Payroll service or provider is a business that will do all the duties independently for a charge, optimizing the business owner’s time to focus on other concerns. Once users set up an account, the employer provides the service with a list of employees, their working hours, and any differences.

Even seasoned business executives may find managing time and attendance, payroll taxes, and workers’ compensation challenging. That’s why the payroll service is established. This article shows the accurate answer to the question of what is a payroll service.

What Is A Payroll Service?

A payroll service or a payroll provider is a third-party company that handles payroll calculations, payroll tax reports, year-end taxes, and other administrative tasks for your business. A full-service outsourced payroll provider may also manage your employees’ deposits and withdrawals, withholding and pay garnishments, and new-hire reporting.

Using a payroll system streamlines the payment of all employees, including full-time, part-time, and freelancers. It enables experts to handle your payroll while you concentrate on running your business.

Some payroll providers also offer further human resource assistance to companies. The ultimate purpose of employing a payroll service is to ensure that each employee receives the correct payment amount on time, every time.

Payroll processing, employee benefits, insurance, and accounting functions such as tax withholding are all outsourced to professional organizations. Many payroll fintech providers, including Atomic, Bitwage, Finch, Pinwheel, and Wagestream, use technology to streamline payroll processes. Also, payroll services also keep electronic payroll records for businesses of all sizes.

Outsourcing payroll services has become a global trend, and it is progressively gaining traction in Vietnam. Particularly in the backdrop of international enterprises pouring money into Vietnam, which creates a powerful competitive environment, businesses must focus more on payroll and developing core company operations.

As a result, payroll outsourcing becomes an effective assistant and an unavoidable trend in Vietnam in the future. Currently, payroll services in Vietnamese firms often comprise a wide range of operations such as payroll, the preparation of supporting reports, the resolution of social insurance, health insurance, and income tax concerns for employees.

What Do Payroll Services Offer?

Simple Payroll Processing

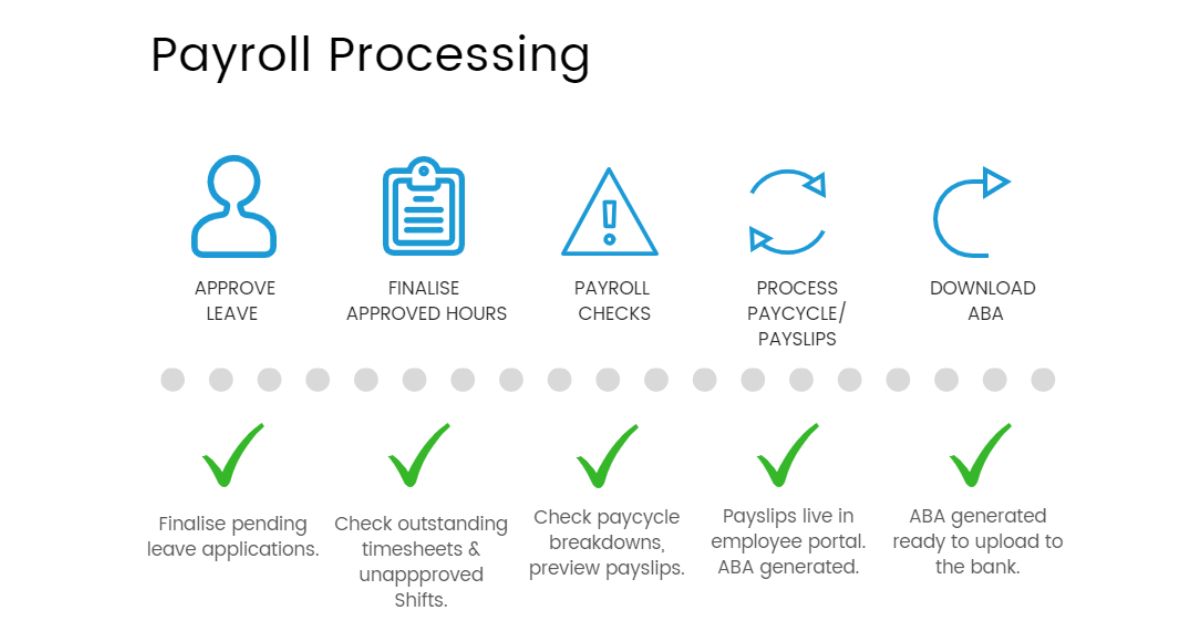

Payroll services make payroll processing easier. They relieve stress on the employee in charge of payroll management and eliminate the unnecessary busywork that manual payroll calculations can generate.

