Key Takeaways

- An employment contract is a formal arrangement between businesses and workers that outlines the terms and conditions of work, payment, benefits, and other essential aspects. It ensures fairness and prevents ambiguity.

- The most popular types of employment contracts cover full-time contracts, Contract professionals, Temporary workers, 1099 Independent Contractor agreements, self-employed Corp. to Corp. Statement of Work, and non-compete clauses. Join ERA to learn the definitions, terms, and examples of 9 types of contracts to ensure their proper application.

What Is A Contract Of Employment?

An employment contract is a legal document that specifies the terms and conditions governing the working relationship between employers and employees. Critical elements of an employment contract include the scope of work, payment, contract duration, dispute resolution mechanisms, confidentiality clauses, and work location.

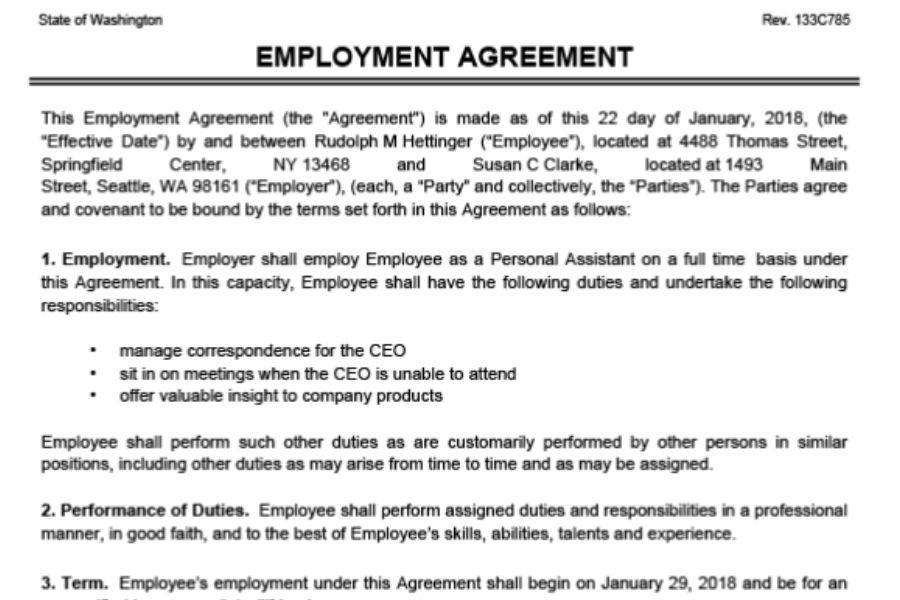

For example, the employment contract below outlines Susan C. Clarke’s hiring of Rudolph M. Hettinger as a Personal Assistant.

Employment contract sample

For independent contractors, the contract further clarifies that they are not company employees and that their relationship concludes upon project completion. Consequently, contractors do not receive employee benefits such as paid time off (PTO) or health insurance and are responsible for handling their taxes.

Benefits Of Employment Contract

A well-drafted employment contract provides substantial benefits for both the company and the worker by:

- Defining clearly each party’s rights and responsibilities helps ensure mutual understanding and reduces the likelihood of misunderstandings or disputes.

- Making enforceable promises allows the company to pursue legal action if the terms are breached. The contract can also specify the jurisdiction for legal action and the procedural steps.

- Safeguarding sensitive company information, such as proprietary technology and trade secrets, through confidentiality clauses that protect the organization’s intellectual property and maintain its competitive edge.

9 Types Of Employment Contracts

1. Full-Time Contract

A full-time contract is an employment agreement where an employee works 35-40 hours per week and is recognized as a permanent company member.

Typically, these contracts detail the job position, salary, schedule, holiday entitlements, pension benefits, statutory rest periods, parental leave (including maternity and adoption), and statutory sick pay (SSP).

