Key Takeaways:

- Foreign investors can operate in Vietnam by establishing a 100% foreign-owned company or setting up a representative office. Scroll down to explore four key options.

- Learn tips from ERA on starting a business in Vietnam, from business registration and workforce management to financial reporting.

Key Benefits of Starting a Business in Vietnam (viết ngắn gọn bullet points)

- Economic Growth and Stability:

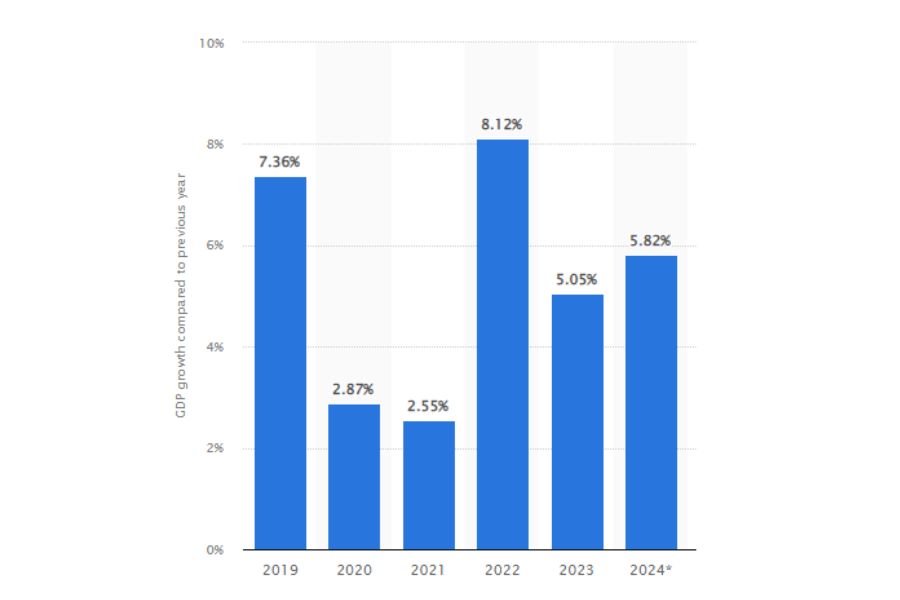

Vietnam’s economic outlook remains robust. The country’s GDP growth is projected at 6.1% in 2024, outpacing eight ASEAN nations and China. Citibank Vietnam’s General Director John Beeman also highlights the country’s political stability as a key advantage over other Asian nations.

In addition, participation in major trade agreements like the CPTPP and EVFTA has strengthened Vietnam’s market appeal. It is expected to boost foreign investment in the coming years.

Vietnam’s GDP growth in recent years. Source: Statista

- Competitive Labor Market:

Vietnam has a young, skilled workforce with affordable wage costs. According to Statista, the hourly manufacturing labor cost is $6.50 in China, compared to just $3 in Vietnam. This makes Vietnamese workers attractive across various industries, from manufacturing to tech.

- Incentives for Foreign Investment:

The Vietnamese government offers numerous incentives to investors. These include up to four years of corporate income tax exemption. A 50 percent tax reduction for the following nine years on high-impact projects. Additionally, preferential tax rates of 10 percent, 15 percent, and 20 percent are available for specific investment types.

