Key Takeaways

- An IR35 contractor is a self-employed worker in the UK whose working conditions resemble an employee’s, leading to potential tax implications.

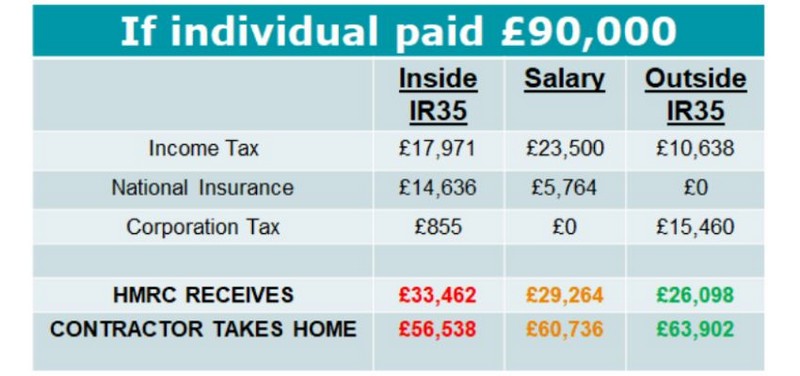

- Inside IR35 means the contractor is considered an employee for tax purposes, while outside IR35 means they are considered genuinely self-employed.

- Inside IR35, contractors pay income tax and National Insurance contributions like employees, while outside IR35, they have more flexibility with tax planning through dividends and expenses.

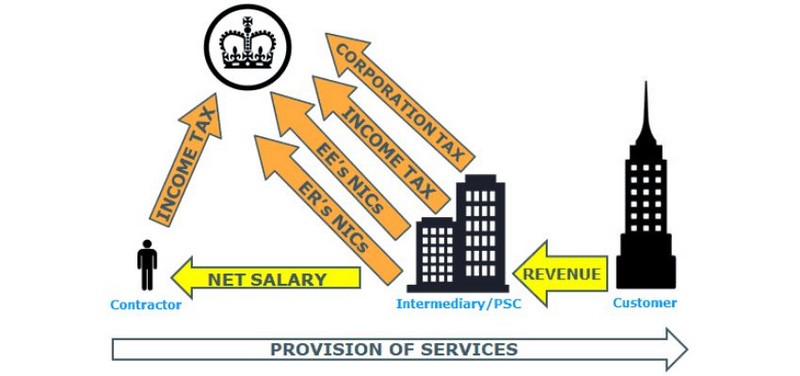

IR35 combats disguised employment via Personal Service Companies in the UK.

What Is An IR35 Contractor? Who Is Liable For It?

IR35, also known as the “Intermediaries Legislation“, is a UK tax law designed to prevent “disguised employment“. It aims to close a loophole where individuals work as contractors IR35 through their limited companies (Personal Service Companies, or PSCs) to gain tax benefits while functioning like regular employees.

If a contractor’s working relationship with their client closely resembles an employee’s, they might be deemed ‘inside IR35’. This determination is based on factors like control, substitution, and mutuality of obligation (explained below).

Before April 2021, contractors were primarily responsible for IR35 compliance and paying the appropriate tax.

Since April 2021, the liability for determining IR35 contractors’ status and paying the correct taxes has shifted from the contractor to the client (the company engaging the contractor) in the private sector. Public sector reforms took place earlier in 2017.

Responsibility:

- For Medium/Large Clients:

Assessing IR35 status using reasonable care and providing a Status Determination Statement (SDS) to the contractor and any intermediary agencies.

If the contractor is’ inside IR35, ‘ the correct income tax and National Insurance Contributions (NICs) are deducted and paid to HMRC.

- For Small Clients: Small businesses are exempt from these rules. The contractor remains responsible for determining their own IR35 status.

Update On IR35 Contractors Regulations In 2024

The 2024 changes are aimed at addressing a major issue with the current off-payroll rules – double taxation:

- Double Taxation: Under the current rules, if HMRC decides a contractor should have been inside IR35, they collect the full PAYE liability from the fee-payer. This doesn’t account for taxes already paid by the contractor, leading to double taxation.

- HMRC Deductions: From April 6th, 2024, HMRC will use “assumption and best judgment” to estimate the taxes already paid by the contractor when calculating the additional tax liability. They’ll consider:

- Corporation Tax (via the client or recruiter)

- Income Tax and Employer NICs (paid to the contractor via the intermediary)

- Tax on dividends

- Class 2 and 4 NICs

What Is Inside IR35?

If your contract falls “inside IR35,” HMRC (the UK tax authority) believes your working relationship strongly resembles employment. This means you are liable to pay income tax and National Insurance Contributions (NICs) like a standard employee.

Inside IR35 Checklist

No single factor definitively places you inside IR35. HMRC evaluates the whole picture of your working relationship. Key areas of focus include:

- Control: Does the client dictate your working hours, location, and how you perform the work? (More control points towards inside IR35)

- Substitution: Is there a genuine right in your contract to send a substitute to do the work? (A genuine right of substitution suggests outside IR35)

- Mutuality of Obligation: Is the client bound to offer you work, and are you bound to accept it? (Strong mutuality of obligation leans towards inside IR35)

- Financial Risk: Do you bear any financial risk (e.g., rectifying faulty work at your expense, investing in equipment)? (Financial risk suggests outside IR35)

- Provision of Equipment: Do you use your equipment and tools to carry out the work? (Providing your points towards outside IR35)

- Part and Parcel: Are you integrated into the client’s organization like a regular employee? (Being “part and parcel” of the company suggests inside IR35)’

What Is Outside IR35?

