You need proof of income to rent a house, get a credit card, or secure a loan. However, verifying your income is more challenging when you are a self-employed worker. Therefore, ERA experts are here to explain the self-employed proof of income and how to show it quickly and simply.

What Is Proof Of Income?

Proof of income is documentation showcasing how much money you’ve earned over a certain period (typically a year). Generally, a lender or landlord will request it to verify your income and determine whether you qualify for a mortgage.

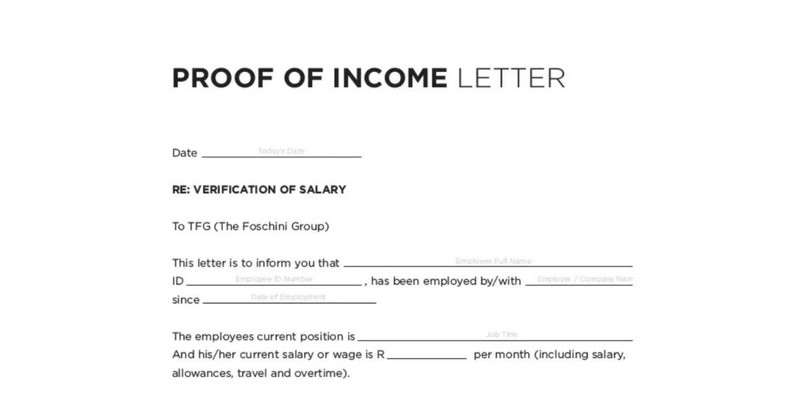

In some cases, you only need a proof of income letter. It includes basic income information, such as your average workweek hours, yearly salary, occupation, employment status, etc.

This letter summarizes and verifies your income and employment. Depending on your situation, it can be written by you, an accountant, or someone else. In addition to this letter, your lender or landlord may request supporting documents as proof.

Proof of income includes both income from salaried or hourly work and passive income from interest, capital gains, and stock investments. Each lender will have their requirements regarding credit score, down payment, income, and debt-to-income ratio for approval of a mortgage or other loan.

For instance, FHA loan requirements for down payments and credit scores are typically less stringent than those for conventional loans. Ask your mortgage lender about their requirements to determine if they fit your financial situation well.

Why Do You Need Proof of Income?

Here are some common reasons you need self-employment income verification:

- Filing taxes

- Getting health insurance

- Applying for a credit card

- Renting an apartment, house, or car

- Buying a car

- Applying for a mortgage

- Getting personal loans

- Getting pension schemes

- Accessing relief during natural disasters.

- Applying for free food rations

These activities involve someone lending you money or covering expenses for a while. You must confirm that you can afford to repay by showing your continuous source of income.

Various documents, such as tax forms or pay stubs, can provide proof of income for self-employed people. Check carefully what is required for the purpose you are applying for, as different organizations require different documents like banks often prefer tax documents or pay stubs for a specific period.

How To Show Self-Employed Proof Of Income?

Providing proof of income is simple for employees: including a W-2 form from the employer and your recent bank statements. However, income verification for self-employed individuals is more complex: They don’t have W-2s, so they must use other documents.

Here are some ways self-employed people can prove their income:

1099 Form

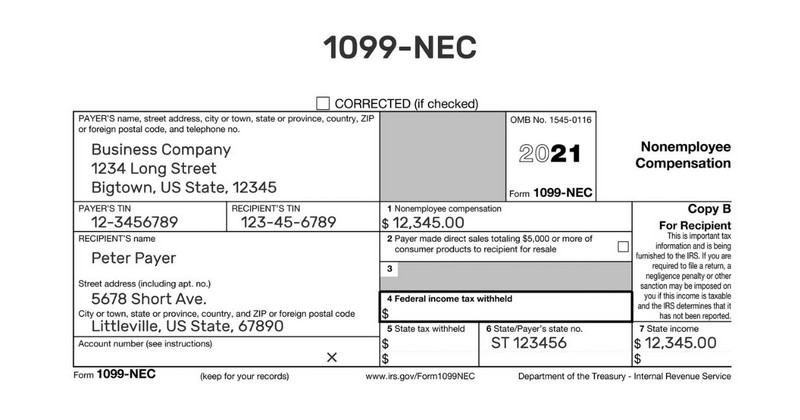

A 1099 form is an “information return,” meaning it informs the Internal Revenue Service (IRS) of taxable payments. It is a record that shows you were paid by a person or company other than your employer.

There are numerous types of 1099 forms:

- Form 1099-NEC

- Form 1099-K

- Form 1099-MISC

- Form 1099-A

- Form 1099-B

- Form 1099-C

- And more.

The 1099 form most commonly used by self-employed people is Form 1099-NEC. Others report different non-wage income sources, from unemployment to real estate transactions.

