As a W2 employed full-time or contract worker living and working in different states, you will be responsible for your own tax filing. You should investigate which state will tax your paycheck. State tax reciprocity agreements can simplify this situation.

ERA’s experts explore “What is a reciprocal state,” how they benefit you, and which states have them in place for 2024. By the end, you clearly understand how these agreements work and how they can save you time and money on your tax filings.

What Is State Tax Reciprocity Agreements?

A state tax reciprocity agreement is a pact between two or more states eliminating double taxation for workers who commute across state lines. In simple terms, if you live in State A but work in State B, and these states have a reciprocity agreement, you only pay income tax to your state of residence (State A). This helps you avoid the inconvenience of having to submit tax returns to both states.

Here are some individuals who should be familiar with state tax reciprocity agreements:

- Remote workers: Anyone working from home in one state and for a company in another state.

- Cross-border commuters: Individuals who live in one state travel daily to work in a neighboring state.

- People with vacation homes: If you spend a significant amount of time working remotely from another state where you own a vacation home.

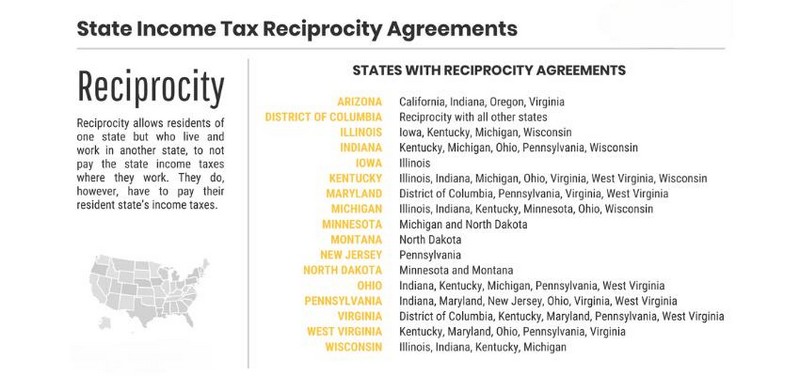

U.S. States with Reciprocity Agreements

State tax reciprocity agreements exist between a limited number of U.S. states. Here’s a breakdown of the state tax reciprocity chart (as of 2024):

| STATE | RECIPROCAL AGREEMENT STATES | FORMS REQUIRED |

| Illinois | Iowa, Kentucky, Michigan, Wisconsin | Form IL-W-5-NR – Employee’s Statement of Nonresidence in Illinois |

| Indiana | Kentucky, Michigan, Ohio, Pennsylvania | Form WH-47 – Employee Withholding Exemption and County Status Certificate |

| Iowa | Illinois, Kentucky, Michigan, Wisconsin | Form 44-016 – Iowa/Nonresident Employee Certificate |

| Kentucky | Kentucky has agreements with Illinois, Indiana, Michigan, Ohio, Virginia, West Virginia, and Wisconsin to share state taxes. However, Virginia and Ohio have conditions. Virginians can only join if they work in Kentucky every regular workday, and Ohioans can only participate if they don’t own a big part of an S corporation. | Form K-4E – Employee’s Withholding Exemption Certificate |

| Maryland | Pennsylvania, Virginia, West Virginia, Washington, D.C. | Form MW507 – Employee’s Maryland Withholding Exemption Certificate |

| Michigan | Illinois, Indiana, Kentucky, Minnesota, Ohio, Wisconsin | Form MI-W4 – Employee’s Michigan Withholding Exemption Certificate |

| Minnesota | Michigan, North Dakota, Wisconsin | Form MWR – Reciprocity Exemption/Recapture Request |

| Montana | North Dakota | Form MW-4 – Employee’s Withholding Certificate |

| New Jersey | Pennsylvania | Form NJ-165 – Employee’s Certificate of Nonresidence in New Jersey |

| North Dakota | Minnesota, Montana | Form NDW-R – Reciprocity Exemption from North Dakota Withholding |

| Ohio | Indiana, Kentucky, Michigan, Pennsylvania, West Virginia | Form IT 4NR – Employee’s Statement of Residency in a Reciprocity State |

| Pennsylvania | Indiana, Maryland, New Jersey, Ohio, Virginia, West Virginia | Form REV-419 – Employee’s Nonwithholding Application Certificate |

| Virginia | Kentucky, Maryland, Pennsylvania, West Virginia, Washington, D.C. | VA-4 – Employee’s Virginia Income Tax Withholding Exemption Certificate |

| West Virginia | Kentucky, Maryland, Ohio, Pennsylvania, Virginia | Form WV/IT-104 – Employee’s Withholding Exemption Certificate |

Why Are State Tax Reciprocity Agreements Important?

