Self-employed individuals can be divided into two main categories: independent contractor vs sole proprietor. A sole proprietor is a one-person business without registering a formal business entity such as an LLC. On the other hand, an independent contractor does specific work for a company for a set fee. But the key differences are more than that.

Wait no longer. Let’s check out the article about sole proprietor vs independent contractor below!

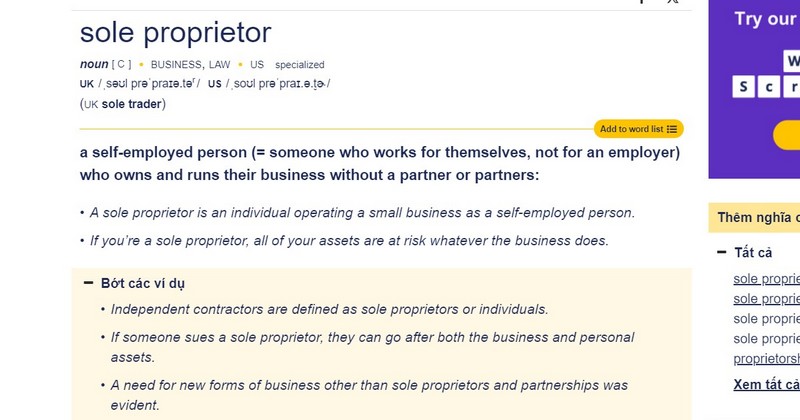

What Is A Sole Proprietor?

If you own and operate a business, you’re a sole proprietor. This means you’re the only one responsible for running the business, but you can hire staff if needed.

As a sole proprietor, you’re personally responsible for any debts and legal obligations your business incurs. Each year, you pay taxes on your business income by filing the IRS Form 1040 Schedule C, which outlines your business income and expenses.

The default business structure for small businesses is usually a sole proprietorship. To operate as a sole proprietor, you don’t need to register your business with the state or federal government, obtain a business license, or secure your business name.

Instead, you must separate your business expenses and income from your personal income. Besides, you also pay your self-employment taxes, including Social Security and Medicare.

Examples of sole proprietors include:

- Freelance writers or graphic designers

- Florists

- A local artist

- Web designers

- Food truck operators

What is An Independent Contractor?

Independent contractors are self-employed workers who offer services to clients (corporations, LLCs, or agencies).

Unlike employees, independent contractors do not have the same benefits.

As an independent contractor, you get paid based on your work. The payment is hourly or per project, depending on the contract terms. Enterprises hiring independent contractors do not withhold payroll taxes from their pay unless there is a backup withholding.

Independent contractors usually are content creators, web developers, graphic designers, or developers. Companies consider independent contractors as 1099 sole proprietors, referring to the tax form they receive at the end of the year.

For example, if you earn at least $600 from a client or company, you will receive a 1099-MISC form from that client or company. It shows the total income you received for the calendar year. If you work with multiple clients, you receive multiple 1099-MISC forms.

Now we know the definitions of the self employed vs sole proprietor. Let’s move on to some key differences between them.

See more: Difference Between 1099 and W2: What Should Employers Know?

Key Differences Between Independent Contractor vs Sole Proprietor

Many business owners still get confused when differentiating between independent contractor vs sole proprietor. The information below can help you overcome this trouble:

Income Source

The first key difference between sole proprietorship vs independent contractor is the income source. A sole proprietor earns income from various sources, including selling goods, providing services, or any other activities related to their business.

An independent contractor earns income from contracts or agreements with clients to provide services, complete projects, or deliver goods. Their income is typically tied to specific projects or contracts rather than diversified across various business activities.

Level Of Control

Generally, independent contractors have more control over how they perform their work. They have the freedom to decide when, where, and how to complete tasks as long as they meet the requirements outlined in the contract.

On the other hand, as the sole owner of the business, a sole proprietor has complete control over all aspects of the business, including decision-making, operations, and management.