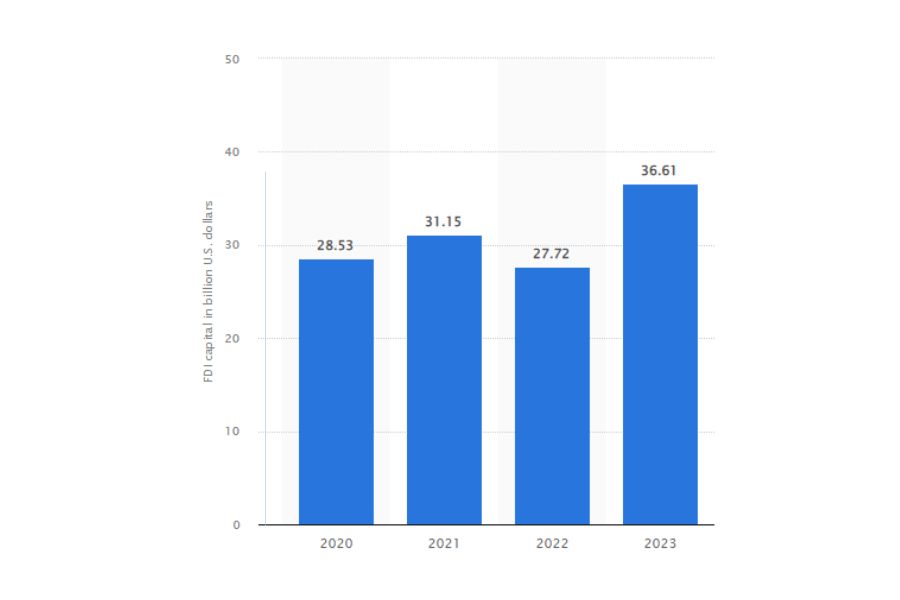

Vietnam’s registered FDI capital of 2020 – 2023. Source: Statista

Above are the statistics of Vietnam’s registered FDI capital from 2020 to 2023. Notably, in the first eight months of 2024, Vietnam recorded over 41,000 valid FDI projects with a total registered capital exceeding 491 billion USD.

Types of Legal Entities for Foreign Businesses (viết ngắn gọn, ko cần bổ heading 3)

- Wholly Foreign-Owned Enterprise (WFOE):

A foreign-owned entity of this type allows 100% foreign ownership. This provides owners with full control over operations, profits, and decision-making in Vietnam without needing a local partner. Notably, WFOEs can also repatriate their earnings back to their home country in accordance with current tax regulations.

- Joint Venture (JV):

A Joint Venture refers to the collaboration of a foreign investor and a Vietnamese investor, combining resources and competencies. This mode enables foreign enterprises to harness local knowledge, network contacts, and market information of a host country. At the same time, they can share the financial risks and returns with a Vietnamese business partner.

How to open a company in Vietnam by Joint Venture? Source: ezybizindia.in

- Representative Office (RO):

The Representative Office enables foreign companies to establish a presence in Vietnam without engaging in direct commercial activities. It would serve as a liaison office that assists in market research and communications with potential partners. This makes RO an inexpensive means for investors to test the waters in the economy before making more significant investments.

- Branch Office:

A Branch Office is permitted to operate business activities in Vietnam, but under the control and supervision of the parent company. In such a format, it allows the branch to invoice customers directly, sign contracts, or even hire local staff. Still, some sectors, such as banking and insurance, are regulated differently and go through more scrupulous scrutiny.

Step-by-Step Company Setup Process in Vietnam

- Step 1: Pre-Investment Considerations:

- Market Research and Feasibility Studies:

By reviewing market research reports and trade journals, investors can gain valuable insights into the industry, competition, and target audience. This helps them evaluate the viability of their business idea before proceeding with company registration in Vietnam.

This kind of extensive research saves one from costly errors at the beginning and hence provides a very solid stepping stone for growth.

- Choosing a Business Location:

When setting up a business in Vietnam, investors often choose big cities like Ho Chi Minh City, Hanoi, and Da Nang. Each town offers distinct upsides in terms of customer reach, talent availability, and costs. Thus, it’s essential to choose a location that aligns with industry needs.

Ho Chi Minh City. Source: tripadvisor.com

For instance, Ho Chi Minh City, as the economic hub, is ideal for sectors like manufacturing and technology, but office costs can be high.

- Step 2: Registering the Company Name:

The chosen name must be unique and comply with local regulations. This means it should not be identical to an existing registered business name. Terms suggesting affiliation with government agencies or those that violate Vietnamese cultural norms are also prohibited.

After verifying compliance, the company name registration can proceed through the local Department of Planning and Investment.

