agreement by giving the other [number] days’ written notice. If termination occurs, the Client must pay the Contractor for any services rendered until the termination date, following the payment conditions specified in this Agreement.”

Ownership of Work Product

Specify the ownership of intellectual property rights for any work the contractor produces throughout the agreement. This is particularly important if the contractor creates original content or designs for your business.

You could state, “All work product created by the Contractor in this agreement shall be the Company’s exclusive property.“

Or:

“Copyrights and trademarks, among other forms of intellectual property, shall belong exclusively to the Client, linked to any work produced by the Contractor during the services outlined in this Agreement.”

Indemnification Clause

Include an indemnification clause to protect yourself from any legal claims arising from the contractor’s work. This should state that the contractor will indemnify and hold the company harmless from any claims, damages, or liabilities related to their work.

For example, “The Contractor agrees to protect and defend the Company against any claims, liabilities, damages, and expenses arising out of or related to the Contractor’s performance of services under this agreement.”

Or:

“The contractor commits to protecting and absolving the client, along with its officials, managers, staff, and representatives, from any claims, damages, debts, costs, and expenses, including reasonable legal fees, linked to or resulting from the contractor’s execution of duties as outlined in this contract, unless the reasons for these problems are due to the client’s willful misconduct or ignorance.“

Wrapping Up

In conclusion, the Independent Contractor Agreement is a crucial document for outlining the terms between a contractor and a client. It ensures clarity on responsibilities, payment, and project scope.

Both parties protect their interests and understand their obligations by agreeing to these terms. Reviewing and understanding every agreement detail before signing is essential to avoid misunderstandings or disputes later. For further guidance on drafting or reviewing such agreements, feel free to contact ERA for consulting.

Frequently Ask Question

How Do I Write A 1099 Contract?

To create a 1099 contractor agreement, follow these steps:

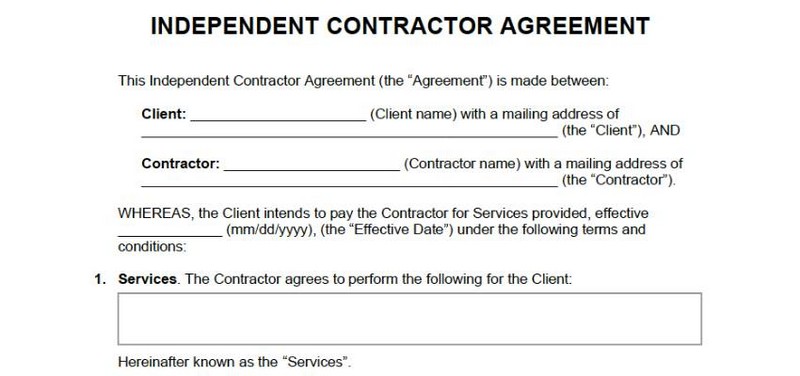

- Identify Parties: Include names and addresses of both parties (contractor and client).

- Scope of Work: Clearly outline the services to be provided by the contractor.

- Payment Terms: Specify payment amount, schedule, and method.

- Timeline: Set deadlines for project completion or milestones.

- Ownership of Work: Clarify who owns the final deliverables.

- Confidentiality: Include any non-disclosure or confidentiality clauses if applicable.

- Termination Clause: Define conditions under which either party can terminate the contract.

- Independent Contractor Status: Clearly state that the contractor is independent, not an employee.

- Signatures: Both parties should sign and date the contract.

How Do I Write An Independent Contractor Proposal?

Follow these steps to craft an independent contractor services agreement:

- Introduction: Briefly introduce yourself or your company.

- Client Overview: Describe the client’s needs and goals.

- Scope of Work: Clearly outline the services you propose to provide.

- Timeline: Provide estimated timelines for each phase of the project.

- Budget: Present a detailed breakdown of costs for your services.

- Qualifications: Highlight relevant experience, skills, and expertise.

- Benefits: Explain the benefits the client will gain from working with you.

- Terms and Conditions: Include any terms and conditions relevant to the proposal.

Closing: Encourage further discussion and express readiness to answer any questions.

See more related articles:

What Is An Independent Contractor? Independent Contracting Pros & Cons

How To Become An Independent Contractor? 3 Independent Contractor Tips

How Much Do Independent Contractors Pay In Taxes?

How to Hire Independent Contractors?

Best Independent Contractor Jobs For A Flexible Work Lifestyle

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.