Tax Implications

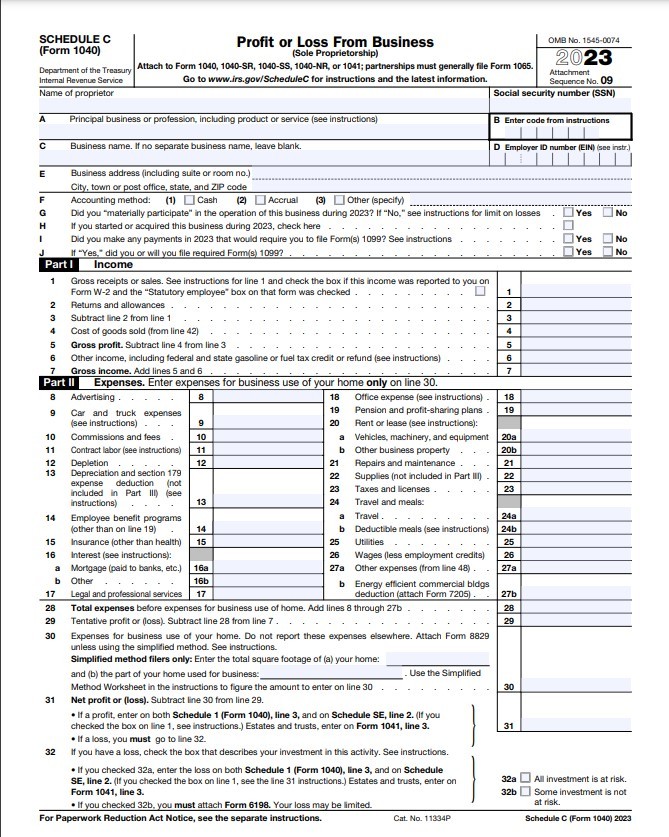

Sole proprietors report their business expenses and income on their personal tax returns, utilizing Schedule C (Form 1040). They must pay self-employment taxes, including the employee and employer percentage of Medicare taxes and Social Security.

Image via IRS

Independent contractors also report their income and expenses on their tax returns, but they may have additional tax obligations, such as making estimated quarterly tax payments. Depending on their business structure, they may have different tax filing requirements than sole proprietors.

How To Choose Between Sole Proprietor and Independent Contractor

Choosing between sole proprietorship vs self employed depends on various factors such as business goals, liability concerns, and tax implications. Here’s a breakdown to guide your decision:

Sole Proprietorship:

As a sole proprietorship, you will

- Have complete control and ownership over your business.

- Requires minimal paperwork and formalities to establish.

- Report business income and expenses on your personal tax return (Form 1040).

- Be liable for business debts and legal obligations, potentially risking personal assets.

- Have direct control over business decisions and operations.

- Hire employees and operate under your business name.

- Manage all financial aspects, including taxes, accounting, and expenses.

Independent Contractor:

As an independent contractor, you will

- Typically, they are hired by a company or individual to perform specific tasks or projects.

- Work for multiple clients simultaneously, offering more variety and potential for higher income.

- Not liable for the client’s business debts or legal obligations.

- Pay income and self-employment taxes ( such as Social Security and Medicare).

- Have less control over client project scope, deadlines, and sometimes work methods.

- Gave you the opportunity to expand your client base and potentially build a business entity.

- Establish a reputation and brand as a skilled independent contractor, leading to more lucrative opportunities.

Ultimately, deciding between operating as sole proprietor vs self employed requires careful consideration of your circumstances, preferences, and long-term objectives.

Final Thoughts

Sole proprietorship involves an individual owning and operating a business as their personal enterprise, giving them full control and responsibility.

On the other hand, an independent contractor provides services to an entity or individual under a contractual agreement with more independence and less overall control and responsibility.

If you have any questions relating to independent contractors vs sole proprietors, feel free to contact ERA!

Frequently Asked Questions

Is It Better To File As Self-Employed Individuals Or Independent Contractor?

It depends. Self-employed individuals and independent contractors are similar in terms of taxes. Both pay self-employment tax and estimated taxes quarterly. The key difference is control.

Independent contractors have less control over their work, which is set by the company hiring them. You’re likely self-employed if you set your own hours and have multiple clients. Consult a tax professional for the best way to file.

What Is The Difference Between Self-Employed And Sole?

Sole proprietors are also self-employed but are much less likely to work for a business under a contract. Instead, they typically work directly with the public, selling products and services on the open market. A hairstylist or barber may be a sole proprietor. So might a solo tax preparer, plumber, or handyman

Is It Better To Be A 1099 Or LLC?

It depends. An LLC and an independent contractor significantly differ in terms of liability protection. An LLC can protect its owners in case of legal claims, bankruptcies, or lawsuits. This protection ensures that your personal assets are secure.

What Is The Main Disadvantages Of Being A Sole Proprietor?

Being a sole proprietor has some disadvantages compared to other business structures. The owner has fewer legal and financial protections, and no benefits are included. There are also fewer resources available to ensure business continuity.

See more related articles:

How To Become An Independent Contractor?

How Much Do Independent Contractors Pay In Taxes?

How to Hire Independent Contractors?

Best Independent Contractor Jobs For A Flexible Work Lifestyle

Independent Contractor Agreement: Definition & Must-have Clauses

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.