You will receive a form if you are self-employed, a freelancer or an independent contractor who meets either of these conditions:

- Earn over $600 from a client or platform and get paid through check or direct deposit.

- Get over $20,000 and record at least 200 transactions through credit, debit, or payment apps.

You will see your Taxpayer Identification Number (or your Social Security number) when receiving this form. That means the IRS knows you received the money, and you have to report it.

The deadline to send this form is January 31, but it may appear a few days later, in early February.

Many organizations, such as landlords, lenders, and government agencies, accept the 1099 Form as reliable proof of income documents for self-employed. Not only that, this form can also help identify any discrepancies in reported income when dealing with the IRS.

Remember that you can not report some earned income on your 1099 form. In such cases, you should provide extra documents or records for that income.

Profit and Loss Statements

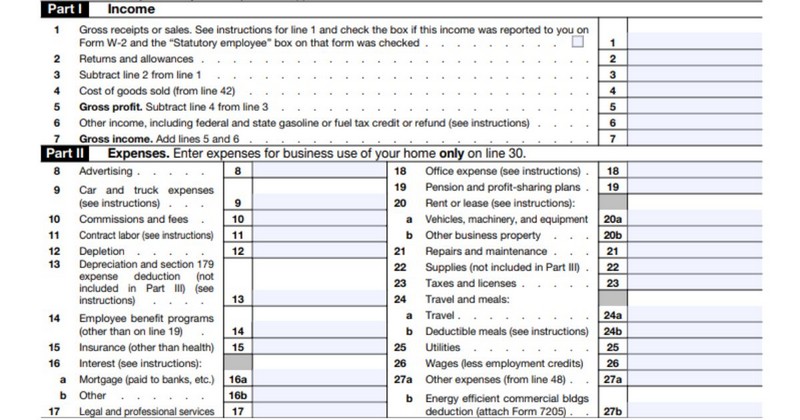

Filling out Schedule C as a self-employed individual each year also means preparing a profit and loss statement for your business activities up to that time. If you are a sole proprietor, completing and submitting this form on time is critical to meet IRS requirements.

But what is a self-employed income statement? A profit and loss statement tracks your business’s profit, costs, and expenses over a specific period. Expenses are only allowed if necessary for running your business and reasonably incurred:

- Allowable expenses include staff wages, business fuel, telephone, rent, advertising, and more.

- Expenses not allowed include depreciation costs, entertainment expenses, and personal expenses.

Your income for benefit purposes is your total income minus allowable expenses, with allowances for tax, National Insurance, and pension contributions. You can find a profit and loss statement on the IRS website, ask your accountant to help or use software to set it up yourself.

These statements summarize your business income and expenses monthly, quarterly, or annually, showing your net income after expenses. While they are more common among self-employed people operating as business entities, freelancers can also benefit from keeping them.

Bank Statements

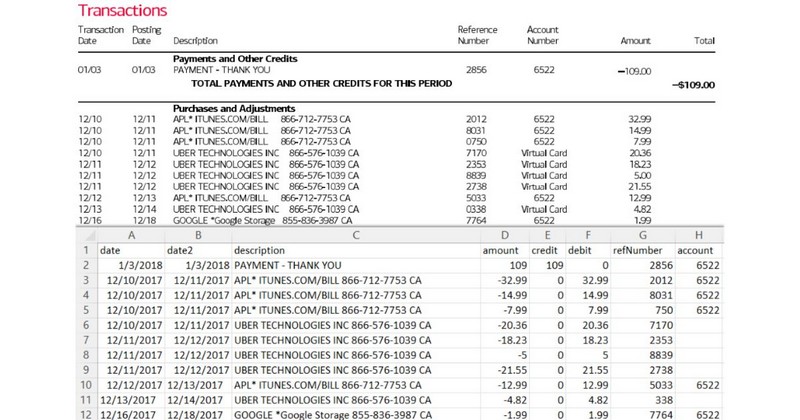

If you need to report proof of self-employment income, your bank statements are a reliable option. You can get them from your bank either on paper or digitally. A bank statement is a document from your bank that shows all the transactions in your account.

Most banks send statements to account holders monthly or quarterly. However, banks and credit organizations only have to send you a monthly statement if you make at least one electronic transfer that month. Electronic money transfers include:

- ATM withdrawals

- Debit card purchases

- Online bill payments

- Direct deposits

As a self-employed individual, you can get bank statements online, through your bank’s website, or by requesting them from the bank. This process is similar to that of a traditional employee.

Bank statements help you in various ways:

- Allow you to manage your money better, find mistakes, and see where it goes.

- Check your statements regularly—daily, weekly, or monthly— to prevent overdraft fees and fraud.

- When you compare your records with your bank statements, you can spot errors and report them quickly.