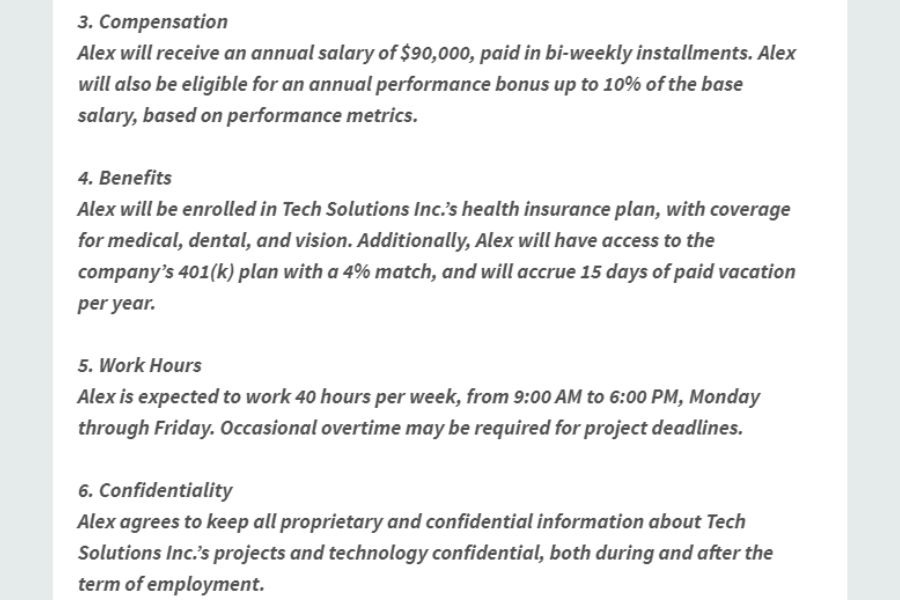

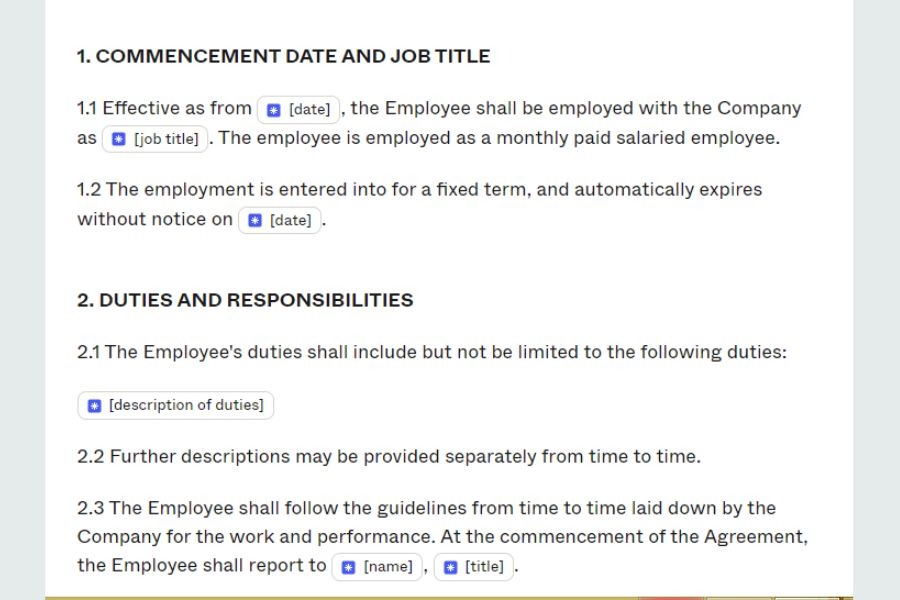

A vital aspect of a full-time contract is clearly outlining the number of workdays per week and daily work hours. Here’s an example:

Example of essential clauses in a Full-Time Contract.

2. Part-Time Contract

Part-time contracts are designed for workers who work fewer hours than full-time staff, generally under 24 hours per week. The number of hours can fluctuate based on the company’s needs, such as working 10 hours one week and 20 the next.

While the terms of part-time contracts often mirror those of full-time agreements, part-time workers typically do not receive benefits like health insurance, sick leave, holiday pay, or vacation time. Additionally, part-time contracts should specify the minimum weekly hours required, with the possibility of overtime when available.

Example of a Part-Time Contract

3. 1099 Independent Contractor Contract

A 1099 contract, also known as an Independent Contractor Agreement, is a formal arrangement between an independent contractor and a company that specifies the terms for a particular project or contract work. Contract work examples involve a graphic designer or software developer.

