If you are an independent contractor in the U.S., you must know your local tax duties and the required documents, including 1099 tax forms. But what is a 1099 exactly? This article will reveal all you need about this tax form and guide you on filing non-employee income during tax season.

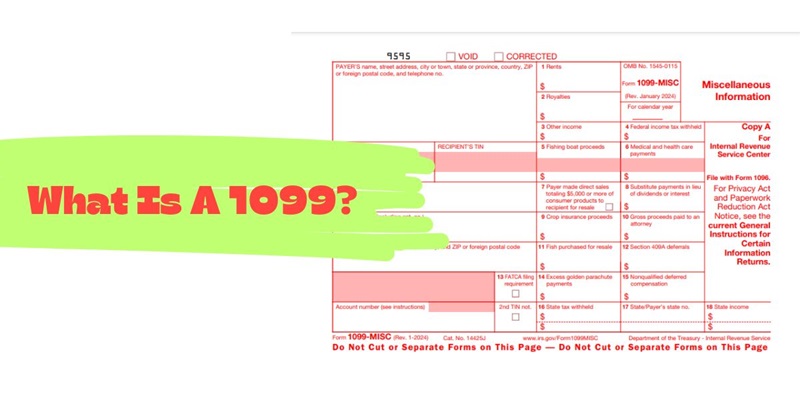

What Is A 1099?

A 1099 is a set of forms recording payments from someone who usually is not your employer to the Internal Revenue Service (IRS). There are dozens of 1099s to report different types of income, such as gambling winnings, interest, dividends, non-employee compensation, etc. If you receive a 1099 Form, you must report your earned income on your tax return.

This form helps the IRS ensure taxpayers accurately report their income for suitable tax collection. They will compare the information on the 1099 Forms with what you write on your Form 1040, the tax form for personal federal income tax returns.

Each 1099 form has a different due date. For example, Form 1099-NEC, frequently used for independent contractors, is due by January 31 to the independent contractor from the company that engaged their services. Should January 31 not be a business day, the due date moves to the next business day.

5 Common Types Of 1099 Form And Which One Should You Fill

After having a basic about what is a 1099 form, you may be curious about the types of 1099s. Some popular ones are the following:

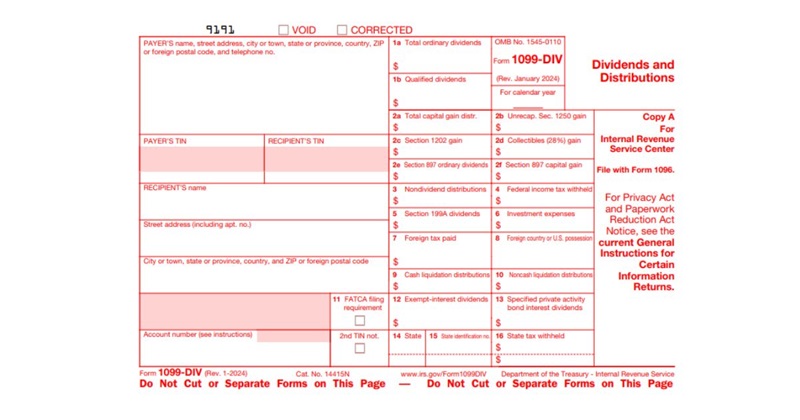

Form 1099-DIV: Dividends and Distributions

A 1099-DIV is sent to taxpayers when they earn dividend income in a tax year.

- Deadline to Recipient: January 31

- Example: If a company pays you dividends, they must report them on Form 1099-DIV.

Form 1099-INT: Interest Income

Taxpayers get a 1099-INT if they earn 10 or more interest in the tax year. Banks, brokerage firms, and other investment firms typically issue a 1099-INT.

- Deadline to Recipient: January 31

- Deadline to IRS: February 28 for paper returns by mail or March 31 for online filing with tax software.

- Example: Financial organizations must issue Form 1099-INT to account holders if they paid at least $10 in interest during the tax year.

Form 1099-K: Payment Card and Third-Party Network Transactions

Payment companies, online marketplaces, or payment apps will send Form 1099-K for products or services they provide during the year.

- Deadline to Recipient: January 31

- Deadline to IRS: February 28 for paper returns by mail or March 31 if e-filed online with tax software.

- Example: You must fill out Form 1099-K if you run an e-commerce website that earned over $20,000 with more than 200 transactions in 2023 through third-party payment networks.