However, it is easy to misidentify certain expenses or deposits. If you use one account for both personal and business banking, it’s crucial to distinguish business-related payments and costs clearly.

Otherwise, you can set up a business account to separate your personal and professional finances. This method makes it easier to prove income and ensures you don’t reveal personal financial details to lenders or landlords.

Before presenting your bank statements as proof of income when self-employed, you must accurately identify incoming payments and business expenses. Finally, review the information to ensure it is accurate and up to date, avoiding unnecessary problems when using it as proof of income.

Annual Tax Returns (Form 1040)

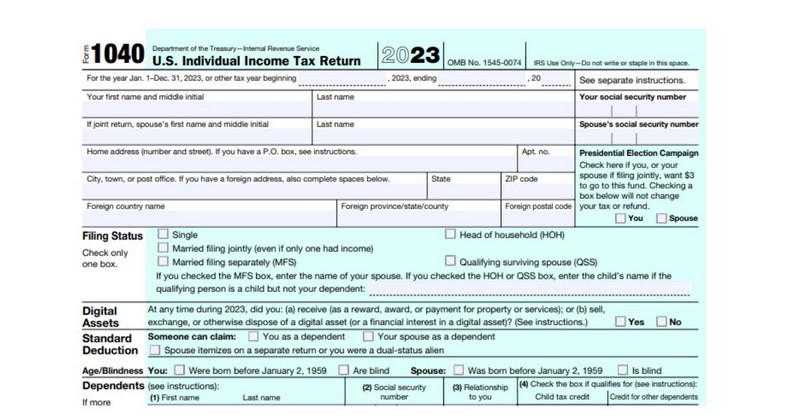

Form 1040, or U.S. Individual Income Tax Return, is an IRS form that individual taxpayers use to file annual income tax returns. This form requires taxpayers to disclose their taxable income for the year to determine whether they owe additional taxes or are entitled to a tax refund.

Form 1040, available on the IRS website, is two pages long and can be submitted by mail or electronically. Taxpayers provide filing status and personal information such as name, address, Social Security number, and the number of dependents. There’s also an option to donate $3 to presidential campaign funds.

The income section requires reporting various sources of income, including:

- Wages

- Salary

- Taxable interest

- Capital gains

- Pensions

- Social Security benefits

Recent tax changes have eliminated certain deductions, such as unreimbursed employee and work-related travel expenses (excluding active duty military).

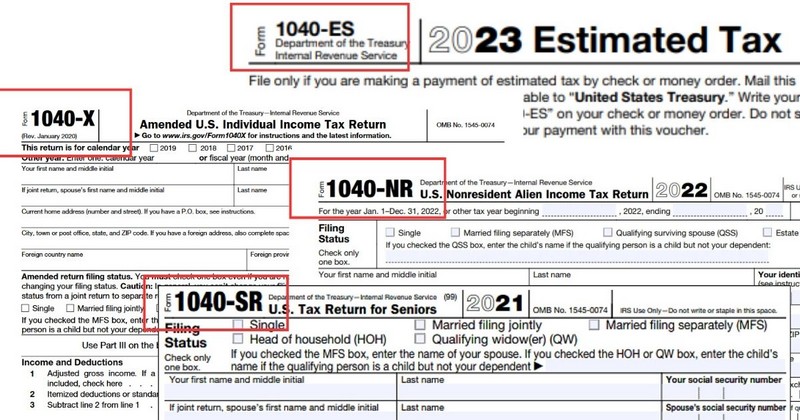

There are currently various variations of Form 1040:

- Form 1040-SR simplifies tax filing requirements for people age 65 and older.

- Form 1040-NR is the primary form nonresident aliens use to file their U.S. tax returns.

- Form 1040-X files for a tax extension.

- Form 1040-ES calculates estimated quarterly taxes.

- Form 1040-V is a statement of payment of the balance owed on your 1040 or 1040-NR tax return.

Various variations of Form 1040

If a person wants to prove their income, they can use Form 1040 or a variation of Form 1040 mentioned above. However, remember that Form 1040 must be filed with the IRS by April 15 every year.

Freelancers or business owners usually receive a tax return for the relevant year to report their annual income. However, tax returns may not fully represent all self-employment income, especially if some income is not officially recorded or includes smaller project fees.

Many self-employed individuals use Schedule C forms to report income and expenses, transferring net profit or loss to Form 1040. Keeping these records after filing is essential to prove a self-employed person’s income.

Typically, self-employed individuals are not required to report income below a certain threshold, which may result in the total income on the tax return being lower than it actually is. In such cases, you can use additional documentation of unrecorded income, such as annotated bank statements, along with the tax return.