Unlike full-time employment contracts, a 1099 contract does not classify the contractor as an employee. Instead, it details vital aspects such as ownership of the work, project scope, deadlines, payment terms, confidentiality, liability, and termination procedures.

Notably, a 1099 contract imposes no restrictions on the number of hours.

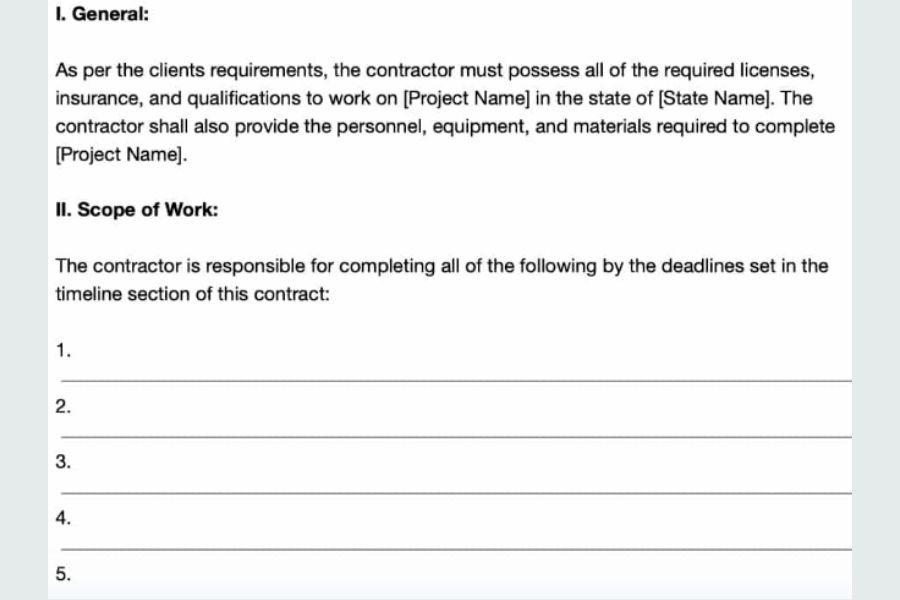

Example of an Independent Contractor Agreement

If facing challenges with local or international contracts for independent contractors, consider consulting ERA’s global Employer of record (EOR) experts. Our EOR service guarantees full compliance with federal, state, and local employment laws, no matter where you operate.

4. Fixed-Term Contract

A fixed-term employment contract specifies a definitive end date or concludes upon the completion of a particular project. This type of contract is commonly used to address seasonal business demands, cover employee maternity leave, or enlist a specialist for a specific task.

Workers on fixed-term contracts usually receive the same conditions, wages, and benefits as permanent staff. Upon expiration, the company may decide to renew, extend, or terminate the contract based on their needs.