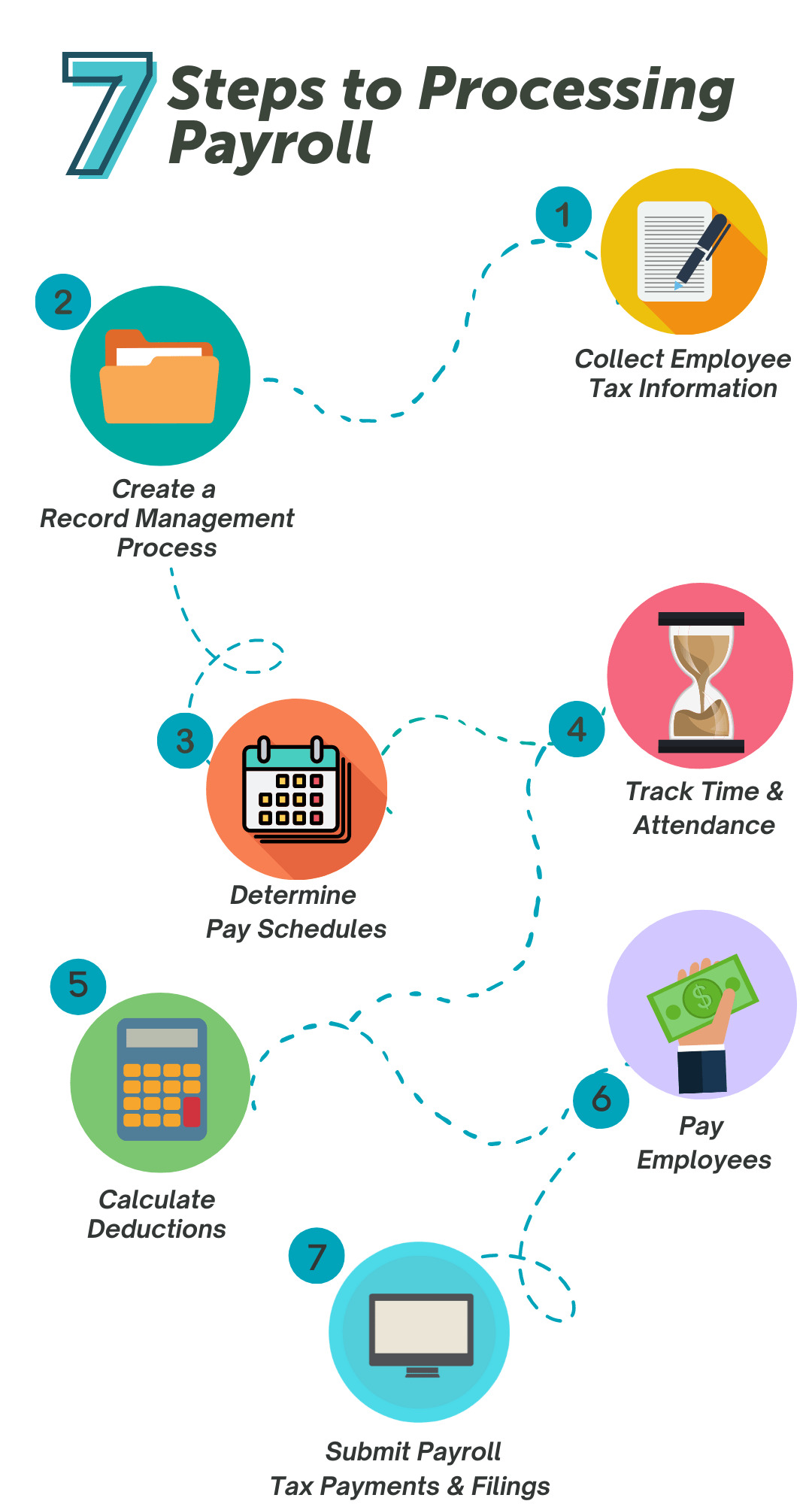

Payroll processing entails rewarding employees for their efforts. Calculating total wage earnings, withholding deductions, paying payroll taxes, and delivering payments are part of the job.

