“What are payroll expenses?” Payroll expenses are the amount of money that a business pays employees in exchange for the work they do for business, including salary and wages expenses paid to employees.

For most industries, payroll expenses may be the most significant expense that a company incurs. To run a business effectively and remain profitable, employers need to take notice of their expenses shrewdly.

In this article, ERA will explore some fundamental aspects of payroll expenses.

What Are Employer Payroll Expenses?

Employer payroll expenses mean all the expenditures associated with hiring employees, including wages, salaries, paid annual leave, sick leave, bonuses, commissions, and non-monetary benefits paid to employees. Employers in Vietnam are responsible for subtracting deductions from their employees’ gross pay at each pay date.

However, employers can have trouble calculating payroll expenses. Therefore, we will explore “How to calculate payroll expenses?” in the next section.

How to Calculate Payroll Expenses?

When it comes to calculating payroll expenses, here are four steps a business needs to follow:

Step 1: Determine working time

- For hourly employees: Working hours, and even minutes if employers want to pay amounts exactly, should be cumulatively added.

- For salaried staff: In Vietnam, this will be the number of hours that both employers and employees agreed upon and signed in the labor contract (e.g., 40 or 44 hours per week).

Step 2: Compute gross pay (before deductions & taxes)

Calculating gross pay is the next step in processing payroll expenses. This is the total pay a worker earns before taxes and other deductions. In other words, gross pay is calculated by multiplying an employee’s pay rate by the time worked.

Step 3: Figure out payroll deductions and taxes

In the third step of processing payroll expenses, employers need to add all payroll deductions and taxes, if any, to get a total amount.

Pretax payroll deductions in Vietnam can include some items as below:

- Insurance premiums: Health insurance, social insurance, unemployment insurance, life insurance, etc.

- Union dues: A payment a member needs to pay when joining a union.

- Personal income tax withholding: Before making salary payments to workers, businesses must withhold personal income tax at the rate of 10% on income (if an individual taxable income is from VND 11 million/month, VND 132 million/year).

- Prohibited deductions: If an employee makes a mistake causing damage/loss of company equipment, the employee’s wage/salary will be deducted. This will lead to deductions from employee wages.

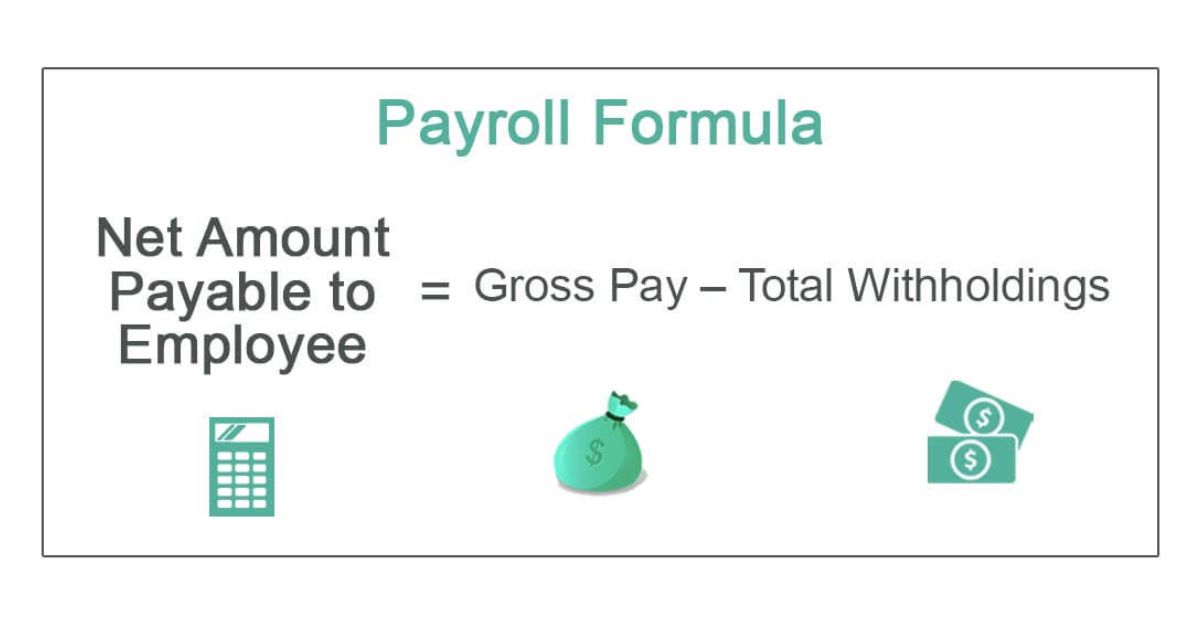

Step 4: Subtract deductions and taxes to know the net pay

To find the final paycheck amount, employers will simply deduct all withholding amounts and taxes from gross pay.