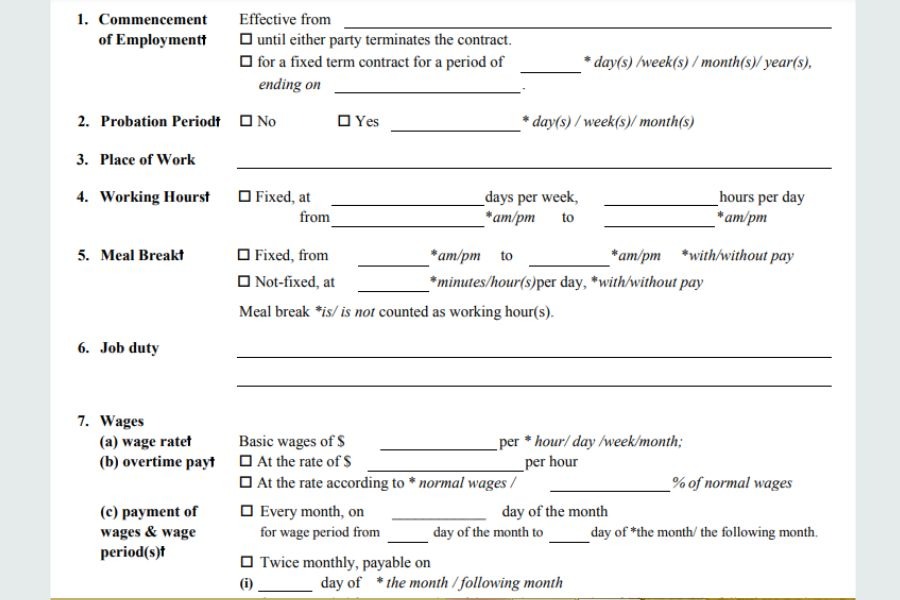

Example of a Fixed-Term Contract

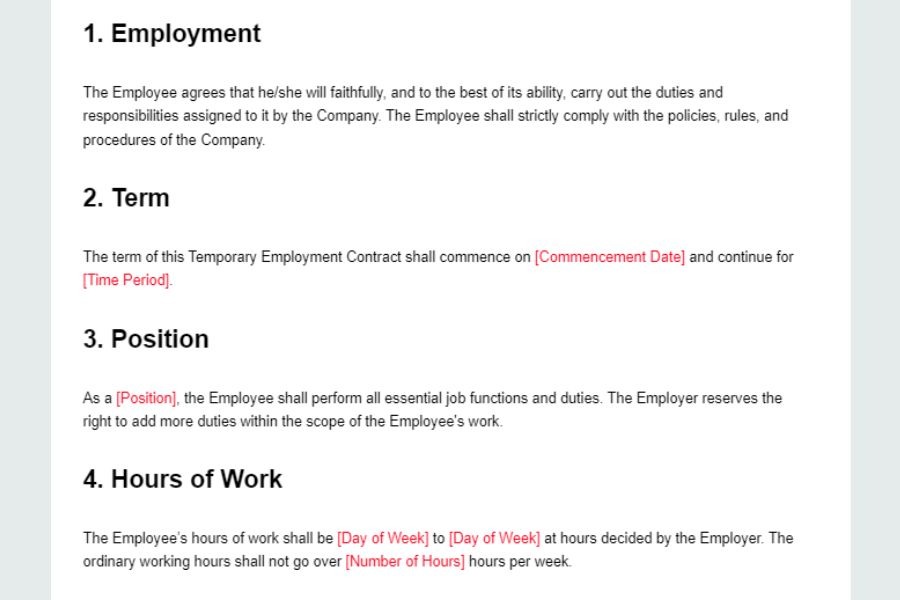

5. Temporary Contract

Temporary contracts are short-term agreements with a clearly defined end date, typically lasting up to one year in the United States. They are established between a company and an individual or, more frequently, through an employment or recruiting agency representing the individual.

This type of contract outlines the employment duration and the expected duties. Unlike part-time or fixed-term contracts, temporary employee contracts generally do not include benefits as part of the employment arrangement.