Payroll service systems can also calculate how much employees should receive each month. Rates of wage, shift differentials, overtime (OT), holiday payment, taxes, and Social Security and benefit deductions are all the tasks that this kind of service needs to handle. Then, these companies will pay employees via direct deposit, prepaid debit cards, or paper checks.

Employee Attendance And Timekeeping

A payroll provider’s primary responsibility is to make tracking employee attendance and time at work easier. Most businesses do this by providing employers with punch-in and clock-in choices.

Employees may clock in using secure badges or fingerprint scanners in some situations.

In others, employees may log into an online account with a view to clocking in and out. Payroll services can also set up these systems to track breaks and lunch times.

Filling And Paying Payroll Taxes

These services can withhold employee taxes, submit quarterly payroll tax reports, and pay the tax withholdings of your employees to suitable local,

Some payroll services include an error-free guarantee, which means that if an error happens, the payroll company will fix the issue and pay any fines or interest you incur.

Integration

Payroll integration occurs when an employer delegates related activities such as time and attendance, contributions, and insurance payments to the same supplier. Employers can avoid inputting the same data repeatedly and decrease mistakes by linking these additional services with payroll.

Furthermore, payroll providers interact with various payroll-related programs organizations currently use, such as accounting software, time and attendance systems, and human resource software.

Handling all payroll compliance matters since it involves municipal requirements governing employees’ pay. Employers who break any of these regulations may face fines that harm their bottom line or force them out of business.

In today’s competitive market, sophisticated payroll management solutions from payroll service providers are required for many businesses to comply with ever-changing statutory compliance rules. HRMS third-party payroll service providers have employees familiar with numerous employment regulations and labor norms. They help customers comply and protect their business from legal disputes.

How Much Do Payroll Services Cost?

Payroll providers vary in price, but most have a basic pricing structure: a fixed base fee each month or per pay period. Per-pay-period services charge you each time you run payroll, but per-month providers enable you to run payroll as often as you like each month.

Payroll services might be costly, but they are often a worthwhile investment for your enterprise. These are some outstanding factors that influence how much you spend on payroll services:

- What kind of services that you require

- Number of employees in your business

- Number of pay periods per year

Some providers give multiple price plans for various levels of service. A simple project, for example, may only feature payroll processing, but more complex and pricey projects may additionally pay your payroll taxes for your employees.

Depending on the plan and provider, base costs range from 50 to $100. Most providers charge $1 to $15 per month or pay cycle for each paid employee or contract worker.

The more services you require, the more expenditure you need to spend. Services, for example, are more expensive if you add third-party benefit integration to your standard payroll processing. In addition, some businesses charge for online and phone support.

Benefits of Working With A Payroll Provider

After identifying the definition as well as expenditure of payroll service, let’s discover the advantages when hiring this kind of company to work with:

Time-saving

Payroll is a lengthy process. By reducing the payroll department for these responsibilities, some enterprises can concentrate on other essential aspects of the business, such as developing financial plans to increase the company’s competitive advantage.

You will provide the payroll service company with all of the information from your company, and it will handle all of the calculations and payroll processing. Many providers allow you to change any information by email or an online portal easily.

If you work in human resources or management, a payroll provider can help you save time on the payroll process. You no longer have to waste time entering employee data, calculating compensation, or delivering payments. Instead, you may devote more time to priority duties directly related to your responsibilities.

Cost-saving

Having an in-house payroll staff may be beneficial at first. However, everything could be better.

Firstly, a payroll staff may need more transferrable abilities to collaborate with colleagues on cross-functional activities. Secondly, when your personnel grows, the expense of hiring, establishing, and managing a payroll team skyrockets. Many business owners and executives must evaluate the time and resources required to handle payroll accurately. Finally, you must meet tax requirements, personnel, and accounting deadlines.

Payroll outsourcing has historically been advantageous in terms of cost savings. Outsourced payroll administration saves firms 18% more than in-house payroll processing.