If you follow these steps to compute total payroll costs as a company’s legal representative, you should be able to calculate payroll expenses accurately. Furthermore, you can avoid employee lawsuits, penalties due to inaccurate payroll expenses calculation, and other back-end work to correct payroll errors.

A professional payroll service can relieve businesses of the burden of managing payroll expenses, providing accurate calculations, timely payments, and comprehensive reporting for enhanced financial control.

What is The Difference Between Payroll Expenses and Cost of Labor?

As explained above, payroll expenses are all the benefits that business owners provide employees, including salary and wages expenses, bonuses, tips, and other payments of money paid to employees.

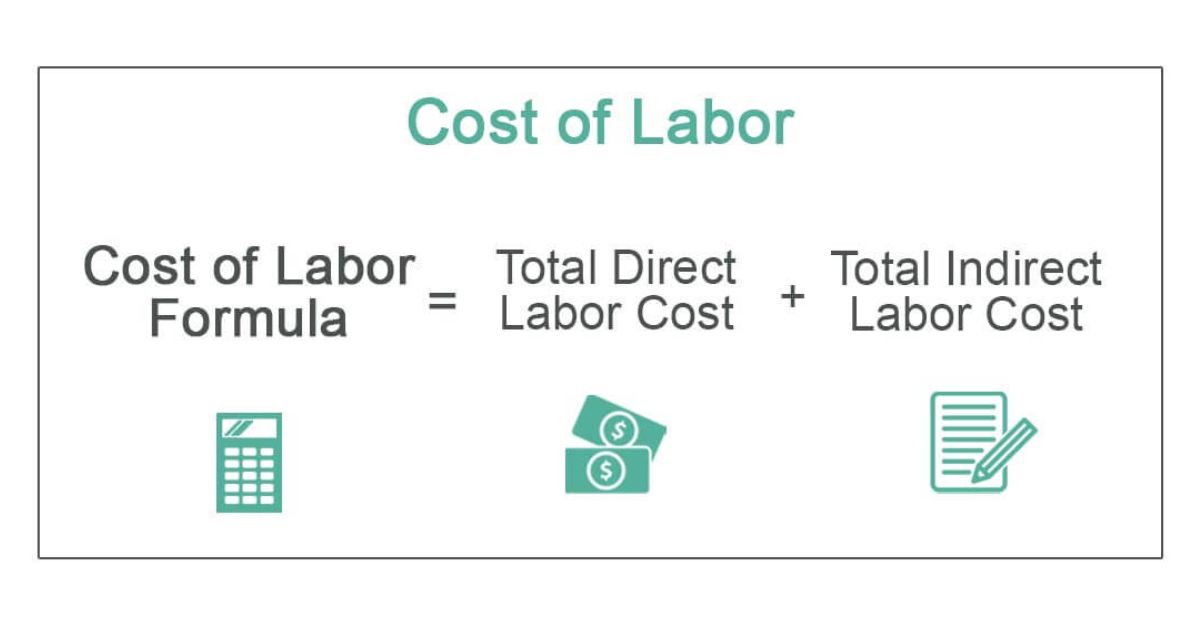

On the other hand, labor costs are the sum of all wages paid to employees plus the cost of employee benefits and payroll tax expenses. Labor costs can be categorized into direct (production) and indirect (non-production) costs.

- Direct costs are wages for the employees working on an assembly line to make a product.

- Indirect costs (also called overhead) refer to the costs to support labor, such as administrative officers, security guards, or individuals who maintain factory equipment. They are not directly in charge of making products.

*Note: When setting the sales price of a product, keep in mind that a manufacturer must take into account the total costs incurred (cost of labor, material cost, warehouse rental cost, etc.). If any costs are missed, earnings are lower than expected.

FAQs

What is the payroll expense example?

For example, if a Vietnamese salaried employee makes VND 12 million gross per month and has VND 2 million deducted for personal income tax and benefit contributions, that individual’s net pay would be VND 10 million.

Who pays payroll expenses?

For payroll expenses, employers (business owners) are responsible for paying when hiring employees. Payroll expenses include employee compensation and the employer-paid portion of total payroll taxes.

What are the 4 required payroll deductions?

Payroll deductions refer to the amount of money that employers withhold from workers’ paychecks. They consist of:

- Insurance premiums

- Union dues

- Personal income tax withholding at the rate of 10% on income if an individual taxable income is from VND 11 million/month, VND 132 million/year

- Prohibited deductions (caused by employee negligence, mistakes which lead to any damage or loss of company equipment)

Conclusion

In short, the business needs to pay attention to what are payroll expenses, all payroll deductions and taxes to keep this cost under control, avoid shrinking earnings, and remain profitable. Therefore, partnering with a reliable payroll provider empowers businesses to efficiently handle their payroll expenses, ensuring accurate calculations, timely payments, and regulatory compliance.

See more: What Is A Payroll Service? A Payroll Management Guide for Businesses

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.