- Step 3: Obtaining Investment Registration Certificate (IRC):

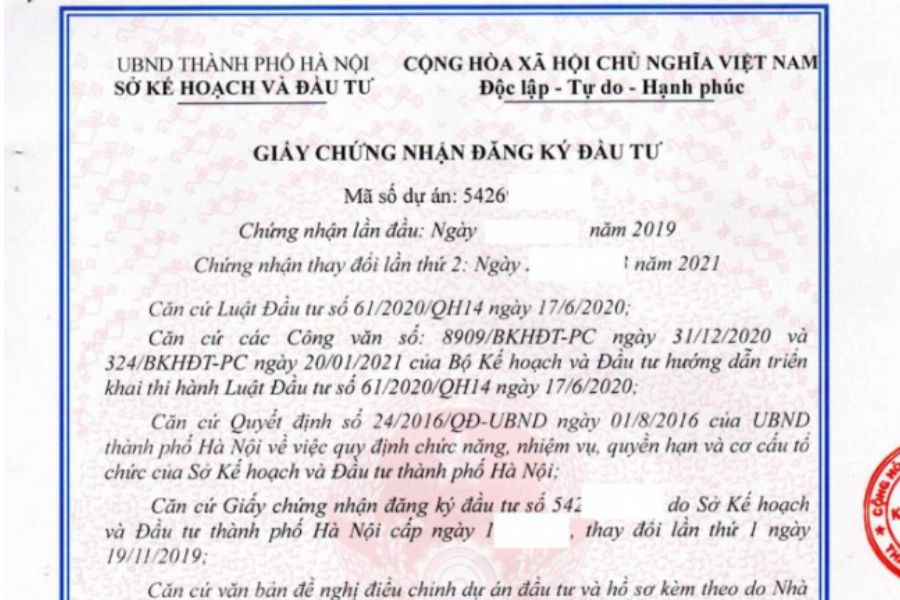

Vietnamese Investment Registration Certificate. Source: novalaw.vn

The IRC is a mandatory document proving that a foreign investor meets all legal requirements to operate in Vietnam. It contains essential information on the investment project, such as the investor’s details, capital source, and project location. Documents required for IRC approval include:

- Application detailing the project scope and objectives in Vietnam.

- Investment project proposal with lease agreements or land use details.

- Investor’s financial report from the past two years.

- Legal documentation for the investor and authorized representative.

- Lease contract or memorandum of understanding.

- Any additional project-specific documents or qualifications.

Approval typically takes up to 15 working days from the submission of a complete application.

- Step 4: Securing the Enterprise Registration Certificate (ERC):

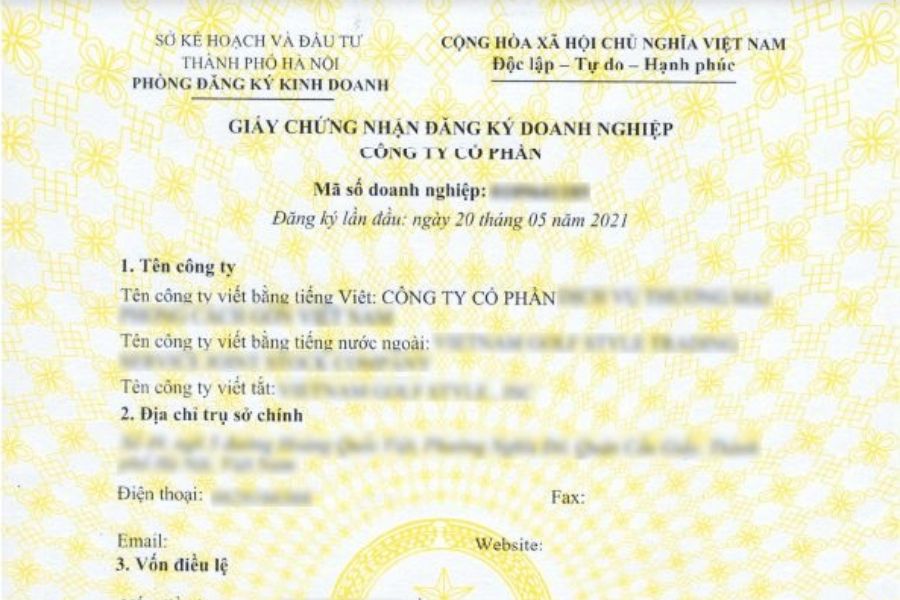

ERC is required to officially confirm a company’s legal status and allow it to begin operations in Vietnam. Without an ERC, a company cannot open a bank account, register for taxes, or engage in business transactions.