See more: 1099 vs. 1040: Key Differences Every Taxpayer Should Know

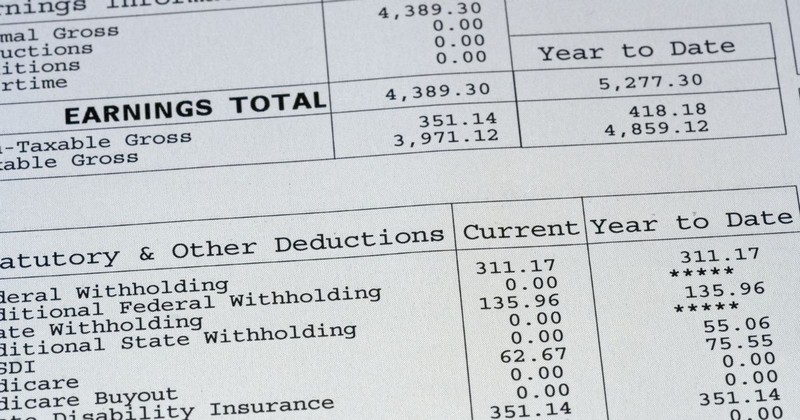

Self-Employment Pay Stubs

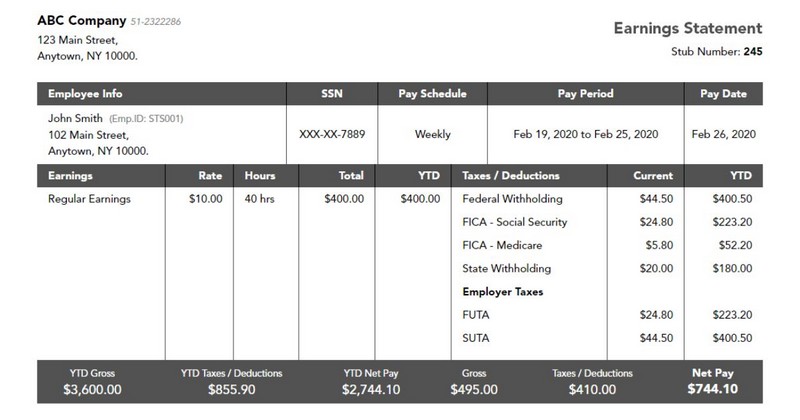

Another way to report proof of employment for self-employed individuals is to use pay stubs. These documents show income, deductions, and expenses, helping freelancers or self-employed workers track their money flow over a specific period.

Typically, pay stubs serve as proof of income for traditional employees. However, self-employed individuals can also create pay stubs to record income easily.

Unlike a regular employee’s pay stub, the self-employed pay stub usually shows no deductions taken directly from the pay. Therefore, the filing process will be pretty complicated because you must independently calculate deductions such as Social Security and Medicare.

Self-employed individuals can create pay stubs using online generation tools, working with professionals, or manually creating them using software programs. No matter what method you choose, ensure they include:

| Information | Description |

| Name and Address | Primary identifier of the self-employed individual |

| Business Name and Address | Proof of business existence and source of incomeRequirement for proving income to lenders |

| Payment Date | Indicating when payment was releasedDetermining compatible pay period for the pay stub |

| Pay Period | Ensuring accuracy in payment amount calculation |

| Payment Amount | Showcasing how much a self-employed worker has earned during a particular pay period. |

| Expenses | Business expenses listing for deduction calculation. |

| Net Pay | Total amount received after deducting expenses. Available for both business and personal use |

| Year-to-Date Information | Including gross income, deductions, net sum, and the corresponding information for the considered period |

| Extra Details | Additional information, such as pending payments or specific situations. |

Pro tip: Record each new paycheck and include the date range to present when income was earned. We recommend using online pay stub generators because they can streamline the process by providing accurate formatting and verifying information.

Be cautious when using pay stubs as proof of income for independent contractors, and ensure the recipient accepts them as valid documents. Finally, maintaining other records, such as bank statements and tax documents, is essential. That is how you can have a comprehensive financial document.

Wrapping Up!

In short, you can show self-employed proof of income using various documents, such as Form 1099, Profit and Loss statement, Bank statement, etc. This process will become complicated if you have different sources of income.

ERA provides tailored accounting services for the self-employed, helping you manage finances easily. Let us deal with the numbers so you can focus on your work. So, don’t hesitate to schedule a consultation with our team today!

Frequently Asked Questions

How do I get an income statement?

You can get an income statement in various ways:

- Get a form on the IRS website.

- Ask your accountant to help create one.

- Use software to set it up yourself.

What is evidence of income?

Evidence of income (or proof of income) is a document that shows how much you earned over a specific time. Generally, you need it to prove you have a stable source of income. Evidence of income can include bank statements, pay stubs, tax returns, and other legal documents.

See more: Self-Employed Tax Deductions

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.