State tax reciprocity agreements are vital in simplifying tax filing and saving money for workers who commute across state lines. Here’s a closer look at their importance:

- Eliminates Double Taxation: Reciprocity means you only pay taxes to your state of residence, like Illinois, avoiding this burden.

- Reduces Tax Filing Complexity: Reciprocity agreements eliminate the need to file in the state where you work, saving you time, effort, and potentially money on tax preparation.

- Boosts Economic Mobility: These agreements benefit both states – the worker’s home state gains tax revenue from a resident with a higher income, while the work state benefits from the employee’s skills and contribution to the local economy.

For example, Sarah lives in Kentucky and works remotely for a company in Ohio. Kentucky has a lower income tax rate (5%) than Ohio (3.94%). Without a reciprocity agreement, Sarah would pay Ohio taxes on her income, even though she doesn’t live there.

Here’s a simplified breakdown:

- Income: $50,000

- Ohio Tax (without reciprocity): $1,970

- Kentucky Tax (with reciprocity): $2,500 (assuming Sarah falls under the 5% tax bracket)

In this scenario, because of the reciprocity state agreement, Sarah saves nearly $530 on her state income taxes.

How To Manage Reciprocity Agreement?

While reciprocity agreements simplify things, some legwork can still be involved. This guide shows how to manage your state tax situation under a reciprocity agreement effectively:

Step 1: Know Your State’s Agreement

The first step is understanding the specific details of your state’s reciprocity agreements. This includes:

- Partner States: Which states does your state have reciprocity agreements with?

- Requirements: Are there any conditions you must meet to qualify for reciprocity (e.g., full-time work, minimum workdays in the home state)?

To update the newest information, refer to official state tax authority websites or consult a tax professional or AOR service.

Step 2: Gather Documentation

Maintain copies of any documents proving your residency in your home state and your eligibility for the reciprocity agreement. Some of the common required paperwork are:

- Driver’s license with your home state address

- Voter registration

- Proof of rent or mortgage payments in your home state

Step 3. Tax Filing

Even with reciprocity, you might still need to file a tax return in your state of residence. However, you’ll claim a credit for any income taxes withheld by the state you work in.

For example, Sarah lives in Kentucky and works remotely for an Ohio company. Here’s how she can manage her situation with a reciprocity agreement:

- Research Sarah confirms that Kentucky has a reciprocity agreement with Ohio. She found details on the Kentucky Department of Revenue website, including that Kentucky has no minimum workday requirement.

- Documentation Sarah keeps a copy of her Kentucky driver’s license and lease agreement for her Kentucky apartment.

- Employer Withholding Sarah provides her employer with a completed Kentucky form (e.g., Form KY W-4) claiming residency in Kentucky.

- Tax Filing While Sarah won’t owe Ohio income tax, she’ll still file a Kentucky tax return to claim a credit for any income taxes withheld by Ohio.

Conclusion

State tax reciprocity agreements offer a welcome relief for workers who commute across state lines. They eliminate double taxation, simplify tax filing, and boost economic mobility. By understanding these agreements and following some key management steps, you can ensure a smoother tax filing process and save money.

Explore the resources on the ERA website to stay updated on your rights and obligations as an employee.

Frequently Asked Questions

What Is A Reciprocal Agreement Between States’ Taxes?

A reciprocal agreement between states’ taxes eliminates double taxation for workers who commute across state lines. If your state has a reciprocity agreement with the state where you work, you’ll only pay income tax to your home state.

What States Have Interchanged With Each Other?

Reciprocal agreements can vary and change over time. Some examples of states having historically had reciprocal agreements include Pennsylvania and New Jersey, Illinois and Iowa, Wisconsin and Minnesota, and Maryland and Virginia. However, verifying the current status of reciprocal agreements is essential, as they may be subject to change.

How Do I File Taxes In A State Without Reciprocity?

If your state lacks a reciprocity agreement with the state where you work, you’ll likely need to file tax returns in both states. This can be complex, so it’s recommended you consult with a tax professional.

Which States Are Reverse Credit States?

“Reverse credit” refers to a state policy allowing residents to claim a credit for taxes paid to another state. This differs from a reciprocity agreement, but it can offer some relief for double taxation. Research your state’s tax laws to see if they offer a reverse credit.

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.