The ERC contains essential information about the enterprise. These include the company name, head office address, business lines, enterprise code, charter capital, and number of shares.

Vietnamese Enterprise Registration Certificate. Source: apolatlegal.com

- Step 5: Opening a Bank Account and Depositing Capital:

To transfer capital into Vietnam, investors must open a capital bank account at a licensed bank. This special-purpose foreign currency account is used to monitor capital flows in and out of the country. It also facilitates transfers to current accounts for local payments and transactions when starting a business in Vietnam.

- Step 6: Obtaining Additional Permits:

During the Vietnam company incorporation process, certain industries may require particular licenses or permits to operate legally. For example, the food and beverage business requires the Food Safety Conditions Certificate. The real estate companies need to get a Land Use Certificate.

Certificate of Food Safety Conditions in Vietnam. Source: giayphepcon.net

Taxation and Accounting Requirements (ko cần bổ heading 3)

- Overview of Corporate Tax Obligations:

- Corporate Income Tax (CIT): A standard 20% rate applies, with higher rates (25%–50%) for oil, gas, and mineral extraction. Companies file and pay CIT quarterly and annually.

- Value Added Tax (VAT): A 10% VAT rate is standard, with a reduced 5% for essential goods and exemptions for exports. VAT is filed and paid monthly or quarterly.

- Foreign Contractor Tax (FCT): This tax applies to payments made to foreign contractors for goods or services in Vietnam, combining CIT and VAT elements. FCT returns are also filed monthly or quarterly with appropriate payments.

- Other Taxes: Additional taxes may apply, such as special consumption, natural resources, and environmental protection taxes. These taxes will depend on business activities.

- Mandatory Accounting and Reporting:

The entities have to meet the requirements of the Vietnamese Accounting Standards. The records are maintained in the Vietnamese language and VND currency. The accounting period starts on January 1 and goes to December 31 of the year. Yet, it can begin on the first day of any quarter if it has been registered at the Tax Department.

The financial statement typically includes a balance sheet, income statement, cash flow statement, and notes. Failure to comply with the requirements of VAS may deny input VAT deductions or loss of tax incentives. Thus, consulting with a local accounting or consulting firm is quintessential.

When starting a business in Vietnam, investors must comply with Vietnamese Accounting Standards. Source: corporatefinanceinstitute.com

- Employee Tax and Social Security Contributions:

Vietnam requires employers to withhold personal income tax on employees’ monthly earnings, with rates ranging from 5% to 35%. This rate will depend on salary levels. Apart from the above taxes, employers and employees also need to contribute to social security funds in the following manner:

- Social Insurance: 17.5% for employer, 8% for employee

- Health Insurance: 3% for employer, 1.5% for employee

- Unemployment Insurance: 1% for employer, 1% for employee

All contributions are calculated with regard to the employee’s monthly salary. However, this is capped at a maximum of 20 times the minimum basic wage.

Key Legal and Compliance Requirements (ko cần bổ heading 3)

- Labor Laws and Employment Contracts:

Under the Labor Code 2019, labor contracts should be in written form and signed by both parties. The normal working hours constitute 8 hours a day and 48 hours a week. The basic employee benefits include the following: 12 days annual leave, public holidays, paid leave, insurance, and maternity leave.

Bilingual employment contract in Vietnam. Source: lawnet.vn

Besides, employers must pay attention to regional minimum wages. This stands within the brackets of 3,450,000 to 4,960,000 VND/ month. There are also some administrative fines for offenses with regard to payroll or working hours.

Investors can comply with Vietnam’s labor legislation by using our Employer of Record (EOR) services without establishing a local entity. With this service, we become the legal employer and handle all employment responsibilities. These include recruitment, contracts, payroll, and severance packages.

- Intellectual Property Protection:

When setting up a business in Vietnam, registration of Intellectual Property is recommended, especially when it involves manufacturing and technology.