Working ‘outside of IR35‘ means you get the tax advantages of being a private contractor. This includes taking a salary, dividends (which aren’t subject to NIC), and a lower corporate tax rate for your limited company (if profits remain under £50,000).

IR35 assessment determines whether a contractor should be considered an employee for tax purposes in the UK. It evaluates factors such as control, substitution, and mutuality of obligation to determine the individual’s employment status.

To prove your ‘outside IR35‘ status, show you run a genuine business with insurance, a website, your own equipment, and various clients.

Outside IR35 Checklist

While no single factor guarantees outside status, HMRC (the UK tax authority) looks at several key areas to determine IR35 status. Here are questions to ask to help you assess your position:

Control

- Do you decide how and when your work is done? Or does your client dictate your schedule and methods extensively?

- Can you provide a substitute worker? This is a strong indication of a business relationship rather than direct employment.

Financial Risk

- Do you bear financial risk for your work? For example, are you responsible for rectifying errors at your own cost?

- Do you invest in your own equipment and business development? This demonstrates a commitment to your business as an independent entity.

Integration into the Client’s Business

- Do you appear as ‘part and parcel‘ of your client’s organization? Do you wear their uniform, get the same benefits as employees, or have a company email address? Too much integration can raise red flags.

- Do you work with multiple clients simultaneously? A diverse client base shows you are not exclusively reliant on one entity.

Other Factors

- Mutuality of Obligation (MOO): Is there an expectation of ongoing work, or is each project clearly defined? MOO can suggest employment-like conditions.

- Right to Termination: Can both parties terminate the contract with reasonable notice?

Inside IR35 vs. Outside IR35: How To Determine?

Key Differences

| Feature | Inside IR35 | Outside IR35 |

| Explanation | Considered a ‘disguised employee’ for tax purposes. | Genuinely self-employed contractor running their own business. |

| Taxation | Income is taxed similarly to a regular employee (PAYE and National Insurance Contributions). | More tax-efficient structure: salary plus dividends, legitimate business expenses deductible. |

| Client Responsibility (Since April 2021) | In the private sector, the client (medium or large businesses) determines IR35 status and bears liability if incorrect. | Contractor IR35 retains some responsibility for determining status, but the client’s assessment is crucial. |

HMRC (Her Majesty’s Revenue and Customs) looks at several factors to determine whether a worker is genuinely self-employed or a “disguised employee“. No single factor is decisive, and it’s the overall working relationship that matters.

If you can’t determine by yourself, you can seek advisory services like ERA to clarify if your contractors are inside or outside IR35.

Here are the most important areas they examine:

- Control: Does the client have significant control over how, when, and where you work? Increased control points towards being inside IR35.

- Substitution: Do you have the right to provide a substitute worker to do the job instead of providing your own services personally? The ability to use a substitute strengthens your case for being outside IR35.

- Mutuality of Obligation (MOO): Is there an expectation that the client has to offer work and you must accept it? This suggests an employer-employee relationship and points towards being inside IR35.

- Financial Risk: Are you taking on financial risks by covering your own expenses, having the potential to make a loss, or being able to profit from good business management? Increased financial risk usually means you’re outside IR35.

- Other Factors: HMRC may also consider whether you’re part and parcel of the client’s organization, provision of equipment, length of engagement, and your right to termination.

For example, a software developer is hired for a 6-month project. They work on-site in the client’s office, use the client’s equipment, and are told exactly what and when to do it. This developer likely falls inside IR35 contractors.

Or a graphic designer who provides services to multiple clients. They work from their own studio, set their own hours, have their own equipment, and can send a substitute if needed. This designer is more likely to be outside IR35.

Frequently Asked Questions

1. What Is IR35, And How Does It Affect Contractors?

IR35 is UK tax legislation. It combats potential tax avoidance schemes where individuals provide services through an intermediary (often their own limited company) but would essentially be considered employees if they were directly contracted.

If IR35 applies to contractors, it means contractors likely pay income tax and National Insurance contributions at levels similar to those of a directly employed person.

2. How Do I Know If IR35 Applies To Me As A Contractor?

IR35 is likely to apply to you if you meet most of these conditions:

- You work for a client through your limited company (intermediary).

- You could be considered an employee if you worked directly for the client. (Check the key criteria below for more on this)

- The client is a public sector body OR a medium/large business in the private sector.

3. What Are The Key Criteria Used To Determine IR35 Status?

- Control: The level of control your client has over how, when, and where you work. Increased control points towards an employment-like relationship.

- Substitution: Your ability to send a substitute to perform the work. If you must provide services personally, this points towards IR35.

- Mutuality of Obligation: The extent to which your client is obliged to offer work, and you are obliged to accept it. A strong sense of mutual obligation suggests IR35 might apply.

- Other factors: These include financial risk, the provision of equipment, how you are paid, and whether you appear to be ‘part and parcel’ of your client’s organization.

4. What Are The Consequences Of Being Inside Or Outside IR35?

Inside IR35 (Disguised Employee):

- You or your client are responsible for deducting income tax and National Insurance Contributions (NICs) from your fees before they reach your limited company.

- Your income will be taxed similarly to an employee’s salary.

- Your client may incur employer NICs, further increasing costs.

Outside IR35 (Genuinely Self-Employed):

- You are responsible for your own tax and NICs payments through your limited company.

- You may be able to take advantage of more tax-efficient structures.

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.