Example of a Temporary Contract

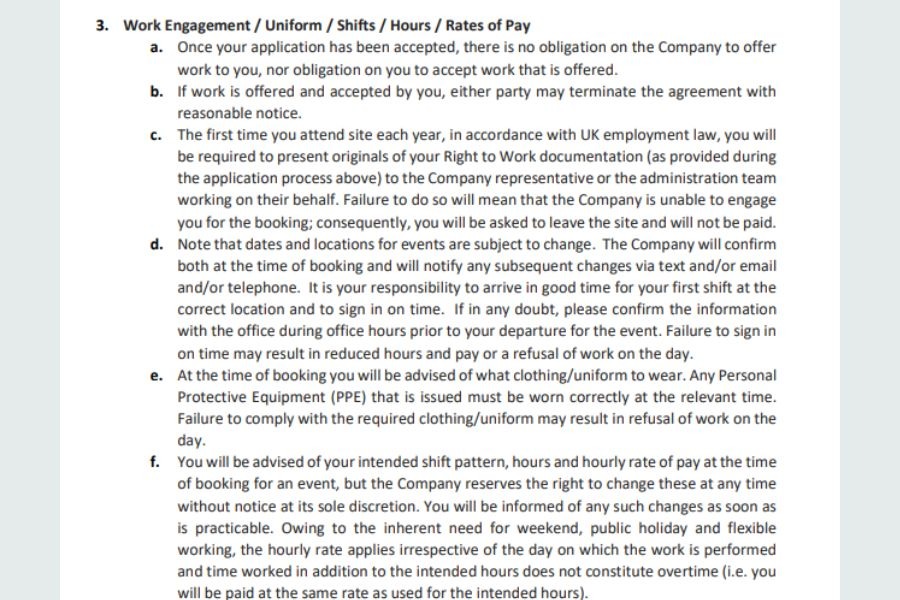

6. Casual Contract

A casual employment contract lacks guaranteed hours or a full-time commitment, and the independent contractor is not required to accept assigned work. Such agreements generally specify that the company only pays for work performed, with no minimum number of shifts or hours needed from the company.

Importantly, contractors under casual contracts are not entitled to benefits such as sick leave or annual leave, and they can terminate the contract without prior notice unless otherwise specified in the agreement.

Example of a Casual Contract

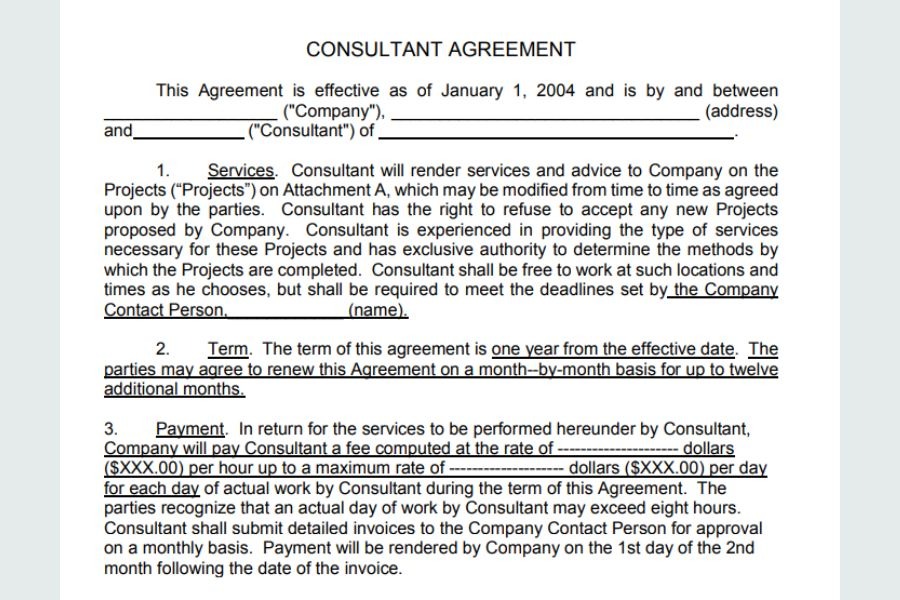

7. Corp to Corp. & Statement of Work “SOW” Agreement

These agreements are a formal contract that details the working relationship between businesses and consultants offering services, such as IT or HR.

This agreement typically details essential terms, including the start and end dates, the scope of services, pay rates, ownership of intellectual property, and termination conditions. It may also specify non-compete and non-disclosure agreements to protect the company’s interests.