In this way, the invention, trademark, designs, and patents of a business are legally protected to deter infringement. The protection of IP enhances competitive advantage and protects brand names, promoting long-term business success.

- Annual Reporting and Audit Requirements:

All enterprises, particularly large-scale ones, are required to undergo annual statutory audits by an independent auditing firm in Vietnam. The audit covers the business performance report, cash flow, balance sheet, and statement of changes in equity.

The tax year follows the calendar year. Investors must submit the audited financial statements to local tax authorities, the Vietnam Ministry of Finance, and the statistical agency. The submission deadline is within 90 days after the end of the fiscal year.

Audited financial statements. Source:indiafilings.com

Pros and Cons of Starting a Business in Vietnam (ko cần bổ heading 3)

- Advantages:

- Growing Consumer Market: With its population of over 100 million, Vietnam presents a massive consumer market. More than 60% of the population falls within the working age bracket of 15 to 59 years, making it an active market.

- Skilled, Affordable Workforce: Vietnam provides a skilled workforce at competitive wages, making it an attractive option for cost-efficient operations.

- Government Incentives: The government introduced a revised Investment Law and a new Public-Private Partnership Law to attract foreign investments.

- Strategic Location for ASEAN Trade: Vietnam has easy access to regional markets and benefits from a number of free trade agreements like EUAFTA and AANZFTA.

Young IT engineers in Vietnam. Source: baotintuc.vn

- Challenges:

- Complex Administrative Processes: Dealing with Vietnam’s legislation may be quite time-consuming due to difficulties within administrative procedures or license issuance procedures.

- Varying Regulatory Transparency: Regulations differ on a province and industry basis, sometimes making compliance quite uphill for starting a business in Vietnam.

- Language Barriers: While English is common for business, the official language is Vietnamese. This can create complex situations in negotiations and day-to-day operations, especially outside of the major cities.

To rise above the challenges, a partnership with local experts is advisable for successfully starting a business in Vietnam. EOR service providers assist in recruiting talent. Local accounting and auditing firms make sure compliance from a financial point of view. Law firms consult on regulatory and administrative procedures.

Tips for Success in the Vietnamese Market (ko cần bổ heading 3)

- Cultural Awareness and Adaptability:

Being a traditional Asian country, Vietnam attaches importance to etiquette both in daily life as well as business. Respect for Vietnamese culture is needed to inspire confidence in local partners.

For example, sending gift baskets to business counterparts during the period of Tet Nguyen Dan is a considerate gesture. Such baskets may contain wine and fruits, among others.

Giving Tet gifts to partners in Vietnam. Source: tiki.vn

- Networking and Building Relationships:

Participation in industry events can help businesses connect with potential partners and customers. Joining local business networks, such as the Vietnam Chamber of Commerce and Industry, further enhances networking opportunities.

Cooperation with credible local consultants will allow one to avoid the feeling of unreadiness when getting into business. This also makes integration into the market smoother.

- Leveraging Government and Trade Resources:

In addition to benefiting from government incentives for foreign investors, businesses should regularly consult the Ministry of Planning and Investment. Staying in touch with the Vietnam Trade Promotion Agency also helps investors stay informed about new opportunities and compliance regulations.

Frequently Asked Questions

- What is the minimum investment required to start a business in Vietnam?

The government does not have minimum requirements for capital when starting a business in Vietnam. However, the Department of Planning and Investment will check whether the registered capital is sufficient to cover expenses. This ensures the company can sustain operations until it reaches its break-even point.

- How long does it take to set up a company in Vietnam?

Starting a business in Vietnam takes 2-3 months, depending on the type of business, the license needed, and the preparation of documents.

- What types of businesses are most successful in Vietnam?

The most successful businesses in Vietnam are typically in the food, beverage, retail, and packaging industries. This is evident from the 2023 list of the 500 most profitable companies, where the majority operate in these sectors.

- Can a foreigner own 100% of a company in Vietnam?

Yes, 100% foreign-owned companies can be set up in most industries by foreigners. However, ownership restrictions apply to sectors such as telecommunications, transport, financial services, and more.

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.