The critical difference between employee and independent contractor is that the employee works in the company and conducts their work as a representation of the company. In contrast, the independent worker offers services to your company while also working to further their business. There are still many differences between independent contractor vs. employee that this article will give you as follow:

What is an Independent Contractor?

An Independent contractor is a neutral person, like a consultant, lawyer, accountant, engineer, or another professional degree holder, who provides services, either to the client/principal or to a third party on behalf of the client, by the terms of the contract between contractor and principal.

Because the independent contractor is not subject to the client’s control or influence, he is free to use his control in completing the contract job. Furthermore, the independent contractor is responsible for the project’s outcome.

See more: how to become an independent contractor?

What Is An Employee?

An employee works for an employer regularly in exchange for a fixed compensation, known as a salary. A contract, known as an employment contract, describes the terms and conditions of employment.

The company controls employees’ jobs, including what, how, and when they complete the tasks.

The employee’s labor might be part-time, full-time, or temporarily recruited by the company. Employees have different jobs with tasks, obligations, responsibilities, and powers. They are paid monthly based on their qualifications, experience, abilities, performance, and position.

Especially, employers who want to hire foreigners to work in Vietnam must obtain permissions or visas, such as a work permit, residence permit, or business visa, to work and stay lawfully in Vietnam.

5 Differences Between Independent Contractor vs. Employee

It is difficult to determine whether a worker is an employee or a contractor. Employers need to try their best to distinguish between these terms. Let’s walk through these five differences between independent contractors vs. employees:

Payment, Taxation, and Benefits

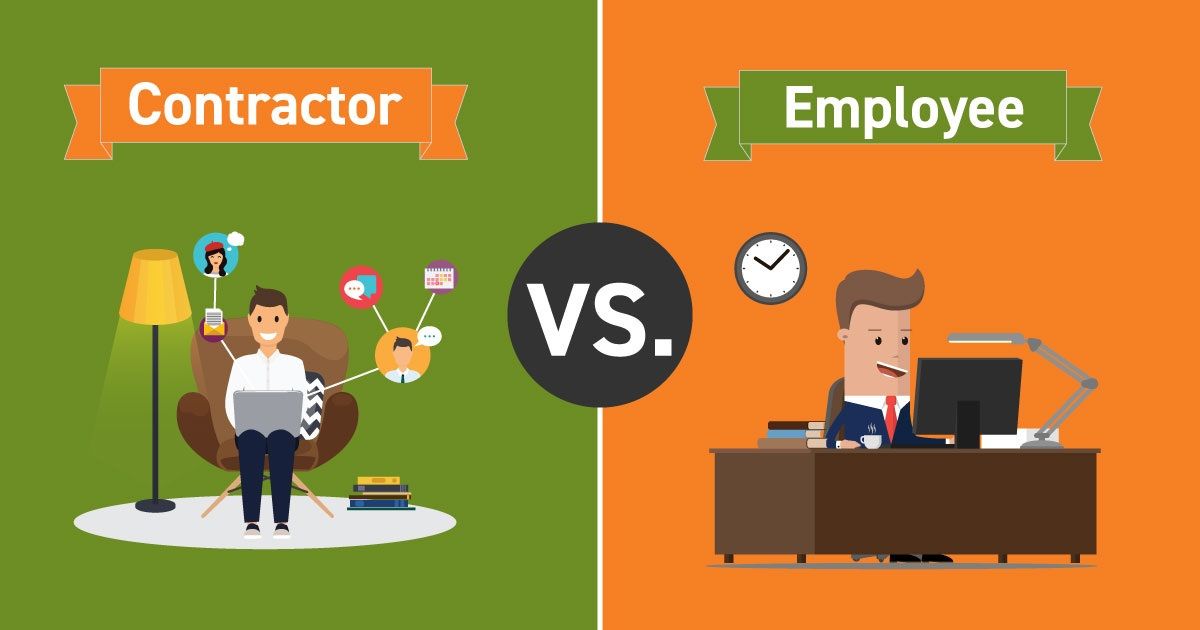

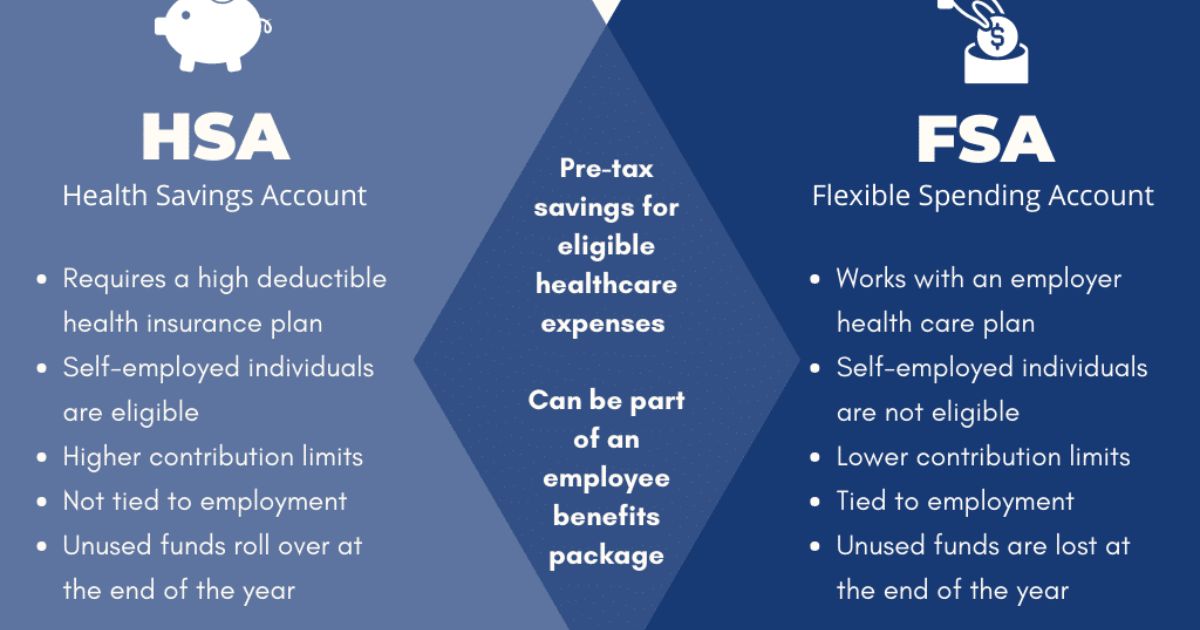

One of the most significant distinctions between contract workers and employees is how they receive salaries and pay for the tax. When an employee is on a company’s payroll, the company pays the employee an hourly rate or salary. It withholds the necessary taxes (e.g., federal income tax, Social Security tax, Medicare tax). The company frequently pays for employee bonuses.

These bonuses include obligatory work benefits such as health insurance and non-mandated benefits. For example, flexible spending accounts (FSAs) as well as health reimbursement accounts (HRAs) and health savings accounts (HSAs), paid vacation, commuting bonuses, and stock options.

On the other hand, that same organization might pay a contractor an agreed-upon salary for their services but would not include or pay any taxes. Contract workers are responsible for their taxes, including federal income and self-employment taxes. Furthermore, they must pay for and receive whatever benefits they choose, including health insurance, on their own.

Flexibility

Another distinction between an employee and a contractor is the level of flexibility in their job. An employee works for one business and is thus subject to the company’s policies and duties. On the other hand, a contractor can work for one or more companies; it is typical for contract employees to manage many customers at once.

Depending on the sort of work-life balance desired, many people view this flexibility as a positive or a hindrance. Contract workers, for example, can take time off anytime they like, but they do so at the expense of not earning money during that time. Many people nowadays are still confused when choosing a contract vs full-time job.

Pay Period

Unless expressly amended, an employee’s pay period must stay the same. The pay period ranges from one week to one month. Federal and state rules require that an employee be paid on the regular payday or sooner if the paycheck is not negotiable on the regular pay date, which might happen on holidays.

After receiving an invoice, Accounts Payable pays a contractor. The contract or Statement of Work will determine if payments are due, such as upon completion of a job or in installments. Most businesses do not pay contract workers through payroll.

Employment laws

Several federal and state employment laws, as well as labor regulations, apply to employees. On the other hand, Employment or labor regulations don’t cover independent workers.

Employees in the U.S, for example, have the liberty not to be bullied or discriminated against (mistreated) because of their race, color, religion, gender (including incubation, sexual orientation, or gender identity), national roots, disabled ability, age, or genetic information (including family medical history).

Moreover, both independent contractors and employees are required to file taxes. However, the tax requirements and forms may vary depending on their classification.

Income

An employee’s source of income is their wage, which is paid monthly by their company. On the other hand, independent contract workers have many sources of income since they work with various clients. As a result, the payment from each decides their overall revenue.

The quantity of work contractors chooses to complete determines their salary. They may sometimes earn more than full-time workers who do the same job. However, other factors that influence the overall pay of a contract employee and full-time employees may be benefits, tax deductions, and liabilities.

How To Distinguish Between A Contract Labor vs Employee?

Despite these distinctions being obvious, there are countless circumstances in which characteristics of either an employee-employer relationship or those of an independent contractor must be explained.