Example of a Consultant Agreement

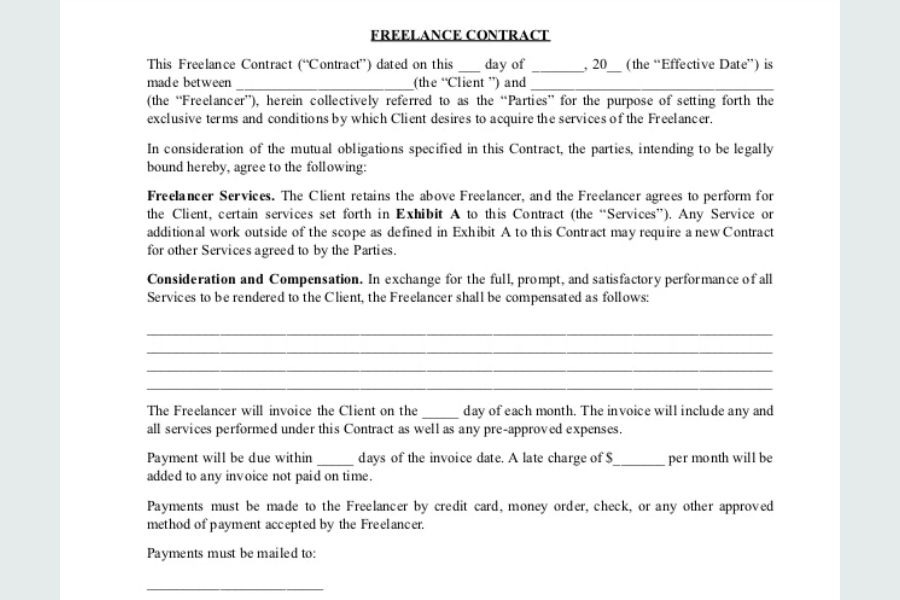

8. Freelance Contract

A freelance contract is a legal agreement that defines the terms and conditions between a company and a freelancer engaged to complete a specific project, such as writing an article, taking photographs, or renovating a home.

This contract details the scope of work, project timelines, working hours, compensation, and payment terms, protecting late payments or other potential issues. Unlike full-time employment contracts, freelance agreements typically do not cover benefits like insurance or paid time off.

Example of a Freelance Contract

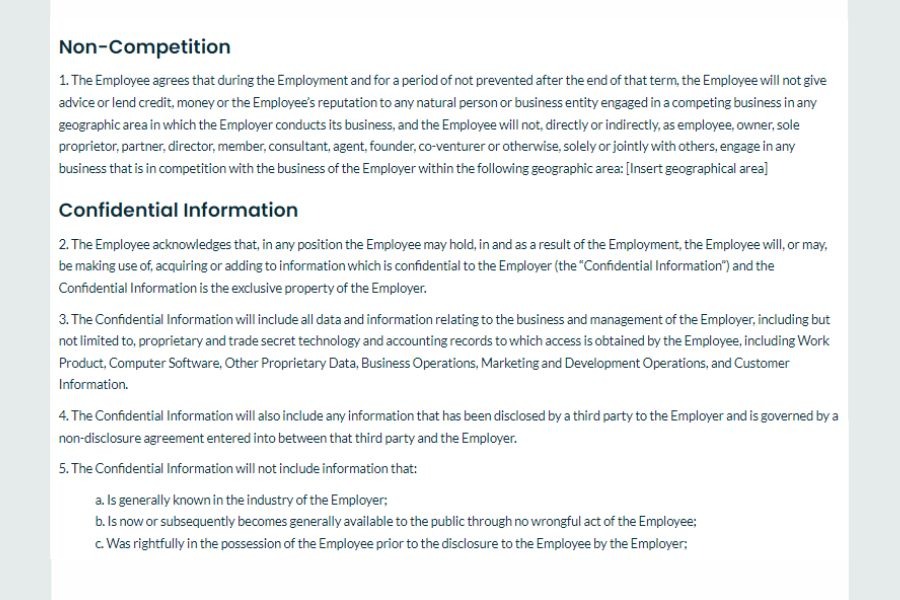

9. Non-Compete Contract

A non-compete contract is a legally binding agreement restricting an independent contractor from working with a competitor or independently in the same industry as the hiring company.

A non-compete agreement often includes clauses on protecting trade secrets, restricting work within a specific geographic area or market, and establishing a time frame—such as one year after the contract ends—during which the contractor must not compete with their former client.

Be aware that non-compete agreements are not indefinite. Instead, they must specify a start and end date.

Example of a Non-Compete Agreement

Frequently Asked Questions

1. How does contracting work in the USA?

Contracting typically involves a written agreement that outlines the contractor’s responsibilities, payment terms, and project timeline. The relationship ends once the job is completed unless the contractor is hired again for another project. Since contract jobs have a defined scope and end date, contractors generally do not receive employee benefits like health insurance.

2. How long are freelance contracts?

Freelance contracts can vary from just a few hours to several weeks, months, or even over a year. Regardless of the duration, all freelance positions are temporary. Similarly, independent contractors also take on temporary roles.

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.