It saves businesses money regarding computer equipment, software, training, etc. By reducing costly payroll processing errors, you offer additional growth opportunities.

Effective Payroll Processing

Having a payroll provider allows you to concentrate all your payroll-related software in one place. The same website is helpful for numerous purposes, including employee hour monitoring, payroll calculation, and direct deposit management.

By streamlining the process, you can eliminate misunderstandings or competing programs.

Accurate

If you are not a skilled accountant or bookkeeper, you may find it challenging to manage your payroll, which may take much longer than you would want. Payroll providers will handle your payroll correctly and keep you updated on tax rules.

Hiring payroll experts whose primary task and concentration is payroll reduces the possibility of mistakes, missed deadlines, omissions, or late payroll tax filings.

Compliance Assurance

Payroll service providers help businesses adhere to statutory compliance and avoid legal problems. To ensure hassle-free statutory and payroll compliance, they provide a comprehensive payroll management system and an HR and leave management system. Furthermore, they deliver fast and correct payroll and tax payments, necessary for remaining compliant and avoiding legal issues.

Frequently Asked Questions

What’s the difference between a payroll service and online payroll software?

Payroll services

Payroll providers are responsible when you outsource a third-party organization to help process payroll and keep things running smoothly. It also gives you time to focus on core operations and business growth. One of the biggest downsides of hiring a payroll provider is the cost.

Ultimately, any problems are your company’s responsibility. That’s why when you think about outsourcing a payroll services provider, finding a trusted payroll provider is crucial to ensure everything goes right on track.

Payroll software

Payroll software can handle many aspects of financial operations, which lets you and your staff manage payroll easier

Compared with working with a payroll provider, using payroll software is cost-effective. However, it may take time for team in your human resources department to learn how to do payroll tasks and become fully skilled. In contrast, a payroll provider can reach this point immediately because of their professional knowledge. To get the most value out of it, make sure you also check out its features and the fee.

How do you choose the best payroll provider?

Regarding choosing the best payroll provider, we have made a list of essential criteria here so you can evaluate the right one for your company:

- Determine your budget: The payroll software costs vary depending on the features or pricing model you choose. Paying a fixed monthly rate or a fee each time you run payroll are available options.

- Have essential features: Picking out the features you feel will be crucial to your company’s payroll process, such as payroll processing and management, direct deposit, social and health tax, compensation administration, and integrated payroll.

- Update software regularly: Choosing payroll software that’s always up to date with new laws and features gives your business competitive advantages in the market.

- Offer dedicated support: The vital thing to check if the business is qualified is the software needs to be supported by the payroll provider. Browsing their website to see if they have customer support via phone, live chat, or email.

- Have good ratings: You can get an overview of the provider’s services through their online reviews, such as Google Reviews, Glassdoor, Trustpilot, and their website and social media platforms.

How do you decide between a payroll service and payroll software?

Your preferences and business requirements ultimately determine the choice between payroll services and software. Here are some things to consider carefully when you make up your mind before choosing:

- Budget

- Number of employees

- Your experience

- Your schedule

- Added Benefits

After reading this article, readers can gain a significant amount of necessary knowledge about payroll service, including its definition, cost, pros, and cons. What is a payroll service will no longer be a big question to solve anymore.

Still have a lot to ask? Contact ERA – Expert Resources Alliance now! We are proud to become one of the leading payroll providers and HR solutions for startups, SMEs, and large enterprises. We offer various services, including Contract, Permanent (Direct) Hire, Managed Solutions, and mobility services. Check our site for more information.

See more related articles:

What Is A Payroll Provider? A Complete Guide To Pick Payroll Services

What Are Payroll Expenses? Payroll Expense & Cost of Labor Differences

Ms. Tracy has worked in human resource consulting for over 15 years. A driven entrepreneur focused on business expansion and people development. She previously worked as Country Manager for an international Australia firm that specializes in global workforce management, as well as several key roles as Business Growth Director and Executive Search Director for both large local firms to effectively drive their business growth. A strong emphasis is placed on aligning organizational priorities/objectives with business needs. She has a large network of local business leaders and a thorough understanding of the local market.