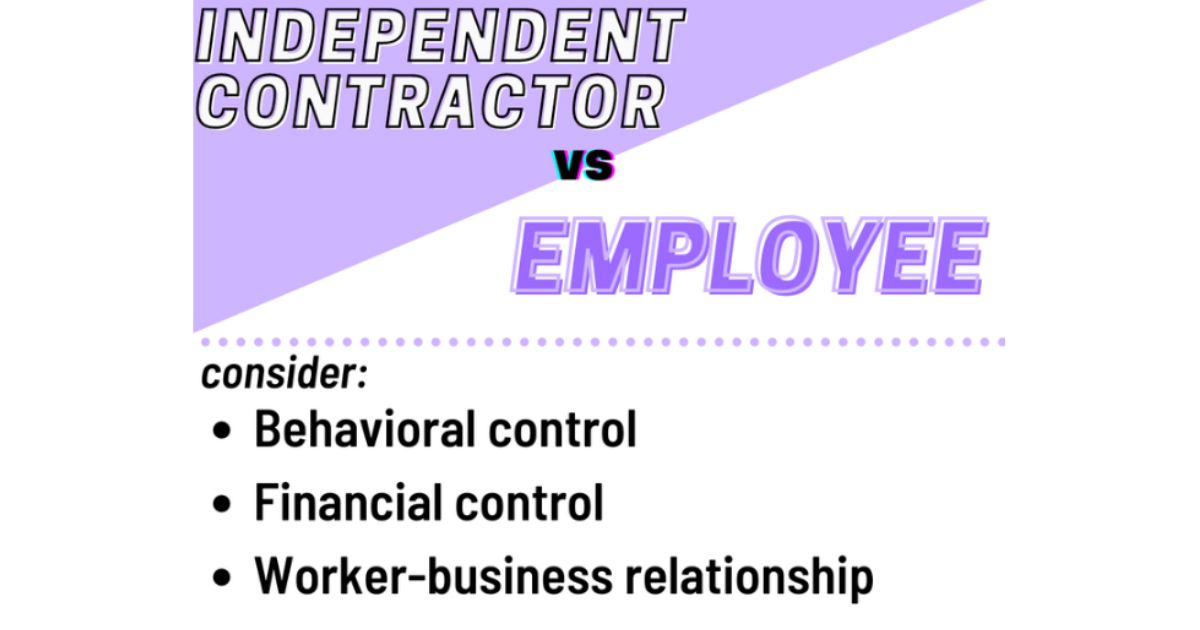

The IRS recommends classifying workers’ connection with their employer into three basic types. So, if you need clarification on these terms, let’s use these criteria.

Behavioral Control

If a person works under the employer’s direction and specifies the work hours, tools to be used, and how he does the task, he is an employee.

If a person can choose their hours, use their tools, and works with little or no supervision from the employer, such a worker is most likely an independent contractor.

So, before engaging an independent contractor, ensure everything is clear about the scope of control. Remember that the employer will only influence the work’s outcome. The contractor will determine how and when the project is over. Hiring an employee is preferable if you like to manage the task by yourself.

Financial Control

The person is presumably an employee if they have fixed-hourly salaries and weekly or monthly rates, and their employer removes taxes from their compensation.

The worker is most likely an independent worker if they invoice the company, their payment terms vary, and no remaining tax from their payments.

Financial control demonstrates whether or not the company has the authority to manage the financial aspects of the worker’s employment. Is the payer in charge of the business parts of the worker’s job? (These include how workers are paid, whether expenditures are reimbursed, who provides tools/supplies, etc.) Companies must consider all these aspects when before deciding the kind of worker.

Relationship

The relationship employer has with a worker will have an impact on their categorization as well.

If a worker performs services linked to your primary company, the IRS will almost certainly categorize the individual as an employee. Furthermore, if you provide them with bonuses such as paid vacation, sick days, and health insurance, they are more likely to be classified as employees.

Because of the length or permanency, independent contractors are typically recruited for a short term or to carry out a specific project. If you hire someone long-term and anticipate them to work for an indeterminate time, they will almost certainly be employees.

Consequences of Misclassifying a Worker

It could have substantial legal and financial ramifications if the misclassification were intentional or unintentional, which could result in the payment of outstanding wages, employees’ salary arrears, retirement payments, and other employee benefits.

It might include overdue taxes, Medicare and Social Security withholding taxes, and other state and federal tax penalties. In some severe circumstances, it may result in a federal lawsuit. In simple words, companies must accurately classify their staff from the start.

FAQs

How much does it cost to have employees and independent contractors?

You can employ independent workers for less money in the long run, but they demand higher hourly rates to cover self-employment taxes. Hourly contractor rates should be 50% to 70% more than what you would pay a permanent employee.

In conclusion, the key distinction between independent contractor vs employee is that the employee works in the company and shows their work as a representation of the company. In contrast, the independent contractor offers services to your company as well as others. However, employers need to classify laborers as carefully as possible to avoid some harmful consequences like overdue taxes, Medicare and Social Security withholding taxes, and other state and federal tax penalties. For further guidance, feel free to contact ERA for consulting.

See more related articles:

How to Hire Independent Contractors?

Best Independent Contractor Jobs For A Flexible Work Lifestyle

Independent Contractor Agreement: Definition & Must-have Clauses

Understand the Differences: Independent Contractor vs Sole Proprietor

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.