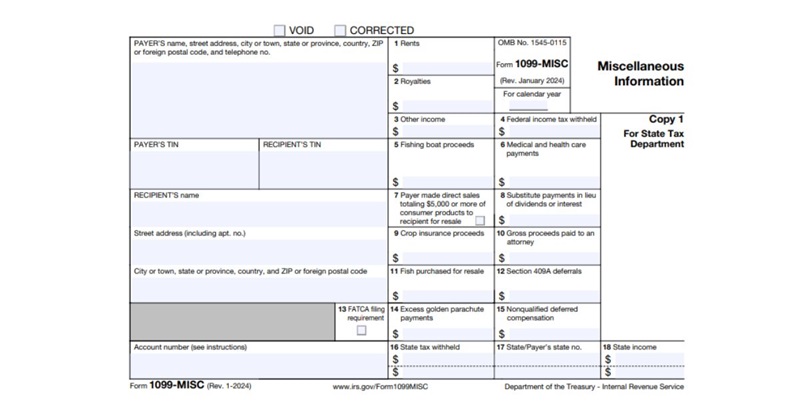

Form 1099-MISC: Miscellaneous Income

Form 1099-MISC covers various payments like royalties or broker payments over $10 and those over $600 for rent, prizes, awards, etc. Also, it reports direct sales of consumer products over $5,000 to a buyer for resale, excluding permanent retail establishments.

- Deadline to Recipient: February 1 (or February 16 for substitute dividends, tax-exempt interest payments reported by brokers, or gross proceeds paid to attorneys)

- Deadline to IRS: February 28 (or March 31 if filed online)

- Example: You win a design competition and earn $800 as an independent contractor. The entity hosting the competition might use Form 1099-MISC to report this payment to the IRS.

Form 1099-NEC: Non-employee Compensation

Businesses must report non-employee compensation using Form 1099-NEC. Non-employees include independent contractors and individuals hired on a contract basis for various tasks, such as graphic designers, writers, web developers, etc.

Self-employed taxpayers working freelance or side gigs making over $600 might receive a 1099-NEC. Also, payments surpassing $600 to an attorney in a tax year must also be reported on a 1099-NEC.

- Deadline to Recipient: February 1

- Deadline to IRS: February 1

- Example: You are an independent contractor who provided content services to a business and earned $700 for your work during the year. The company might use Form 1099-NEC to report this payment to the IRS.

So, who gets a 1099 Form is decided by various factors such as the type of income earned and specific financial transactions. The Form 1099 you need depends on your income in a tax year. For guidance on the proper form for your situation, refer to IRS guidelines or contact ERA.

5 Facts You Must Be Aware About 1099 Tax Form

As you’ve explored the basics of 1099s, we want to reveal some facts about this essential tax document.

Fact 1: Report Your 1099 Form To IRS

When filing your income tax return, you report your 1099 tax form information to the Internal Revenue Service (IRS). The details from the 1099 form, which includes income from sources other than employment, must appear in your tax filings with the IRS.

Fact 2: Get a 1099 Tax Form On The IRS Website

Here are ways to get a 1099 form:

- Download blank copies from the IRS website

- Order physical copies directly from the IRS

- Visit the IRS page for online tax form orders.

As contractors, you don’t need to download Form 1099 yourself. Your payee will send and then notify you of the information that needs to be filled on the form.

Fact 3: Do You Have To Pay Taxes On 1099? Depends.

Income reported on a 1099 is usually taxable, but some exceptions and offsets can lower taxable income. For example, if a taxpayer makes a profit from selling a home, they might not owe taxes on the gain, due to a possible exclusion of up to $250,000.

The tax outcome varies, so it’s better to hire a tax professional like us if you’re unsure about your tax obligations related to your 1099 income.

Fact 4: What If You Miss Your 1099 Form

If the company submits a 1099 to the IRS but you don’t receive it, the IRS may send you a letter stating you owe taxes on the income. Be aware that the letter might not arrive promptly, and you’re responsible for paying owed taxes even if you don’t receive the form.

Fact 5: Ask for Help When Needed

Taxpayers are responsible for handling their income and taxes, but when unsure, seeking help from the IRS or a tax advisor is a good choice. For example, if you don’t receive a 1099-R and efforts to contact the payer fail, the IRS suggests contacting them, and they will get the payer on your behalf.

Frequently Asked Questions

What does it mean if you are on a 1099?

Being on a 1099 means you earned income as an independent contractor or freelancer. You use this form to report that income and must handle your own taxes, including self-employment taxes.

What is the difference between a 1099 and a W-2?

The significant difference between a 1099 and a W-2 is:

- A 1099 form displays non-employment income, like that earned by freelancers and independent contractors.

- In contrast, a W-2 shows a taxpayer’s yearly wages or employment income from a specific employer in the tax year.

Unlike a 1099, a W-2 also reveals the taxes the employer deducted from the employee’s salary over the year.

Conclusion

With the above sharing, we have thoroughly answered your question: What is a 1099? Regardless of your income sources, understanding this form is vital for accurate financial records and complying with tax regulations.

Feel free to ERA if you have more questions or need assistance. Your hassle-free tax filing experience is just a message away!

See more related articles:

Independent Contractor Agreement: Definition & Must-have Clauses

How To Fill Form 1096: Step By Step Guide For Employers

What Is Corp-to-Corp? Expert Guide About C2C Contractors

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.